10 Steps to Set Up a Small Business: The Complete Startup Checklist for 2025

Learn 10 steps to set up a small business with this checklist covering LLC, banking, invoicing, insurance, and pricing.

You have the skills. You have done the work for someone else. Now you are ready to do it for yourself.

If you are looking for a clear small business startup guide for 2025, you are in the right place. The 10 steps to set up a small business outlined below cover exactly what you need, in the right order, with specific actions you can take this week. No generic advice. No unnecessary complexity. Just the practical steps to start a small business that actually works.

Starting a service business is more accessible than ever, but the path from “I want to start a business” to “I have a functioning business” can feel overwhelming. There are legal requirements, financial decisions, tool choices, and marketing questions all competing for your attention. This how to start a small business checklist cuts through the noise so you can stop planning and start doing.

Whether you are a contractor going independent, a freelancer formalizing your side hustle, or a skilled tradesperson ready to build something of your own, this freelance business checklist and contractor business setup guide gives you the complete roadmap.

Table of Contents

- Validate Your Business Idea and Target Market

- Choose Your Business Structure

- Register Your Business Name

- Get Your EIN and Tax Setup

- Open a Business Bank Account

- Set Up Your Invoicing and Payment System

- Get the Right Insurance

- Build Your Basic Tech Stack

- Set Your Pricing and Service Packages

- Get Your First Customers

Step 1: Validate Your Business Idea and Target Market

Before you file paperwork or buy equipment, confirm that people will pay for what you plan to offer. This is the first and most important step when you set up a small business, and skipping it is one of the top reasons startups fail.

For service businesses and contractors, validation is straightforward:

- Have you already done this work for an employer or as side jobs?

- Do people regularly ask you for this service?

- Are competitors in your area busy and charging reasonable rates?

If you have been working in HVAC, plumbing, electrical, landscaping, or any skilled trade, you already have validation. You know the work exists. Your question is whether you can build a business around it.

Specific actions this week:

Identify your target customer. Be specific. “Homeowners” is too broad. “Homeowners with houses built before 1980 in [your city] who need electrical upgrades” is useful.

Research local competitors. Google your service + your city. Look at the top 5 results. What are they charging? What do their reviews say? Where are they falling short?

Talk to potential customers. Not your friends. Actual potential customers. Ask what frustrates them about finding your type of service. Ask what would make them choose one provider over another.

Calculate minimum viable revenue. What monthly income do you need to replace your current job? Add 30% for self-employment taxes and business overhead expenses. That is your baseline target.

Red flags to watch for:

- No one in your area offers this service (could mean no demand, not opportunity)

- Competitors are all struggling or cutting prices

- Potential customers are not willing to pay what you need to charge

Step 2: Choose the Right Business Structure

Your business structure affects taxes, liability, and how you present yourself to clients. Getting this contractor business setup decision right early saves headaches later.

The main options for service businesses:

Sole Proprietorship:

- No formation required. You are automatically a sole proprietor when you start business activity

- Zero liability protection. If your work causes damage, personal assets are at risk

- Simplest taxes. Business income reported on your personal return (Schedule C)

- Best for: Testing a business idea with minimal commitment

LLC (Limited Liability Company):

- Requires state filing ($50-500 depending on state)

- Provides liability protection. Business debts stay with the business

- Pass-through taxation by default. Can elect S-Corp treatment later

- Best for: Service businesses with any real liability exposure

S-Corporation:

- Not a legal structure, but a tax election. Form an LLC, then elect S-Corp status

- Can reduce self-employment taxes once income exceeds $70,000-80,000

- Requires payroll and more complex tax filing

- Best for: Established businesses with consistent profits above $80,000

The practical recommendation for most new service businesses:

Form an LLC. The liability protection alone justifies the cost. A single lawsuit from a customer accident could wipe out everything you own as a sole proprietor.

Review the complete breakdown in our guide to business structure types, including a side-by-side comparison of LLC vs. sole proprietorship vs. S-Corp.

