Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Creating a professional auto repair invoice is about more than documenting charges—it’s the difference between a customer who returns for every service and one who posts a scathing online review. Every auto repair shop owner knows the moment: a customer squints at their invoice, flips it over, and asks, “What exactly am I paying for here?”

How you answer that question—and more importantly, how your auto repair invoice answers it before they ask—determines whether that customer becomes a repeat client or takes their business elsewhere.

Auto repair invoice best practices go far beyond listing parts and labor. In an industry where a 2023 AAA survey found two-thirds of drivers distrust repair shops, your invoice is your most powerful trust-building tool. It’s also a legal document that must meet specific state requirements, or you could face fines, lawsuits, or losing your operating license.

This guide covers everything auto repair shop owners need to know about creating compliant, transparent invoices that protect your business and earn customer loyalty. You’ll learn state disclosure requirements, proper parts and labor itemization, warranty documentation, and the critical distinction between diagnostic and repair billing.

Table of Contents

- Why Auto Repair Invoices Require Special Attention

- State Disclosure Requirements You Cannot Ignore

- Mastering Parts vs. Labor Itemization

- Warranty Information: Protecting Both Parties

- Diagnostic vs. Repair Billing: Avoiding the Trust Trap

- The 3 C’s Method: Professional Documentation

- Building Trust Through Transparent Pricing

- Streamlining Your Invoice Process

- Auto Repair Invoice Checklist

- Frequently Asked Questions

Why Auto Repair Invoices Require Special Attention

Unlike a restaurant receipt or retail transaction, an auto repair invoice documents a complex service relationship. Your customers typically don’t understand what you did, can’t verify the work themselves, and are spending significant money on something they hope they never need again.

This creates a trust gap that dishonest shops have exploited for decades. As a result, most states have enacted specific regulations governing what auto repair invoices must contain. Failing to comply doesn’t just erode trust—it can result in penalties ranging from a few hundred dollars to losing your operating license.

The consequences of poor auto repair invoicing:

- Customer disputes and chargebacks

- Negative online reviews damaging your reputation

- State regulatory fines and license suspension

- Warranty claim denials from manufacturers

- Legal liability in negligence cases

The good news? Shops that embrace transparency as a competitive advantage consistently outperform those that don’t. A detailed, clear auto repair invoice signals professionalism and builds the kind of trust that generates referrals and repeat business.

State Disclosure Requirements You Cannot Ignore

Auto repair invoice best practices start with understanding your legal obligations. While requirements vary by state, certain elements appear almost universally.

Universal Requirements Across Most States

Nearly every state requires auto repair invoices to include:

- Shop identification: Business name, address, phone number, and license or registration number

- Customer information: Name and contact details of the vehicle owner

- Vehicle identification: Year, make, model, VIN, license plate, and odometer reading at intake and completion

- Itemized breakdown: Separate listing of parts and labor with individual prices

- Authorization reference: Connection to the written estimate the customer approved

- Completion date: When the work was finished

- Warranty terms: Clear statement of what’s covered and for how long

States With Stricter Auto Repair Invoice Regulations

Some states impose additional requirements that catch shop owners off guard.

California (Bureau of Automotive Repair) mandates that invoices include:

- Specific labor time for each operation

- Your posted labor rate

- Whether parts are new, used, rebuilt, or reconditioned

- Whether crash parts are OEM or non-OEM aftermarket

- Automotive repair dealer registration number

- Customer’s authorization signature on file

- Prohibition on “shop supplies” or “miscellaneous parts” generic line items

New York requires shops to:

- Keep invoice records for at least three years

- Provide customers with written notice of their rights before work begins

- Follow specific Motor Vehicle Repair Shop Regulations (DMV Form CR-82)

Florida requires clear disclosure of:

- Any sublet work—repairs outsourced to another shop—including the subcontractor’s name and charges

- Whether replacement parts are used, rebuilt, or reconditioned

- A specific statement if non-OEM parts are used, along with warranty disclosure

- Shop supplies or waste disposal charges must include a disclosure statement

- Battery recycling fee of $1.50 per new or remanufactured battery (FS403.7185)

Michigan requires invoices to state whether a manufacturer’s warranty might cover the repair, protecting customers from paying for work their warranty should handle.

