7 Best FreshBooks Alternatives in 2026

Looking for a FreshBooks alternative? Compare 7 invoicing and accounting apps by pricing, features, AI capabilities, and mobile experience.

FreshBooks is a well-established accounting and invoicing platform used by businesses in over 160 countries. Founded in 2003, it has earned a strong reputation — 4.8 out of 5.0 across 120,000+ reviews — for award-winning customer support, reliable time tracking, and a full double-entry accounting suite that goes well beyond basic invoicing.

But FreshBooks isn’t the right fit for everyone.

Based on app store reviews, G2 feedback, and user forums, the most common reasons people look for FreshBooks alternatives include:

- Too expensive for invoicing alone. FreshBooks starts at $19/month (after the promo ends) for just 5 clients. If you only need to send invoices, you’re paying for accounting, time tracking, and project management features you may never touch.

- Misleading promotional pricing. FreshBooks offers 70% off for 4 months, then the price jumps to $19-$60/month. Multiple users report sticker shock when the promotion expires.

- Client limits on lower tiers. The Lite plan caps you at 5 clients. Plus allows 50. Growing businesses hit these walls fast and face an immediate price jump.

- No AI features. Every invoice requires manual, form-based creation. There’s no natural language input, no smart automation for invoice generation, and no predictive features.

- No offline mode. FreshBooks is cloud-only. Field service professionals working at job sites with poor cell signal can’t create or send invoices until they find a connection.

- Feature bloat for simple needs. Many freelancers and small businesses only need invoicing, not full accounting. FreshBooks can feel overwhelming when all you want to do is send a bill.

We evaluated 7 FreshBooks alternatives based on pricing, invoice limits, mobile experience, AI features, offline support, and integrations. Full disclosure: Pronto Invoice (our product) is on this list. We’ve done our best to give every tool a fair assessment.

Quick Comparison

| App | Starting Price | Free Plan | Unlimited Invoices | AI Features | Offline Mode | Time Tracking | Full Accounting |

|---|---|---|---|---|---|---|---|

| Pronto Invoice | $0/mo | Yes (10/mo) | $12/mo | Yes | Yes | No | No (QuickBooks sync) |

| Wave | Free | Yes | Free | No | No | No | Yes |

| QuickBooks Online | $30/mo | No | All plans | No | No | Yes (add-on) | Yes |

| Invoice Simple | $4.99/mo | No | $19.99/mo | No | No | No | No |

| Invoice Ninja | Free | Yes (5 clients) | $10/mo | No | No | Yes | No |

| Zoho Invoice | Free | Yes (5 clients) | Free | No | No | Yes | No (Zoho Books) |

