ACH Bank Transfer for Small Business: The Complete Guide to Low-Cost Payments

ACH bank transfer for small business saves 2-3% vs credit cards. Setup guide, fees, timing, and when to use ACH.

Table of Contents

- What Is ACH and How Does It Work?

- ACH vs Credit Card: Cost Comparison

- When ACH Bank Transfer Makes Sense

- How to Accept ACH Payments

- ACH Payment Timing Explained

- Communicating ACH to Customers

- Common ACH Concerns Addressed

- Frequently Asked Questions

You just finished a $3,500 bathroom renovation. The customer pulls out their credit card, and you realize that $87.50 in processing fees is about to disappear from your profit margin.

There is a better way.

ACH bank transfer for small business offers a dramatically cheaper alternative to credit card payments. While credit cards typically cost 2.4% to 3.5% per transaction, ACH transfers often cost less than $1 regardless of the invoice amount. For businesses processing larger invoices, the savings add up fast.

The ACH network processed 8.8 billion payments valued at $23.2 trillion in Q3 2025 alone, with business-to-business payments growing 10% year-over-year. Small businesses are increasingly adopting ACH bank transfers to cut costs and improve cash flow predictability.

This guide covers everything you need to know about accepting ACH payments: how they work, when to use them, how to set them up, and how to communicate the option to your customers without creating confusion.

What Is ACH and How Does It Work?

ACH stands for Automated Clearing House, the electronic network that moves money between bank accounts across the United States. When a customer pays you via ACH, the funds transfer directly from their bank account to yours without going through the credit card networks.

You already use ACH regularly. Direct deposit for payroll, automatic bill payments, and bank-to-bank transfers all run through the ACH network. The system processes over 30 billion transactions annually, moving more than $80 trillion.

How ACH Payments Work for Business Invoices

- Customer receives your invoice with ACH payment option

- Customer authorizes the transfer (enters bank account and routing numbers)

- The ACH network initiates the transfer from their bank to yours

- Funds settle in your account (typically 1-3 business days)

Unlike credit cards, there is no card network (Visa, Mastercard) taking a percentage. There is no interchange fee going to the customer’s bank. The only cost is what your payment processor charges, which is typically a flat fee or a very small percentage.

ACH Debits vs ACH Credits

There are two types of ACH transactions:

- ACH Debit (Pull): You initiate the transfer to pull funds from your customer’s account. This is what happens when customers pay invoices via ACH.

- ACH Credit (Push): The customer initiates the transfer to push funds to your account. This is how direct deposit works.

For accepting invoice payments, you will use ACH debit. Your customer authorizes you to pull the payment from their account.

ACH vs Credit Card: The Real Cost Difference

Understanding credit card processing fees helps you appreciate why ACH bank transfer for small business matters for larger invoices.

Credit Card Processing Costs

Most small businesses pay between 2.4% and 3.5% per credit card transaction. This includes:

- Interchange fees (paid to the card-issuing bank): 1.5% - 2.5%

- Assessment fees (paid to Visa/Mastercard): 0.13% - 0.15%

- Processor markup (paid to your payment processor): 0.2% - 1.0%

- Per-transaction fee: $0.15 - $0.30

ACH Processing Costs

ACH payments typically cost:

- Flat fee per transaction: $0.20 - $1.50

- Or small percentage: 0.5% - 1.0% (often with a cap at $5-6)

- No interchange fees

- No assessment fees

Cost Comparison by Invoice Size

| Invoice Amount | Credit Card (2.9%) | ACH ($0.50 flat) | You Save |

|---|---|---|---|

| $500 | $14.50 | $0.50 | $14.00 |

| $1,000 | $29.00 | $0.50 | $28.50 |

| $2,500 | $72.50 | $0.50 | $72.00 |

| $5,000 | $145.00 | $0.50 | $144.50 |

| $10,000 | $290.00 | $0.50 | $289.50 |

The math is clear: for invoices over $500, ACH saves significant money. For invoices over $2,000, the savings become substantial.

Real-world example: A general contractor billing $150,000 annually in projects over $2,000 could save $4,000 or more per year by shifting larger invoices to ACH.

Pronto Invoice offers free ACH transfers on Professional and Business plans, eliminating payment processing costs entirely for bank transfer payments. When your customer chooses to pay via ACH, you keep the full invoice amount.

When ACH Bank Transfer Makes Sense for Your Business

ACH is not the right choice for every transaction. Understanding when to offer it maximizes your savings without sacrificing convenience.

