Automated Invoice Reminders That Work: Templates + Timing

Automated invoice reminders that work: 8 proven templates, timing sequences, and tone escalation to get paid faster.

Table of Contents

- Why Most Payment Reminders Fail

- The Optimal Payment Reminder Timeline

- Tone Escalation: From Friendly to Firm

- Choosing the Right Channel: Email vs Text vs Phone

- 8 Ready-to-Use Payment Reminder Templates

- What to Look for in Invoice Reminder Software

- Making Your Reminders Work Harder with Automation

- Frequently Asked Questions

- Key Takeaways

You finished the job. You sent the invoice. Now you wait.

And wait.

The payment due date passes. You check your bank account again. Nothing. Now you face the uncomfortable question every business owner dreads: How do you ask for your money without sounding desperate, aggressive, or damaging a relationship you worked hard to build?

According to recent data, 87% of businesses struggle with late payments. Here is the truth most business owners learn the hard way: getting paid is not just about doing great work. It requires a systematic approach to automated invoice reminders that work—balancing persistence with professionalism.

The good news? Automated invoice reminders that work follow predictable patterns. When you understand the timing, tone, and channel strategies that drive results, you can collect more payments faster while actually strengthening client relationships.

This guide gives you everything you need: proven timing sequences, 8 ready-to-use templates, and the psychology behind reminders that get results.

Why Most Payment Reminders Fail

Before diving into templates, understand why most payment reminders go ignored.

They are too passive. Generic reminders that read like automated spam get treated like spam. They land in the inbox, get skimmed, and get forgotten.

They lack clear calls to action. Telling someone they owe money without making it dead simple to pay creates friction. Every extra step reduces your chances of getting paid.

The timing is wrong. Send too early and you seem pushy. Wait too long and the invoice slips off their radar entirely. Most businesses guess at timing instead of following proven sequences.

They ignore client context. A first-time client who forgot needs a different approach than a chronic late-payer testing your boundaries.

They’re sent at the wrong time of day. Studies show the best time to send payment reminders is Tuesday through Thursday, between 10-11 AM or 2-3 PM when people are actively checking email and handling administrative tasks.

The reminders that actually work share common traits: clear timing, appropriate tone escalation, easy payment options, and personalization that shows the message came from a real person who remembers the work performed.

The Optimal Payment Reminder Timeline

Research and real-world testing point to a consistent pattern for maximum effectiveness. Here is the timeline that works for automated invoice reminders.

Pre-Due Date Reminder (3-5 Days Before)

This is your most overlooked opportunity. A friendly heads-up before payment is due accomplishes several things:

- Catches clients who genuinely forgot they had an outstanding invoice

- Allows time to resolve disputes before the due date

- Sets a professional tone that you track payments carefully

- Reduces actual late payments by 25-40%

Due Date Reminder (Day Of)

A brief, friendly reminder on the actual due date. Many clients simply need the prompt to process payment that same day.

First Late Reminder (3-7 Days Overdue)

Still friendly but slightly more direct. This catches the “I meant to pay but got busy” crowd, which represents the majority of late payments.

Key statistic: After 3 months overdue, only 70% of invoices are ever collected. Act quickly.

Second Late Reminder (14 Days Overdue)

Tone shifts to concerned but professional. You are now explicitly acknowledging the payment is late and requesting immediate attention.

Third Late Reminder (30 Days Overdue)

Formal and firm. This message introduces consequences without threats. You are laying groundwork for potential escalation.

Key statistic: After 6 months overdue, only 50% of invoices are recovered.

Final Notice (45-60 Days Overdue)

Direct statement of next steps if payment is not received. This might include late fees, service suspension, or collection referral.

Key statistic: After 12 months, only 10% of outstanding invoices are ever paid.

For a deeper dive into setting expectations upfront, see our complete guide to invoice payment terms.

Tone Escalation: From Friendly to Firm

The art of payment reminders lives in the escalation. Move too fast and you damage relationships. Move too slow and clients learn they can ignore you.