| Xero | $20/mo | No | All plans | No | No | Add-on | Yes |

1. Pronto Invoice — Best for AI-Powered Mobile Invoicing

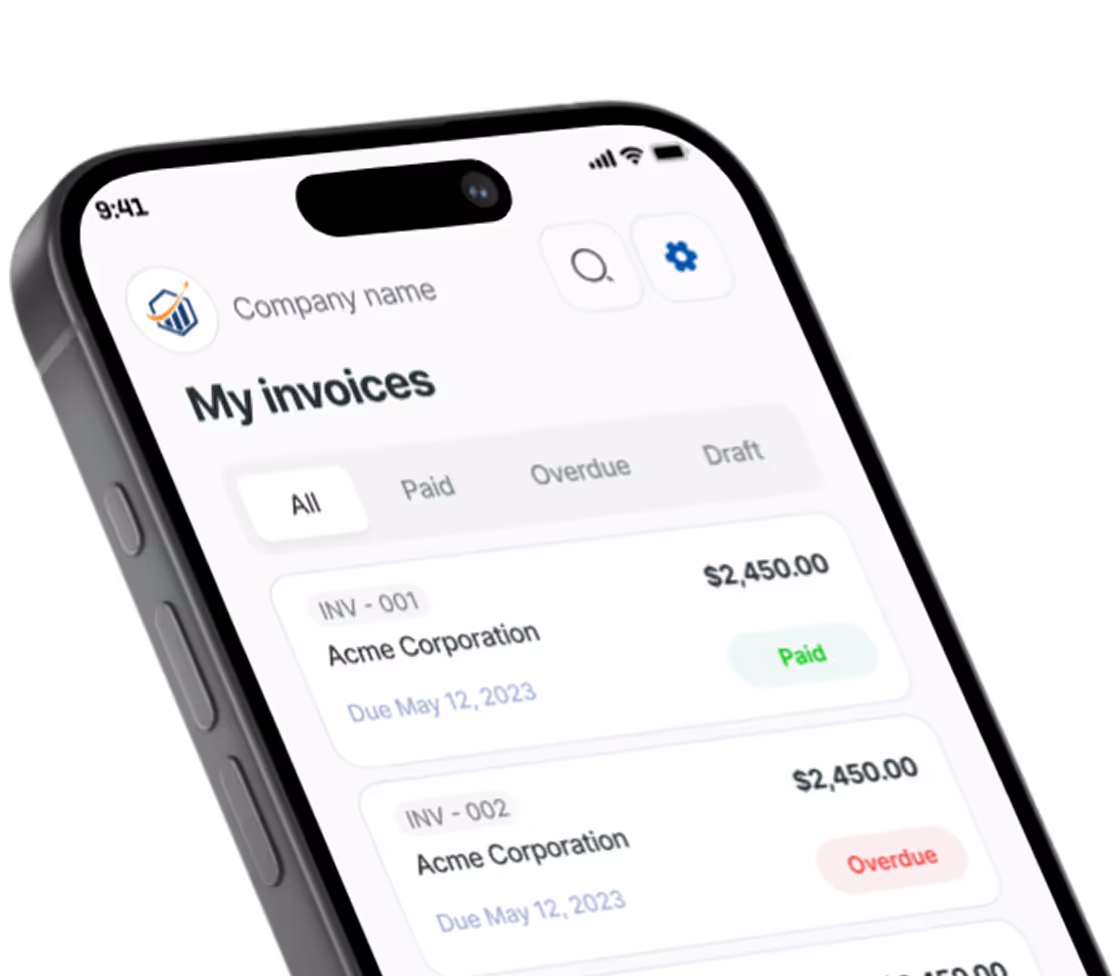

Pronto Invoice is purpose-built for fast invoicing, not accounting. Its AI assistant creates invoices from natural language descriptions in under 60 seconds. It’s a native mobile-first app designed for one-handed operation — built for job sites, not desks.

If you’re leaving FreshBooks because you only need invoicing and want it faster and cheaper, Pronto Invoice is the most direct answer.

Standout Features

- Smart AI invoice creation. Type or speak “Invoice John Smith $500 for AC repair” and the AI builds the complete invoice — client matching, item suggestions, tax calculations. Under 15 seconds for repeat clients.

- 5-step guided workflow. Client > Items > Payment > Document Info > Review & Send. Enforced simplicity that keeps things fast and prevents feature creep.

- Full offline mode. Create invoices, add clients, and preview PDFs without internet. Everything syncs when you reconnect. Built for basements, rooftops, and rural job sites.

- One-handed mobile operation. Every critical action is reachable with your thumb. No pinching, no zooming, no landscape mode required.

- 16 industry templates. Tailored layouts for plumbing, electrical, HVAC, photography, consulting, freelance, and more. See all templates.

- Zero payment processing markup. Connect your own Stripe or PayPal. Keep your negotiated rate. No additional percentage on top.

- QuickBooks sync. Real-time two-way sync on Growth ($12/mo) and above. Get invoicing speed without sacrificing your accounting workflow.

Pricing

| Plan | Monthly | Annual | Invoices |

|---|---|---|---|

| Free | $0 | $0 | 10/mo |

| Starter | $5 | $48/yr | 30/mo |

| Growth | $12 | $115/yr | Unlimited |

| Pro | $24 | $230/yr | Unlimited + 3 users |

No promotional pricing tricks. What you see is what you pay. Compare that to FreshBooks’ $19/month Lite plan (after promo), which limits you to 5 clients. Pronto Invoice’s Growth plan ($12/mo) gives you unlimited invoices, unlimited clients, AI features, offline mode, recurring invoices, and QuickBooks sync — for $7/month less.