ACH Works Best For:

Large invoices ($500+)

The percentage savings on credit cards become meaningful. A customer paying a $3,000 invoice via ACH instead of credit card saves you $75 or more.

Recurring clients and subscription billing

Customers you invoice monthly or regularly can set up ACH once and reuse it. The slight inconvenience of entering bank details is worthwhile for an ongoing relationship. ACH is particularly effective for recurring payments like memberships, retainers, or subscription services.

B2B transactions

Business clients are accustomed to paying vendors via bank transfer. Many actually prefer it because it keeps their credit card limits available for other expenses.

Projects with deposits

When collecting a 50% deposit on a $10,000 project, ACH on the $5,000 deposit saves you $125 compared to credit card.

Customers who request it

Some customers actively prefer bank transfers to avoid putting large charges on credit cards.

Credit Cards Work Better For:

Small invoices (under $200)

The per-transaction fee for ACH may not justify the savings. Plus, customers expect to use cards for smaller amounts.

One-time customers

The effort of entering bank details is not worth it for a single transaction. Make card payment easy.

Customers who want rewards

Some customers specifically use credit cards to earn points or cash back. Respect their preference.

Urgent situations

When speed matters more than cost, credit cards clear faster than standard ACH.

How to Accept ACH Payments for Your Small Business

Setting up ACH bank transfer for small business is straightforward with modern invoicing tools.

Step 1: Choose a Payment Processor That Supports ACH

Most major payment processors offer ACH alongside credit card processing. Here is how the top providers compare:

| Provider | ACH Pricing | Fee Cap | Notes |

|---|---|---|---|

| Stripe | 0.8% per transaction | Capped at $5 | No monthly fees |

| Helcim | 0.5% + $0.25 | Capped at $6 | No contracts |

| GoCardless | 0.5% + $0.05 | Capped at $5 | Best for recurring |

| Square | 1% per transaction | Minimum $1 | Integrated POS |

| Pronto Invoice | Free | $0 | Professional/Business plans |

Compare the ACH-specific pricing, not just credit card rates. Some processors that are competitive on cards charge more for ACH.

Step 2: Connect Your Bank Account

Your payment processor needs your business bank account information to deposit ACH payments. This typically requires:

- Business bank account number

- Bank routing number

- Verification of account ownership (micro-deposits or instant verification)

Micro-deposits send two small amounts (like $0.12 and $0.34) to your account. You verify ownership by confirming those amounts. This is a one-time setup that takes 5-10 minutes, though micro-deposit verification may take 1-2 business days.