Connecticut mandates that if final charges exceed the estimate by more than 10%, you must obtain additional authorization before proceeding.

How to Stay Compliant

The safest approach is to design your auto repair invoice template to meet the strictest state requirements, even if your state is more lenient. This protects you if regulations change, if you expand to additional locations, or if you serve customers from neighboring states.

Review your state’s automotive repair regulations annually. Requirements evolve, and what was compliant three years ago might not be today. Your state’s Department of Motor Vehicles or consumer protection office typically publishes current requirements online.

Mastering Parts vs. Labor Itemization

One of the most critical auto repair invoice best practices is the proper separation of parts and labor charges. This isn’t just a legal requirement—it’s the foundation of customer trust.

Parts Documentation That Builds Confidence

For every part on your auto repair invoice, include:

- Part description: Specific enough for the customer to understand (not just “gasket” but “valve cover gasket”)

- Part number: Manufacturer or aftermarket part number (SKU) for verification

- Part source: OEM, aftermarket, or quality grade (premium, standard, economy)

- Part condition: New, remanufactured, rebuilt, or used (required in many states)

- Unit cost: What you paid for the part

- Markup: Your margin, either as a percentage or dollar amount

- Total part cost: Final price to the customer

Transparency about markup might feel uncomfortable, but it actually reduces disputes. Customers understand that businesses need margins. What frustrates them is feeling like they’re being charged mystery fees. A clear 35% parts markup is easier to accept than an unexplained $200 discrepancy from prices they looked up online.

Labor Itemization That Justifies Your Rates

Break down labor charges by individual operation:

- Operation description: Plain-language explanation of what was done

- Labor time: Hours or tenths of hours for each task

- Labor rate: Your shop’s hourly rate (which should be posted visibly in your waiting area)

- Labor subtotal: Time multiplied by rate for each operation

Many shops use standardized labor guides (like Mitchell or ALLDATA) to determine labor times. Referencing these guides adds legitimacy—you can note “Labor time per Mitchell guide” on your invoice, showing customers that you’re not inflating hours.

Understanding how to properly format professional invoices ensures your auto repair documents meet both legal requirements and customer expectations.

Handling Taxes and Shop Fees

Your auto repair invoice must clearly show:

- Sales tax: Rate applied to taxable items (varies by state and locality)

- Environmental/disposal fees: Waste oil, tire disposal, refrigerant recovery

- Shop supplies: If permitted in your state, with required disclosure language

California prohibits generic “shop supplies” charges, while Florida requires specific disclosure language: “This charge represents costs and profits to the motor vehicle repair facility for miscellaneous shop supplies or waste disposal.”

Warranty Information: Protecting Both Parties

Your auto repair invoice must clearly document warranty terms for both parts and labor. Vague language like “standard warranty applies” invites disputes. Instead, specify exactly what’s covered.

Elements of Clear Warranty Documentation

- Coverage period: “12 months or 12,000 miles, whichever comes first”

- What’s covered: Parts only, labor only, or both

- What’s excluded: Normal wear, customer-supplied parts, damage from neglect

- Claim process: What the customer needs to do if something goes wrong

- Transferability: Whether warranty follows the vehicle if sold

Parts Warranty vs. Labor Warranty

Distinguish between these two types of coverage on your auto repair invoice. Parts warranties often come from the manufacturer and may extend beyond your labor warranty. Make this clear:

“Brake pads: Manufacturer lifetime warranty on parts. Labor warranty: 12 months/12,000 miles.”

This protects you from covering labor costs on a part that fails due to manufacturing defects years after installation, while still standing behind your workmanship.

Special Warranty Situations

Document special circumstances that affect warranty coverage:

- Customer-supplied parts: Most shops wisely don’t warranty labor when customers provide their own parts. State this clearly: “No labor warranty on customer-supplied components.”

- Modified vehicles: If aftermarket modifications complicate the repair, note warranty limitations.

- Declined recommendations: If the customer declined related repairs that might affect the warranted work, document it: “Customer declined recommended transmission flush. Warranty void if failure results from contaminated fluid.”

Diagnostic vs. Repair Billing: Avoiding the Trust Trap

Few things frustrate customers more than paying for diagnostics and then paying again when those same symptoms require repair. Auto repair invoice best practices require clear communication about how diagnostic charges work.