Specific actions this week:

- Research LLC filing requirements in your state

- Decide on your business name (see Step 3)

- File your LLC online (most states process in 1-2 weeks)

Step 3: Register Your Business Name

Your business name appears on invoices, contracts, marketing, and your bank account. Choose something that works long-term.

Guidelines for service business names:

Option 1: Your Name + Service

- “Martinez Plumbing” or “Jennifer Walsh Design”

- Pros: Personal, builds your reputation, easy to register

- Cons: Harder to sell the business later, may limit expansion

Option 2: Descriptive Business Name

- “Precision HVAC Services” or “Bright Ideas Electrical”

- Pros: Immediately communicates what you do, more sellable

- Cons: May need to check availability more carefully

Option 3: Distinctive Brand Name

- “Redhawk Contracting” or “Pixel Perfect Studios”

- Pros: Memorable, flexible for expansion

- Cons: Requires more marketing to establish what you do

Practical naming checklist:

- Easy to spell and pronounce over the phone

- Available as a .com domain (or close variation)

- Not already in use by another business in your state

- Available for LLC registration in your state

- Works on a business card, vehicle wrap, and invoice header

Specific actions this week:

- Brainstorm 5-10 name options

- Check domain availability for each (use namecheap.com or similar)

- Search your state’s business name database to confirm availability

- Register your LLC with your chosen name

- Secure the domain name immediately (domains cost $10-15 per year)

Step 4: Get Your EIN and Complete Tax Setup

An Employer Identification Number (EIN) is your business’s tax ID. You need one to open a business bank account, file taxes, and work with many clients. This is a non-negotiable step in any how to start a small business checklist.

Getting your EIN:

- Go to IRS.gov and search “apply for EIN”

- Complete the online application (takes 10 minutes)

- Receive your EIN immediately at the end of the application

- Download and save the confirmation letter

Cost: Free. Time: 15 minutes.

Tax registrations you may need:

- State tax ID: Most states require separate registration for state income tax

- Sales tax permit: If you sell taxable goods (varies by state and service type)

- Local business license: Many cities require a general business license

- Contractor license: Required for most construction trades, varies by state

Quarterly estimated taxes:

As a business owner, you pay taxes quarterly instead of waiting until April. Plan to pay estimated taxes in:

- April 15

- June 15

- September 15

- January 15

Set aside 25-30% of your net income for taxes. Open a separate savings account just for tax payments so the money is there when you need it. For a deeper look at tracking deductible costs, read our guide to business overhead expenses.

Specific actions this week:

- Apply for your EIN online (free, immediate)

- Research your state’s tax registration requirements

- Check local business license requirements in your city

- Set up a separate savings account for tax payments

Step 5: Open a Business Bank Account

Never mix personal and business finances. A business bank account is essential for:

- Tracking income and expenses accurately

- Maintaining your LLC’s liability protection

- Looking professional when clients pay you

- Simplifying tax preparation

Setting up a proper chart of accounts from day one makes bookkeeping and tax filing dramatically easier.

What you need to open a business account:

- EIN letter from the IRS

- LLC formation documents (Articles of Organization)

- Personal identification (driver’s license)

- Initial deposit (typically $25-100)

Choosing a bank:

Traditional banks (Chase, Bank of America, Wells Fargo):

- Physical branch access

- Established business services

- Higher fees and minimum balances

Online banks (Novo, Mercury, Relay):

- No monthly fees, no minimums

- Better integration with business tools

- No physical branch access

Credit unions:

- Often lower fees

- More personal service

- May have limited business services

For most new service businesses, an online bank like Novo or Relay offers the best value: no fees, easy integration with accounting software, and quick setup.