Pros

- Free plan with 10 invoices/month — no credit card required

- AI invoice creation is genuinely unique in the invoicing market

- Fully native iOS and Android apps with complete offline support

- No payment processing markup at any tier

- Recurring invoices and QuickBooks sync on Growth ($12/mo)

- Dramatically cheaper than FreshBooks for invoicing-focused users

Cons

- Newer product with a smaller user base than FreshBooks

- No built-in accounting (uses QuickBooks sync instead)

- No in-app client signatures yet (on the roadmap)

- Smart AI requires internet connection (traditional form-based creation works offline)

Best For

Contractors, field service pros, and freelancers who primarily need fast invoicing and can use QuickBooks for accounting. Especially strong for anyone who invoices from a phone on job sites.

2. Wave — Best Free All-in-One

Wave offers completely free invoicing AND double-entry accounting with no invoice or client limits. It generates revenue through payment processing and payroll services, which keeps the core product free.

If your main issue with FreshBooks is price and you want both invoicing and accounting at zero cost, Wave is the most obvious option.

Standout Features

- Unlimited free invoicing — no caps, no client limits, no trial period

- Full double-entry accounting and bookkeeping

- Receipt scanning with automatic categorization

- Financial reports (profit & loss, balance sheet, cash flow)

- Payroll services (paid add-on, US and Canada only)

Pricing

| Feature | Price |

|---|---|

| Invoicing | Free |

| Accounting | Free |

| Payment processing | 2.9% + $0.60 (credit), 1% ($1 min for bank payments) |

| Payroll | $20/mo + $6/employee |

Pros

- Truly free invoicing and accounting — no invoice limits, no client limits, no time limits

- Full double-entry bookkeeping included at no cost

- Receipt scanning and expense categorization

- Good for businesses that need both invoicing and accounting but can’t afford FreshBooks

Cons

- No native mobile app (web-based mobile experience only)

- No offline mode — requires constant internet connection

- No AI features — every invoice is manual form entry

- Higher payment processing fees than average (2.9% + $0.60 per transaction)

- Interface feels dated compared to modern apps

- No dedicated features for field service professionals

- No time tracking

Best For

Budget-conscious businesses that need free invoicing with full built-in accounting and don’t need a strong mobile experience or AI automation.

3. QuickBooks Online — Best for Comprehensive Accounting

QuickBooks Online is the market leader in small business accounting. If you’re leaving FreshBooks because you need MORE accounting power — deeper reporting, inventory management, or better integrations — QuickBooks is the most common destination.

Standout Features

- Industry-leading accounting and bookkeeping

- Massive integration ecosystem (750+ apps)

- Payroll built into the platform

- Inventory management with FIFO tracking

- Tax preparation and filing features

- Accountant-friendly — most accountants already use QuickBooks

Pricing

| Plan | Monthly |

|---|---|

| Simple Start | $30/mo |

| Essentials | $60/mo |

| Plus | $90/mo |

| Advanced | $200/mo |

QuickBooks frequently runs promotional pricing (50% off for 3 months). Prices shown are regular rates.

Pros

- Most comprehensive small business accounting platform available

- Largest integration ecosystem in the market (750+ integrations)

- Accountant-friendly — easy to collaborate with your bookkeeper or CPA

- Industry standard that most financial professionals know

Cons

- Significantly more expensive than FreshBooks ($30-$200/month)

- Overkill for businesses that primarily need invoicing

- No AI invoice creation — form-based entry only

- Steep learning curve for non-accountants

- No offline mode

- Mobile app is functional but not designed for field invoicing

Best For

Businesses that have outgrown FreshBooks’ accounting capabilities and need enterprise-grade bookkeeping, inventory management, or deep integration with third-party tools.