The Diagnostic Fee Debate

Some shops charge a flat diagnostic fee, others bill diagnostic time hourly, and some waive diagnostics if the customer approves repairs. Whatever your policy, it must be:

- Disclosed upfront: Before you connect a scan tool or open the hood

- Clearly invoiced: Shown as a separate line item, not buried in repair charges

- Consistently applied: Don’t change the rules based on customer pushback

Understanding the difference between an estimate and an invoice helps customers appreciate why diagnostic charges exist separately from repair costs.

When Diagnostic Time Should Be Separate

Diagnostic billing makes sense when:

- The diagnosis is complex and time-consuming

- You’re using specialized equipment or expertise

- The customer might take the diagnosis elsewhere for repair

- The vehicle has intermittent issues requiring extended monitoring

When to Roll Diagnostics Into Repair

Consider waiving or reducing diagnostic fees when:

- The issue is obvious (visibly leaking hose, dead battery)

- Diagnosis takes under 15 minutes

- The customer approves repairs on the spot

- You’re building a relationship with a new customer

Whatever your approach, the auto repair invoice should clearly show what the customer is paying for. If you’re waiving a diagnostic fee, show it as a line item with a $0 charge or discount—this reinforces the value you’re providing.

Documenting Diagnostic Findings

Even when no repair is performed, provide detailed documentation of what you found. This serves multiple purposes:

- Justifies the diagnostic charge

- Gives the customer a record for future reference

- Protects you if they claim you missed something

- Demonstrates your expertise and thoroughness

The 3 C’s Method: Professional Documentation

Professional auto repair shops use the 3 C’s method for documenting every repair on their invoices. This industry-standard approach ensures clarity for customers, insurers, and future warranty claims.

What Are the 3 C’s?

- Concern: The customer’s reported problem (“A/C not cooling”)

- Cause: Your diagnosed root cause (“Low refrigerant due to leaking condenser”)

- Correction: The work performed (“Replaced condenser, evacuated and recharged system, verified performance”)

Example 3 C’s Documentation on an Auto Repair Invoice

Customer Concern: Vehicle pulls to the right when braking

Cause Found: Left front brake caliper seized, causing uneven braking force. Right front brake pads worn to 2mm (minimum 3mm). Rotors show heat scoring from metal-on-metal contact.

Correction: Replaced left front caliper. Replaced front brake pads (both sides). Resurfaced front rotors. Tested brake system, confirmed even braking performance.

This documentation style transforms your auto repair invoice from a confusing list of charges into a clear narrative that customers can understand and trust.

Building Trust Through Transparent Pricing

Beyond legal compliance, the most successful auto repair shops use their invoices as trust-building tools. Here’s how to implement auto repair invoice best practices that turn one-time customers into loyal advocates.

Use Plain Language

Technical jargon alienates customers and breeds suspicion. Instead of “R&R water pump, flush coolant, verify thermostat operation,” write:

“Removed and replaced water pump. Flushed old coolant and refilled with new. Tested thermostat to confirm proper engine temperature.”

Show Your Work

Include brief notes explaining why work was needed:

“Brake pads measured at 2mm (minimum safe thickness: 3mm). Rotors showed heat scoring from metal-on-metal contact. Replaced to restore safe stopping ability.”

Provide Before/After Documentation

When possible, photograph the worn or damaged components you’re replacing. Many shops now attach these images to digital invoices or email them separately. Visual evidence eliminates doubt and often generates “wow, it was that bad?” reactions that validate the repair.

Specify Clear Payment Terms

Every auto repair invoice should include clear payment terms. Specify:

- Payment due date (due on pickup, Net 15, Net 30)

- Accepted payment methods (cash, check, credit card, financing)

- Late payment penalties if applicable

- Any early payment discounts

Make Corrections Promptly

If you discover an error—even a small one in your favor—correct it immediately and proactively contact the customer. The trust you build by returning $15 is worth far more than keeping it.

Streamlining Your Invoice Process

Implementing these auto repair invoice best practices might sound overwhelming, especially if you’re still using handwritten tickets or basic spreadsheets. The key is building systems that make compliance and transparency automatic rather than requiring extra effort for every transaction.

Build a Parts and Labor Library

A well-designed parts library eliminates the most tedious aspect of auto repair invoicing. When your common parts, labor operations, and markup formulas are saved and organized, creating a detailed invoice takes minutes instead of half an hour. You can focus on explaining the work to your customer rather than hunting for prices and calculating margins.