Specific actions this week:

- Gather your LLC documents and EIN letter

- Compare 2-3 bank options based on fees and features

- Open your business account online or in person

- Transfer your initial operating funds

- Order a business debit card

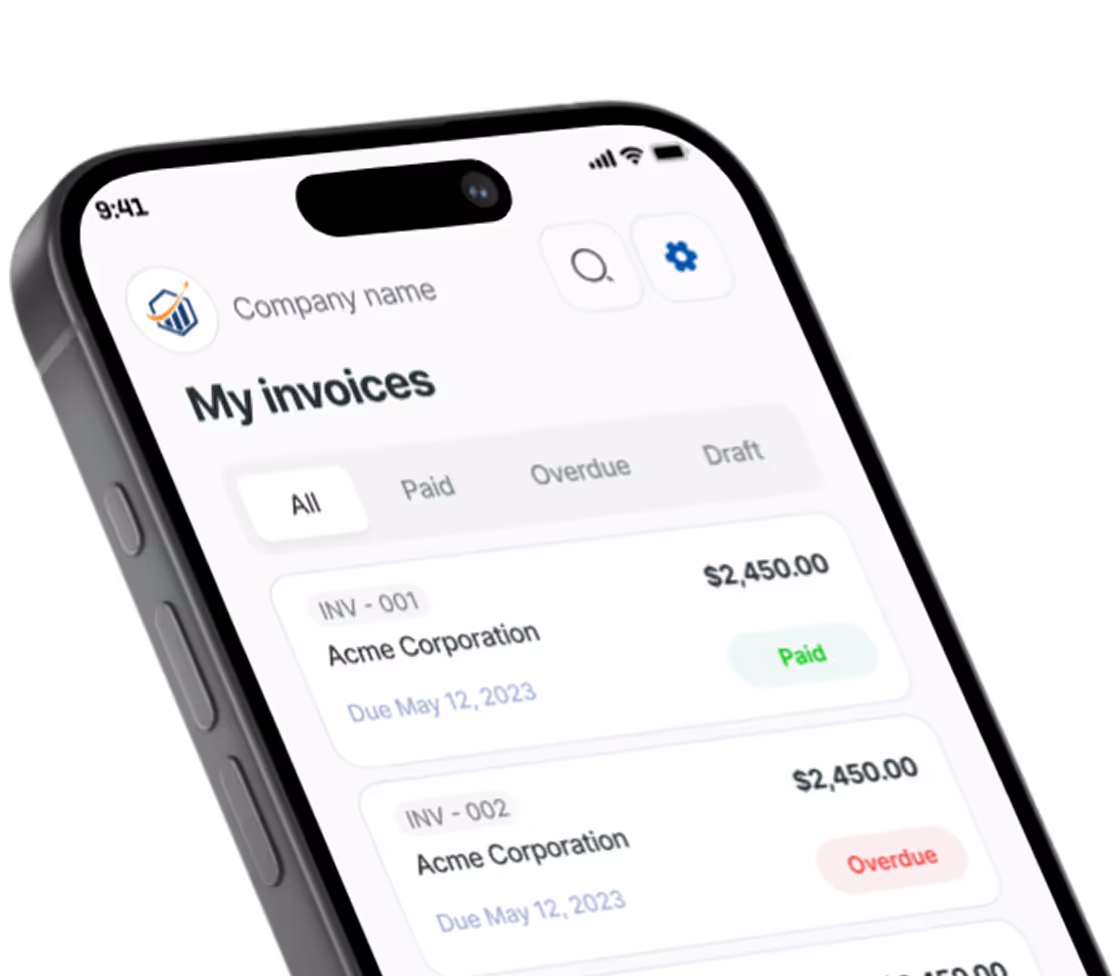

Step 6: Set Up Your Invoicing and Payment System

Here is where many new business owners stumble. They complete fantastic work, then lose money because their invoicing is unprofessional, slow, or confusing. Your invoicing and payment system is the engine that turns completed work into cash in your bank account.

Your invoicing system needs to:

- Create professional invoices that reflect your business quality

- Send invoices immediately (same day you complete work)

- Accept multiple payment methods (card, ACH, check)

- Track what is owed and what is paid

- Send payment reminders when invoices go overdue

For field service professionals specifically:

You need to invoice from job sites. Not later at your desk. Not tomorrow when you remember. Right there, before you leave the customer’s home.