Stage 1: Friendly (Pre-Due Through 7 Days Late)

Language markers:

- “Just a friendly reminder”

- “Wanted to make sure this didn’t slip through the cracks”

- “Let me know if you have any questions”

- Casual sign-off (“Thanks!” or “Cheers”)

Stage 2: Professional Concern (7-21 Days Late)

Language markers:

- “Following up on our previous reminder”

- “Please let us know the status”

- “We’d appreciate your prompt attention”

- Slightly formal sign-off (“Best regards”)

Stage 3: Firm and Direct (21-45 Days Late)

Language markers:

- “This invoice is now significantly overdue”

- “Immediate payment is required”

- “Please contact us today to resolve”

- Formal sign-off with full name and title

Stage 4: Final Notice (45+ Days Late)

Language markers:

- “Final notice before further action”

- “We will be forced to…”

- Clear deadline for response

- Reference to specific next steps

The key insight: match your tone to the situation, not your frustration level. A long-term client with one late payment deserves more patience than a new client showing warning signs. For detailed strategies on this balance, check out how to handle late-paying clients without losing the relationship.

Choosing the Right Channel: Email vs Text vs Phone

Each communication channel has strengths and appropriate use cases.

Email: The Foundation

Best for:

- Formal documentation

- Detailed information (itemized invoices, payment links)

- First contact in reminder sequence

- Clients who prefer written communication

Limitations:

- Easily ignored or filtered to spam

- Average open rate: 20-30%

- Can feel impersonal

Text/SMS: The Attention-Getter

Best for:

- Follow-up after ignored emails

- Urgent reminders (significantly overdue)

- Field service clients who live on their phones

- Quick confirmations (“Got it, paying today!”)

Limitations:

- Character limits reduce detail

- Can feel intrusive if overused

- Less formal documentation trail

Pro tip: Text messages have 98% open rates compared to 20-30% for email. A brief, professional text after an ignored email often gets immediate response.

Phone Calls: The Relationship Preserver

Best for:

- Long-term client relationships

- Large invoice amounts

- Situations where there may be a dispute

- Final attempts before escalation

Limitations:

- Time-intensive

- Can be avoided (voicemail)

- May create confrontation

The most effective approach combines channels strategically. Start with email, follow up with text if no response, and reserve phone calls for high-value situations or final notices.

8 Ready-to-Use Payment Reminder Templates

Copy, customize, and send. These templates are tested and proven effective.

Template 1: Pre-Due Date Reminder (Email)

Subject: Upcoming payment due: Invoice #[NUMBER]

Hi [CLIENT NAME],

Quick heads-up that Invoice #[NUMBER] for [AMOUNT] is due on [DATE].

For your convenience, here’s a direct link to view and pay: [PAYMENT LINK]

If you have any questions about the invoice or the work completed, just reply to this email.

Thanks for your business!

[YOUR NAME]

Template 2: Due Date Reminder (Email)

Subject: Payment due today: Invoice #[NUMBER]

Hi [CLIENT NAME],

Just a reminder that Invoice #[NUMBER] for [AMOUNT] is due today.

Pay now: [PAYMENT LINK]

Thanks!

[YOUR NAME]

Template 3: Due Date Reminder (SMS)

Hi [CLIENT NAME], this is [YOUR NAME]. Friendly reminder: Invoice #[NUMBER] for [AMOUNT] is due today. Pay here: [LINK]

Template 4: First Late Reminder - 3-7 Days (Email)

Subject: Following up: Invoice #[NUMBER] past due

Hi [CLIENT NAME],

I wanted to follow up on Invoice #[NUMBER] for [AMOUNT], which was due on [DUE DATE].

In case it slipped through the cracks, here’s a quick link to view and pay: [PAYMENT LINK]

If there are any issues with the invoice or you need to discuss payment arrangements, please let me know.

Best,

[YOUR NAME]

Template 5: First Late Reminder (SMS)

Hi [CLIENT NAME], this is [YOUR NAME] from [COMPANY]. Quick reminder that Invoice #[NUMBER] for [AMOUNT] is past due. Here’s a link to pay: [LINK]. Thanks!

Template 6: Second Late Reminder - 14 Days (Email)

Subject: Action required: Invoice #[NUMBER] - 14 days overdue

Hi [CLIENT NAME],

I’m following up regarding Invoice #[NUMBER] for [AMOUNT], which is now 14 days past the due date of [DATE].

I’ve attached a copy of the invoice for your reference. Please arrange payment at your earliest convenience using this link: [PAYMENT LINK]

If you’re experiencing any difficulties or have questions about this invoice, please contact me directly so we can find a solution.