Following consistent invoice numbering best practices also helps you track repairs, reference previous work, and maintain organized records for audits.

Go Mobile

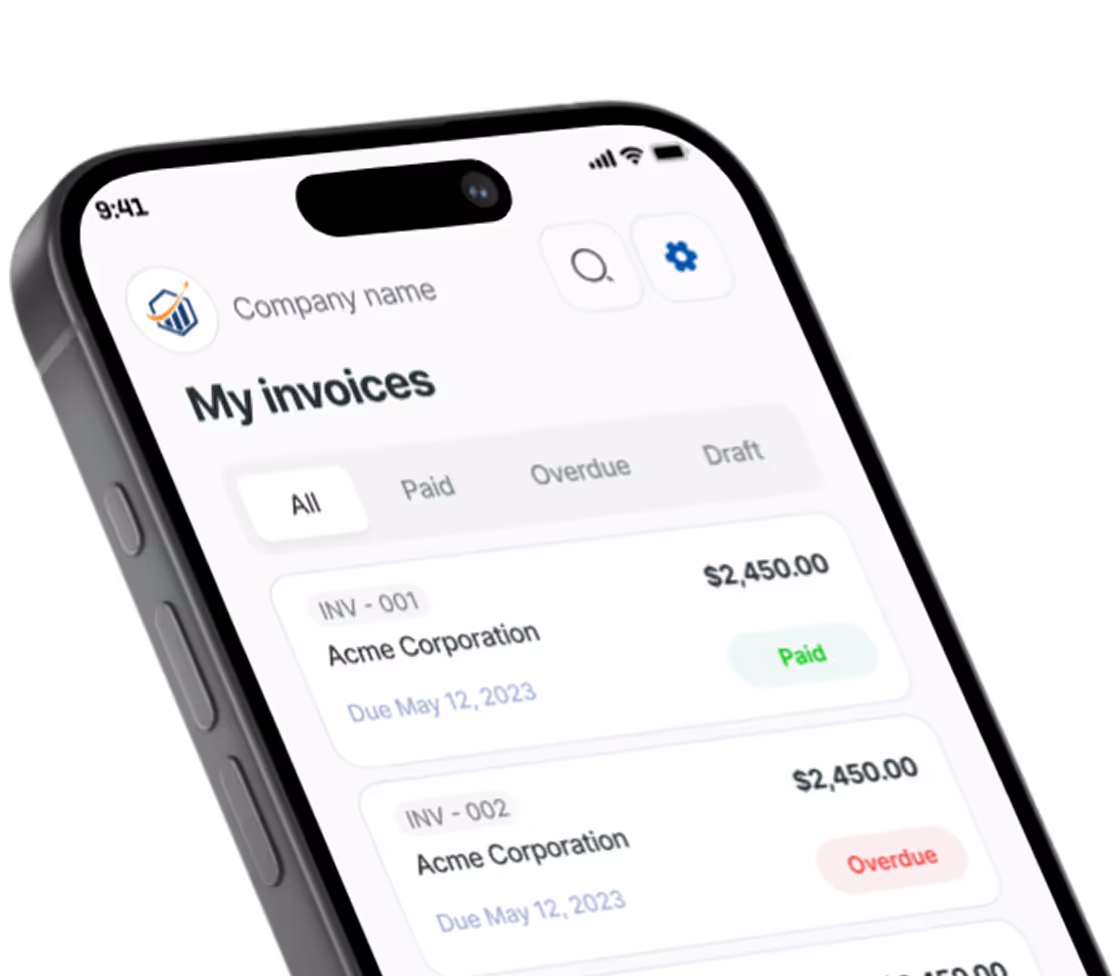

Mobile invoicing capabilities matter, especially for shops that want to present invoices at the vehicle rather than making customers wait at a counter. The ability to generate a professional, itemized auto repair invoice on the spot—complete with all required disclosures—transforms the customer experience.