Why? Because invoices sent same-day get paid 30% faster than invoices sent later. The work is fresh, the value is clear, and the customer has not moved on to other priorities.

This requires mobile invoicing that works anywhere, including locations with poor cell service.

Pronto Invoice was built specifically for this reality. Create professional invoices in under 60 seconds from your phone, even offline. Accept payments on the spot with credit card, ACH, or payment links. Your customer gets a professional PDF, and you get paid faster.

What your invoicing system should include:

- Your legal business name and contact information

- Professional invoice template with your logo

- Clear payment terms (Net 15, Due on Receipt, etc.)

- Multiple payment options

- Automatic payment reminders

- Integration with your accounting software

If you are a freelancer setting up invoicing for the first time, our freelance invoice software guide covers everything from numbering systems to payment terms in detail.

Specific actions this week:

- Choose an invoicing solution that works on mobile

- Set up your business profile with logo, address, and payment terms

- Connect your bank account for payment deposits

- Create your first invoice template

- Test the complete process: create invoice, send to yourself, verify it looks professional

Step 7: Get the Right Business Insurance

Business insurance protects you from the unexpected. The right coverage depends on your trade and risk exposure. Skipping insurance is one of the most dangerous shortcuts when starting a service business.

General Liability Insurance:

- Covers third-party injury and property damage claims

- Required by many commercial clients before you can work on their sites

- Typical cost: $400-800 per year for basic coverage

- Essential for all service businesses

Professional Liability (Errors & Omissions):

- Covers claims of negligence or inadequate work

- Important for consultants, designers, and professional services

- Typical cost: $500-1,500 per year

Workers Compensation:

- Required if you have employees (requirements vary by state)

- Covers workplace injuries

- May be required by commercial clients even for solo operators

Commercial Auto:

- Covers your vehicle when used for business

- Personal auto policies often exclude business use

- Essential if you drive to job sites

Tools and Equipment:

- Covers theft or damage to your work equipment

- Often available as a rider on general liability

Where to get quotes:

- Next Insurance: Online, fast quotes, designed for small businesses

- Hiscox: Good for professional services and consultants

- Simply Business: Comparison quotes from multiple carriers

- Local insurance agents: Often can find better rates for specific trades

Specific actions this week:

- Identify what coverage types you need based on your trade

- Get quotes from at least 3 providers

- Verify coverage meets any licensing or client requirements

- Purchase at minimum general liability before taking on jobs

Step 8: Build Your Small Business Tech Stack

You do not need expensive software to run a small business. You need the right tools that work together without creating administrative overhead. This section of our small business startup guide covers the essentials.

Essential tools for 2025:

Invoicing and Payments: A mobile-first solution that lets you invoice from anywhere and accept payments immediately. This is the core tool that directly affects your cash flow. Solutions like Pronto Invoice combine invoicing, payment acceptance, and client management in a single app.

Accounting:

- QuickBooks Simple Start ($15-30/month): Industry standard, integrates with everything

- Wave (Free): Good for very simple businesses

- FreshBooks ($17-55/month): Easier interface than QuickBooks

For help organizing your accounts from the start, see our sample chart of accounts for small business.

Scheduling:

- Calendly (Free tier available): For booking consultations or estimates

- Jobber ($29+/month): Field service specific with scheduling and dispatch

- Your phone’s calendar: Honestly works fine when starting out

Communication:

- Google Workspace ($6-18/month): Professional email with your domain

- Your cell phone: Add a dedicated business line or use Google Voice (free)

Contracts and Estimates: Clear documentation protects both you and your client. Learn how to write a statement of work that defines scope, deliverables, and payment expectations before work begins.

AI tools for 2025: AI has become genuinely useful for small business tasks:

- ChatGPT or Claude: Draft emails, create marketing copy, answer quick questions

- AI scheduling assistants: Handle appointment booking via text or email

- Smart invoicing: AI-powered item suggestions and autocomplete (like Pronto Invoice)

For a deeper dive into building the right toolkit, read our complete small business tech stack guide for 2025.