Step 3: Enable ACH on Your Invoices

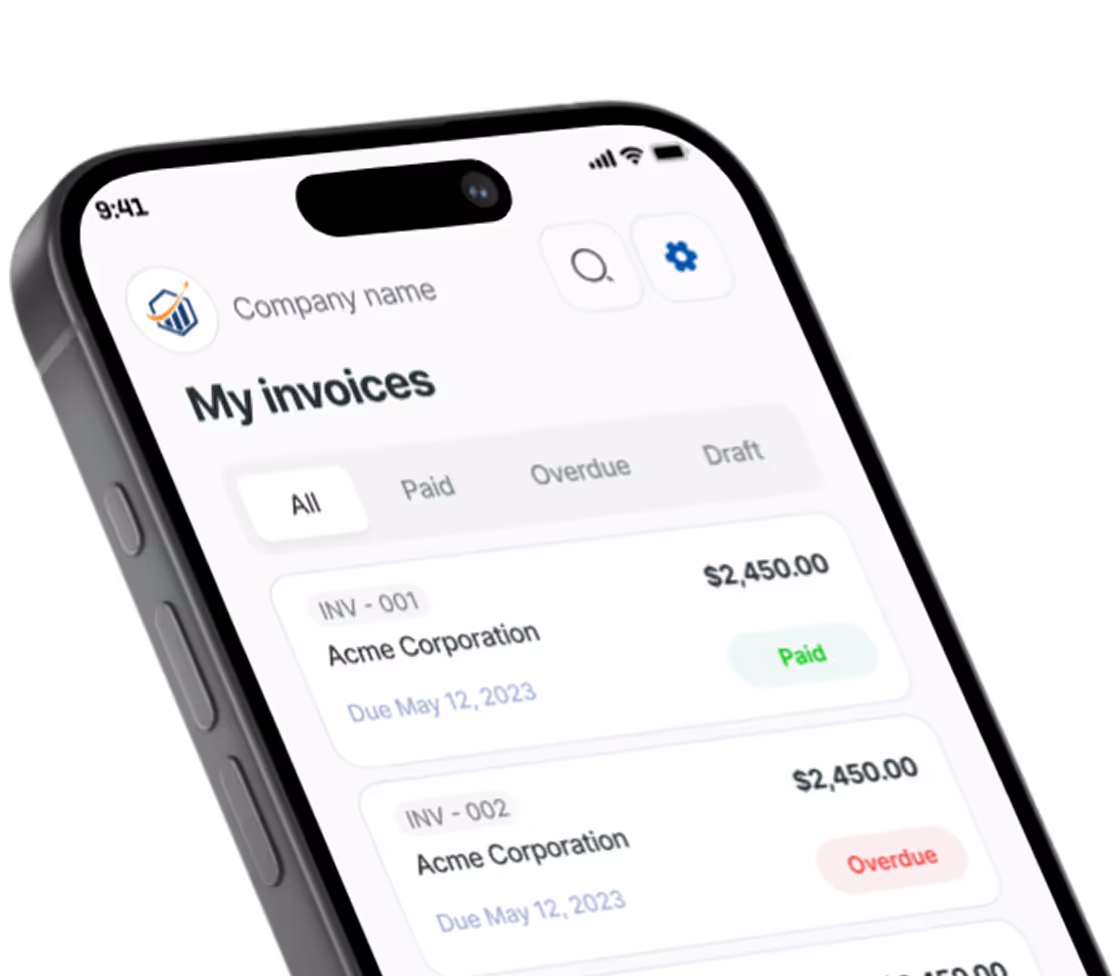

Configure your invoicing software to offer ACH as a payment option. With Pronto Invoice, toggle ACH on in your payment settings and it automatically appears on every invoice you send.

Step 4: Get Customer Authorization

Before processing an ACH payment, you need written authorization from the customer. This can be:

- Online consent through a payment form

- Signed authorization form

- Recorded verbal authorization (for phone orders)

Your payment processor typically handles this through their checkout flow.

Step 5: Communicate the Option to Customers

The payment method only works if customers know about it. More on this in the next section.

ACH Payment Timing: What to Expect

The primary tradeoff with ACH is speed. Credit card payments typically deposit in 1-2 business days. ACH takes longer, though options exist for faster processing.

Standard ACH Timeline

- Day 1: Customer authorizes payment

- Day 1-2: ACH network processes the transaction

- Day 1-3: Funds arrive in your bank account

Most ACH payments now settle in 1-3 business days. The ACH network has improved significantly, and many processors offer next-day settlement as standard.

Same-Day ACH Option

NACHA (the organization governing ACH) now supports same-day ACH for transactions up to $1 million. Same-day ACH posts on the same business day when submitted before cutoff times, typically between 10:30 AM and 4:45 PM Eastern Time.

Some processors offer same-day ACH for an additional fee, usually $1-10 per transaction. This bridges the speed gap with credit cards while maintaining lower costs.

Why the Delay?

Unlike credit cards, where the card network guarantees the payment, ACH pulls directly from the customer’s bank account. The system needs time to:

- Verify the customer has sufficient funds

- Process the transfer between banks

- Handle any potential issues (NSF, incorrect account info)

Managing Cash Flow with ACH

The 1-3 day delay rarely matters if you:

- Invoice promptly: The sooner you invoice, the sooner you start the clock. Same-day invoicing after completing work means payment arrives within a week. Learn more about getting customers to pay faster.

- Mix payment methods: Offer both ACH and cards. Urgent invoices can be paid by card; larger, planned payments can use ACH.

- Set appropriate payment terms: Net 15 or Net 30 terms give customers time to initiate ACH and for funds to clear before the due date.

How to Communicate ACH to Customers

Customers will not use ACH if they do not understand it or find it confusing. Clear communication makes adoption easy.

On Your Invoice

Include ACH as a clearly labeled option alongside credit card payment. Avoid jargon. Instead of “ACH Transfer,” consider “Pay by Bank Transfer” or “Pay from Bank Account.”

Sample invoice language:

Payment Options:

- Pay by Credit Card (Visa, Mastercard, Amex)

- Pay by Bank Transfer (no fees, 1-3 days to process)

For Larger Invoices

When sending invoices over $1,000, consider a brief note explaining the option:

“For your convenience, this invoice can be paid by credit card or direct bank transfer. Bank transfer has no processing fees and is often preferred for larger amounts.”