Best regards,

[YOUR NAME] [PHONE NUMBER]

Template 7: Third Late Reminder - 30 Days (Email)

Subject: Urgent: Invoice #[NUMBER] - 30 days overdue

Dear [CLIENT NAME],

This is a formal notice that Invoice #[NUMBER] for [AMOUNT] is now 30 days past due.

Despite previous reminders, we have not received payment or communication regarding this outstanding balance.

Please submit payment immediately using this link: [PAYMENT LINK]

Alternatively, contact me today at [PHONE NUMBER] to discuss this matter.

If we do not receive payment or hear from you within 7 business days, we will need to evaluate next steps, which may include late fees per our payment terms and potential referral to collections.

We value your business and hope to resolve this quickly.

Sincerely,

[YOUR NAME] [TITLE] [COMPANY]

Template 8: Final Notice - 45+ Days (Email)

Subject: Final Notice Before Collections: Invoice #[NUMBER]

Dear [CLIENT NAME],

This is a final notice regarding Invoice #[NUMBER] for [AMOUNT], originally due on [DATE].

Despite multiple attempts to contact you, this invoice remains unpaid after [X] days.

If payment is not received by [SPECIFIC DATE - 7 days out], we will:

- Apply late fees of [AMOUNT/PERCENTAGE]

- Suspend any ongoing services

- Refer this account to our collections partner

To avoid these actions, please pay immediately: [PAYMENT LINK]

Or contact me directly at [PHONE NUMBER] before [DATE] to discuss payment arrangements.

[YOUR NAME] [TITLE] [COMPANY]

Using payment links in every reminder reduces friction and dramatically increases the likelihood of immediate payment.

What to Look for in Invoice Reminder Software

When choosing software for automated invoice reminders that work, look for these key features:

Customizable timing sequences - Set specific days for pre-due, due date, and escalating overdue reminders.

Multi-channel support - Send reminders via email and SMS from one platform.

Template customization - Personalize messages with client names, invoice details, and payment links.

Payment link integration - Every reminder should include a one-click payment option.

Client payment history tracking - See which clients pay on time and which need more reminders.

Smart scheduling - Ability to pause reminders for clients you’re in active discussion with.

Delivery confirmation - Know when reminders are opened and links are clicked.