The key principle: Start lean. Add tools only when you have a specific problem they solve. Every subscription is a recurring cost that requires revenue to justify.

Specific actions this week:

- Set up professional email with your domain

- Choose and set up your invoicing system

- Connect invoicing to a basic accounting tool

- Organize a folder system for project documentation

Step 9: Set Your Pricing and Service Packages

Pricing is where new business owners lose the most money, almost always by charging too little. Whether you are starting a service business as a contractor or launching as a freelancer, getting pricing right from day one sets the foundation for profitability.

Calculate your minimum hourly rate:

- Target annual income: What you need to take home

- Add self-employment taxes: Multiply by 1.15

- Add business expenses: Typically add 20-30% (insurance, tools, vehicle, software)

- Divide by billable hours: Most service providers bill 60-70% of working hours

Example calculation:

- Target income: $75,000

- After self-employment tax adjustment: $86,250

- With business overhead expenses (25%): $107,800

- At 1,400 billable hours per year: $77 per hour minimum

That $77/hour is your floor. Going lower means you are losing money.

Flat rate vs. hourly pricing:

Hourly billing:

- Pros: Simple, adjusts for scope changes automatically

- Cons: Punishes efficiency, clients may nickel-and-dime hours

Flat rate / project pricing:

- Pros: Clients know cost upfront, you benefit from efficiency

- Cons: Requires accurate estimating, scope creep risk

Most successful service businesses use flat rate pricing with clear scope definitions. You get better at estimating with experience. For a detailed comparison of both approaches with real examples, see our guide on flat rate vs. hourly pricing.

Creating service packages:

Package your most common services with clear deliverables and pricing:

- Basic service call: X-Y price range, includes specific tasks

- Standard service: Higher price, more comprehensive

- Premium service: Top tier, everything included

Packages make quoting faster, reduce negotiation, and help customers self-select the right level.

Specific actions this week:

- Calculate your minimum hourly rate using the formula above

- Research what competitors charge for similar services

- Create 2-3 standard service packages with fixed prices

- Practice explaining your pricing confidently

Step 10: Get Your First Customers

You have the business set up. Now you need customers. This final step in our how to start a small business checklist is where the real work begins.

Immediate revenue sources (this month):

Your existing network:

- Tell everyone you know that you are starting a business

- Post on personal social media: specific, not generic (“I am now offering [specific service] to [specific customer type] in [location]”)

- Ask former colleagues and clients for referrals

Online presence basics:

- Set up a Google Business Profile (free, essential for local searches)

- Claim your listing on Yelp, Thumbtack, and industry-specific directories

- Create a simple one-page website with your services, contact info, and a way to request a quote

Strategic first jobs:

- Offer competitive rates on your first 3-5 jobs to build reviews and portfolio

- Do exceptional work. Take before/after photos

- Ask every satisfied customer for a Google review

Early marketing that works for each business type:

For residential services (HVAC, plumbing, electrical, landscaping):

- Door hangers in neighborhoods after completing visible work

- Yard signs at job sites (with customer permission)

- Nextdoor posts and participation

- Vehicle wrap or magnetic signs

For B2B and commercial:

- LinkedIn presence and content

- Direct outreach to target companies

- Networking groups and industry associations

- Referral partnerships with complementary businesses

For creative and professional services:

- Portfolio website with case studies

- Content marketing (blog posts, social media showing your work)

- Cold outreach with personalized pitches

- Freelance platforms to build initial reputation

The 30-day customer acquisition sprint:

Week 1: Tell everyone in your network, set up Google Business Profile Week 2: Complete first 2-3 jobs (even at lower margins), get reviews Week 3: Double down on what is working, try 1 new marketing channel Week 4: Evaluate results, systematize what works, drop what does not

Specific actions this week:

- Create your Google Business Profile listing

- Email or text 20 people who might need your service or know someone who does

- Post on social media announcing your business

- Follow up personally with anyone who expresses interest

Your Complete Small Business Startup Checklist

Print this checklist and check off each item as you complete it:

Week 1: Foundation

- Validate your business idea and target market

- Choose your business structure (LLC recommended)