For Recurring Clients

Introduce ACH during onboarding:

“We offer bank transfer as a payment option for ongoing clients. It is secure, has no processing fees, and is easy to set up. Would you like me to walk you through it?”

What Customers Need to Know

When customers ask about ACH, address these common questions:

- Is it secure? Yes. ACH uses bank-level encryption and is regulated by NACHA and the Federal Reserve. A 2019 Federal Reserve study found ACH payments have the lowest fraud rate of any payment method, approximately 8 cents for every $10,000 in payments.

- What information do I provide? Bank account number and routing number (same as writing a check).

- How long does it take? 1-3 business days to process.

- Can I cancel? You can dispute within 60 days, similar to other electronic payments.

Common ACH Concerns Addressed

What if the payment fails?

ACH returns (failed payments) happen for several reasons:

- Insufficient funds (NSF): Customer’s account lacks the balance

- Incorrect account info: Wrong account or routing number

- Account closed: Customer’s bank account no longer exists

Your payment processor notifies you of returns, typically within 3-5 business days. You can then follow up with the customer to resolve the issue, just as you would with a bounced check.

Return fees: Most processors charge $2-5 for ACH returns. NSF fees may be higher ($20-35). Factor this into your decision when choosing a processor.

What about chargebacks?

ACH disputes work differently than credit card chargebacks. Customers have 60 days to dispute unauthorized ACH debits with their bank. However, ACH disputes are less common than credit card chargebacks, and the dispute process is more straightforward.

Will customers actually use it?

Customer adoption varies by industry and invoice size. B2B customers are very comfortable with bank transfers. Consumer customers may prefer cards for smaller amounts but appreciate the option for larger invoices.

Start by offering ACH alongside credit cards rather than replacing cards entirely. Let customers choose based on their preference.

Is there a minimum invoice size where ACH makes sense?

Generally, ACH becomes worthwhile for invoices over $300-500. Below that threshold, the convenience of credit cards often outweighs the small cost savings.

Frequently Asked Questions

What does ACH stand for?

ACH stands for Automated Clearing House, the electronic network that processes bank-to-bank transfers in the United States. It handles direct deposits, bill payments, and business-to-business transactions.

How much does it cost to accept ACH payments?

ACH payment costs vary by processor. Typical rates range from $0.20 to $1.50 per transaction flat fee, or 0.5% to 1.0% of the transaction amount with a cap around $5-6. Some invoicing platforms, like Pronto Invoice, offer free ACH on higher-tier plans.

How long do ACH payments take to clear?

Standard ACH payments take 1-3 business days to settle. Same-day ACH is available for transactions submitted before cutoff times, typically for an additional fee.

Are ACH payments safe for my business?

Yes. ACH transactions are processed through the Federal Reserve and use bank-level security. Customers must verify their bank accounts before making payments, reducing fraud risk. ACH has the lowest fraud rate of any payment method.

Should I offer ACH or credit cards?

Offer both. Credit cards work best for smaller transactions and customers who want convenience or rewards. ACH works best for larger invoices where you want to avoid 2-3% processing fees.

What is the difference between ACH and wire transfer?

Wire transfers are immediate but expensive ($25-50 per transaction). ACH is slower but nearly free. For most small business invoices, ACH is the better choice due to cost.

Can I accept ACH payments online?

Yes. Most payment processors and invoicing platforms allow you to accept ACH payments through online payment forms. Customers enter their bank account and routing numbers, authorize the transfer, and funds are pulled from their account.

What is the ACH transaction limit?

NACHA raised the same-day ACH limit to $1 million per transaction in 2022. Standard ACH has no per-transaction limit, though your processor may impose their own limits.

Making ACH Bank Transfer Work for Your Small Business

ACH payments are not complicated. They are simply bank transfers with a fancy name. For small businesses billing larger invoices, they represent real savings that add up over a year.

The key is offering ACH as an option without making it the only option. Let customers who want the convenience of credit cards continue using them. Gently guide customers with larger invoices toward ACH by highlighting the benefits.

Start here:

- Check if your current payment processor supports ACH and what it costs

- Enable ACH as a payment option on your invoices

- For invoices over $1,000, mention the bank transfer option to customers

- Track your savings over a few months to see the impact

With Pronto Invoice, ACH transfers are free with our integrated payment processing on Professional and Business plans. Every payment your customer makes via bank transfer goes directly to you with no processing fees taken out. For a contractor billing $5,000 jobs, that is $145 per invoice staying in your pocket instead of going to payment processors.

Your pricing already accounts for the work you do. Keep more of what you earn by giving customers a smarter way to pay.

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.