Automate Recurring Elements

Modern invoicing solutions let you:

- Auto-populate vehicle information from VIN scans

- Apply consistent markup percentages by part category

- Include required state disclosures automatically

- Generate warranty documentation from templates

- Track odometer readings at intake and completion

Auto Repair Invoice Checklist

Before your next customer walks in, review your current invoice template against these auto repair invoice best practices:

Legal Compliance

- Shop name, address, phone, and license/registration number

- Customer name and contact information

- Vehicle year, make, model, VIN, plate, and odometer (in/out)

- Parts and labor itemized separately with individual prices

- Part condition stated (new, used, rebuilt, reconditioned, OEM/aftermarket)

- Reference to authorized estimate

- Completion date

- State-specific disclosures included

Parts Documentation

- Part descriptions in plain language

- Part numbers included for verification

- Part source and condition clearly stated

- Markup transparent and consistent

Labor Documentation

- Operations described in customer-friendly language

- Labor time shown for each task

- Labor rate displayed

- Labor guide reference noted (Mitchell, ALLDATA, etc.)

Warranty Information

- Coverage period specified (months and/or miles)

- Parts vs. labor warranty distinguished

- Exclusions clearly stated

- Claim process explained

Taxes and Fees

- Sales tax calculated and shown

- Environmental fees itemized with required disclosures

- Shop supply charges compliant with state rules

Professionalism

- Invoice is professional and easy to read

- 3 C’s documentation included (Concern, Cause, Correction)

- Payment terms clearly stated

- Contact information for questions provided

If you answered “no” to any of these questions, you have an opportunity to strengthen both your compliance and your customer relationships.

Frequently Asked Questions

What must be included on an auto repair invoice?

An auto repair invoice must include shop identification (name, address, license number), customer information, vehicle details (year, make, model, VIN, odometer), itemized parts with condition noted (new/used/rebuilt), itemized labor with hours and rates, reference to the approved estimate, completion date, warranty terms, and applicable taxes and fees. Specific requirements vary by state, with California, Florida, and New York having particularly strict regulations.

Is an auto repair estimate the same as an invoice?

No. An estimate is a non-binding preliminary document provided before work begins, giving customers an approximate cost. An auto repair invoice is a binding final document issued after work is completed, requesting payment for services rendered. Customers must authorize the estimate before repairs begin, and the final invoice should reference this authorization.

How long should auto repair shops keep invoice records?

Most states require auto repair shops to retain invoice records for three to seven years. New York specifically requires three years minimum. The IRS recommends keeping business records for at least seven years to protect against audits. Digital invoice storage makes long-term retention easier and more accessible.

Can I charge shop supplies or miscellaneous fees on an auto repair invoice?

It depends on your state. California prohibits generic “shop supplies” or “miscellaneous parts” charges on invoices. Florida allows these charges but requires specific disclosure language stating the charge “represents costs and profits to the motor vehicle repair facility for miscellaneous shop supplies or waste disposal.” Always check your state regulations for compliance.

What happens if the final invoice exceeds the estimate?

Most states require shops to obtain customer authorization before exceeding the original estimate. Connecticut specifically requires authorization if charges exceed the estimate by more than 10%. Document all additional authorizations with date, time, and approval method (written, verbal, electronic). Failing to obtain proper authorization can result in customers disputing charges.

How should diagnostic fees appear on an auto repair invoice?

Diagnostic fees should appear as a separate line item clearly labeled “Diagnostic” or “Diagnosis.” Include the time spent, your diagnostic rate, and a summary of findings using the 3 C’s method (Concern, Cause, Correction). If you waive the diagnostic fee when the customer approves repairs, show it as a discounted or $0 line item to demonstrate the value provided.

Start Creating Professional Auto Repair Invoices Today

The auto repair industry will always face trust challenges—but your shop doesn’t have to. Every auto repair invoice you send is a chance to demonstrate that you’re different: transparent, professional, and worthy of your customers’ confidence.

Start treating your invoices as the powerful trust-building tools they are, and watch your reputation—and your repeat business—grow.

Similar to how HVAC contractors have specific invoice requirements, auto repair shops benefit from industry-specific documentation that protects both the business and the customer. Start with our auto repair invoice template and customize it for your shop.

Ready to create professional auto repair invoices in under 60 seconds? Try Pronto Invoice free and see how mobile-first invoicing transforms your customer relationships.

There is always something more to read

Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.

15 Essential Fields Every Professional Invoice Must Include

Learn the 15 essential invoice fields that protect your business, accelerate payments, and reinforce your brand.