- Register your business name with the state

- Apply for your EIN (free, immediate)

Week 2: Financial Setup

- Open a business bank account

- Set up your invoicing and payment system

- Create a separate savings account for taxes

- Research insurance requirements

Week 3: Operations

- Get required insurance policies

- Set up your essential tech stack

- Calculate your pricing and create service packages

- Create invoice templates and payment terms

Week 4: Launch

- Set up Google Business Profile

- Tell your network you are open for business

- Complete your first paying job

- Request your first customer review

Frequently Asked Questions About Starting a Small Business

How much money do I need to start a small business?

For most service businesses, $500-2,000 covers essential startup costs: LLC formation ($100-500), basic insurance ($300-800), domain and email ($50), and invoicing software ($10-30/month). You do not need significant capital if you already own tools and a vehicle. According to the SBA, the average startup cost varies widely by industry, but service-based businesses consistently have the lowest barrier to entry.

Do I need an LLC to start a business?

Legally, no. You can operate as a sole proprietor immediately. Practically, an LLC provides liability protection that is essential for any service business where your work could cause property damage or injury. The cost is minimal relative to the protection. Our complete guide to business structure types compares all your options in detail.

How long does it take to start a small business?

You can complete the legal and financial setup in 2-3 weeks. Getting your first customers may take 2-4 weeks more. Many service professionals complete their first paid job within 30 days of deciding to start.

What is the biggest mistake new business owners make?

Underpricing. New business owners charge too little because they lack confidence or fear losing bids. Calculate your true costs using the pricing formula in Step 9, charge accordingly, and compete on quality rather than being the cheapest option.

Do I need a business plan to start a small business?

For service businesses and freelancers, you do not need a formal 50-page business plan. However, you should document your target market, services, pricing, and financial projections. A one-page plan covering these basics is sufficient for most small business startups. If you are seeking outside funding or a business loan, a more detailed plan may be required.

What licenses and permits do I need to start a small business?

Requirements vary by state, city, and industry. Most businesses need at minimum a general business license from their city or county. Contractors typically need trade-specific licenses (plumbing, electrical, HVAC). Check with your state’s Secretary of State website and your local city clerk office for specific requirements. The SBA also maintains a permit lookup tool to help you identify what you need.

Can I start a business while still employed full-time?

Yes, and many successful business owners recommend it. Starting as a side hustle lets you test the market, build a client base, and generate revenue before taking the financial risk of going full-time. Just verify that your current employment contract does not include a non-compete clause that restricts your planned business activity.

What is the best business structure for a contractor or freelancer?

For most contractors and freelancers, an LLC provides the best balance of liability protection, tax flexibility, and simplicity. It shields your personal assets if something goes wrong on a job, and the filing cost ($50-500 depending on state) is minimal compared to the protection it provides. Once your profits consistently exceed $80,000, consider electing S-Corp tax treatment to reduce self-employment tax.

Take Your First Step to Set Up a Small Business Today

You have the complete roadmap. The difference between reading this guide and building a successful business is action.

Start with Step 1 today. Not tomorrow. Not next week. Today.

The business you are imagining is possible. The skills you have are valuable. The customers are out there. Your job now is to build the bridge that connects what you can do with the people who need it.

And when you are ready to invoice your first customer professionally, from the job site, before you even leave, try Pronto Invoice free. Create professional invoices in under 60 seconds, accept payments on the spot, and start your business the way you mean to continue: getting paid fast.

There is always something more to read

Handyman Services Invoice Guide: How to Bill for Multiple Small Jobs

Complete handyman invoice guide for billing multiple small jobs. Learn minimum charges, itemization strategies, and material markups.

How to Write a Painting Invoice That Gets You Paid Fast

Learn how to write a painting invoice that gets paid fast. Covers square footage billing, paint vs labor costs, and prep work itemization.

AI for Small Business: Your Practical Guide to AI Powered Invoicing Software

Learn what AI for small business can actually do. Discover AI powered invoicing software and practical tools that save time.