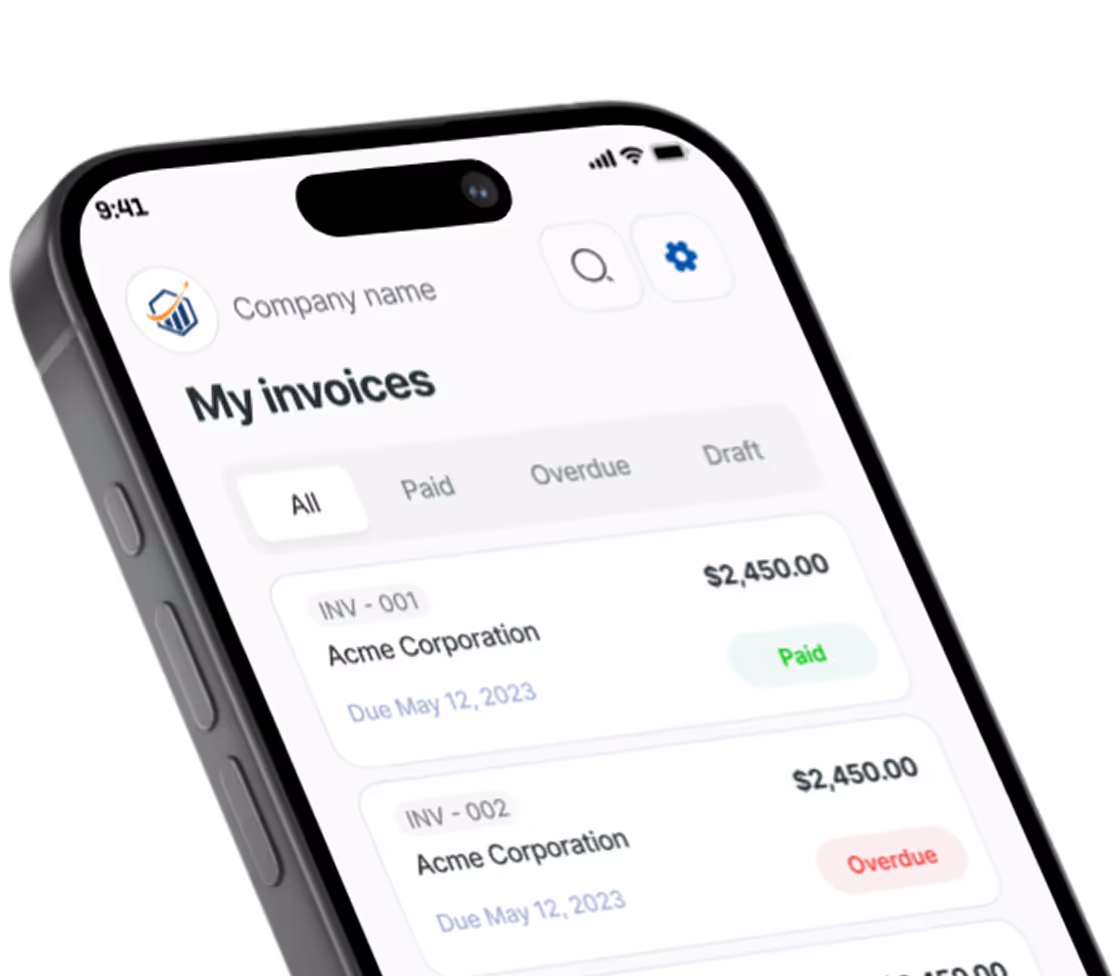

Pronto Invoice includes all of these features with smart AI assistance plus AI-powered optimization that learns from client behavior patterns to send reminders at the optimal time for each individual client.

Making Your Reminders Work Harder with Automation

Manual reminders work, but they require discipline most busy business owners struggle to maintain. You are focused on doing the work, not chasing payments.

This is where automation changes the game.

Modern invoicing tools can send reminders automatically based on your defined timeline. But basic automation just sends generic emails on schedule. The next level of automated invoice reminders that work uses intelligence.

Smart reminder systems adapt to client behavior patterns. A client who typically pays within 48 hours of receiving an invoice might only need a due-date reminder. A client who consistently pays on day 14 might benefit from an earlier nudge. And a client who always responds to texts but ignores emails should receive reminders where they will actually see them.

Pronto Invoice takes this approach with AI-powered reminders that learn from client payment patterns. Instead of treating every client identically, the system adapts reminder timing and frequency based on individual client history. The result: more payments collected with fewer reminders sent.

For more strategies on accelerating payments, explore our guide on how to get customers to pay invoices faster.

Frequently Asked Questions

How many payment reminders should I send before taking action?

Most businesses send 4-6 reminders over a 45-60 day period: pre-due date, due date, 7 days late, 14 days late, 30 days late, and a final notice at 45+ days. After the final notice, escalate to late fees, service suspension, or collections.

When is the best time to send payment reminders?

Tuesday through Thursday between 10-11 AM or 2-3 PM local time tends to get the highest response rates. Avoid Mondays (inbox overload) and Fridays (weekend mindset).

Should I send payment reminders by email or text?

Start with email for formal documentation. If no response after 2-3 email reminders, follow up with SMS. Text messages have 98% open rates compared to 20-30% for email.

How do I automate invoice reminders?

Use invoicing software with built-in reminder automation. Set up a sequence (pre-due, due date, 7/14/30/45 days late) and let the software send reminders automatically. Look for tools that allow template customization and multi-channel delivery.

Do automated payment reminders actually work?

Yes. Businesses using automated reminders report 25-40% fewer late payments and faster average collection times. The key is combining automation with personalization—generic spam gets ignored.

Key Takeaways

Getting paid does not require being pushy. It requires being systematic with automated invoice reminders that work.

Start reminders before payments are late. A friendly pre-due date reminder prevents most late payments before they happen.

Follow a consistent timeline. Days 3, 14, 30, and 45 mark key escalation points. Stick to the schedule regardless of your comfort level.

Escalate tone gradually. Match your language to the situation’s severity. Friendly becomes concerned becomes firm becomes final.

Use multiple channels strategically. Email first, text for follow-up, phone for high-value situations.

Make payment effortless. Every reminder should include a direct payment link. Remove all friction between “I should pay this” and “It’s paid.”

Automate intelligently. The best reminder is one you do not have to remember to send. Let technology handle the follow-up so you can focus on the work that generates your next invoice.

Your time is better spent doing billable work than manually chasing payments. Build a system once, and let it work for you indefinitely.

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.