4. Invoice Simple — Best for Simple, Proven Invoicing

Invoice Simple is a focused invoicing app with over 500,000 users and 4.8 stars across 284,000+ reviews. It strips away accounting complexity and focuses on one thing: sending invoices.

If FreshBooks feels like too much and you just want clean, simple invoicing, Invoice Simple delivers that with a proven track record.

Standout Features

- Clean, straightforward form-based invoice creation

- Client signatures on estimates (unique feature)

- Receipt scanning and expense tracking

- QR codes for fast payment

- Strong app store ratings (284K+ reviews, 4.8 stars)

Pricing

| Plan | Monthly | Invoices |

|---|---|---|

| Essentials | $4.99 | 3/mo |

| Plus | $9.99 | 10/mo |

| Premium | $19.99 | Unlimited |

Pros

- Massive, proven user base with outstanding app store ratings

- Simple, focused interface with zero accounting complexity

- Client signatures on estimates — useful for contractors

- Good mobile apps on both platforms

Cons

- No free plan (trial only)

- Only 3 invoices/month on the lowest tier — limiting for active businesses

- No recurring invoices on any plan

- No AI features — manual entry only

- No QuickBooks integration

- No offline invoice creation

Best For

Users who want proven simplicity and a large, established user community without any accounting features to navigate.

5. Invoice Ninja — Best Open-Source Option

Invoice Ninja is an open-source invoicing platform with a free tier and the option to self-host. It’s popular with developers and tech-savvy business owners who want full control over their data and infrastructure.

Standout Features

- Fully open-source codebase with self-hosting option

- Free cloud tier for up to 5 clients

- Project management with Kanban boards

- Built-in time tracking with billable hours

- 40+ payment gateway integrations

- Multi-language support (12+ languages)

Pricing

| Plan | Monthly | Clients |

|---|---|---|

| Free | $0 | 5 clients |

| Ninja Pro | $10 | Unlimited |

| Enterprise | $14+ | Unlimited + advanced features |

Self-hosting is free for all features with no client limits.

Pros

- Self-hosting option gives you complete control over your data

- Generous feature set on the free cloud tier

- Extensive payment gateway integrations (40+)

- Active open-source community and regular updates

- Time tracking and project management built in

Cons

- Cloud free tier limited to 5 clients — same limitation as FreshBooks Lite

- No AI invoice creation

- No offline mode on the cloud-hosted version

- Mobile apps exist but are less polished than dedicated mobile-first tools

- Self-hosting requires technical knowledge to set up, maintain, and secure

Best For

Developers, tech-savvy freelancers, and businesses that want open-source control, data ownership, or the ability to self-host their invoicing infrastructure.

6. Zoho Invoice — Best for Zoho Ecosystem Users

Zoho Invoice is the invoicing module within the larger Zoho business suite. It’s free for up to 5 clients and integrates deeply with Zoho CRM, Zoho Books, and Zoho Projects. If you already use Zoho products, adding Zoho Invoice is seamless.

Standout Features

- Free for up to 5 clients with no invoice limits

- Deep integration with Zoho CRM, Books, Projects, and Inventory

- Automated payment reminders and follow-ups

- Multi-currency invoicing with exchange rate updates

- Client portal for invoice viewing and payment

- Built-in time tracking

Pricing

| Plan | Price | Clients |

|---|---|---|

| Free | $0 | 5 |

| Standard | $9/mo | 500 |

| Professional | $19/mo | Unlimited |

Pros

- Free tier with no invoice limits (5-client cap)

- Excellent value if you already use Zoho products

- Client portal included on all plans

- Strong automation for payment reminders and recurring invoices

- Competitive pricing compared to FreshBooks

Cons

- Limited value outside the Zoho ecosystem — lacks deep third-party integrations

- No AI invoice creation

- No offline mode

- Mobile apps are functional but not mobile-first

- 5-client limit on the free tier is restrictive for growing businesses

- Can feel corporate and complex for solopreneurs

Best For

Businesses already using Zoho products (CRM, Books, Projects) that want integrated invoicing within their existing ecosystem at a lower price than FreshBooks.

7. Xero — Best FreshBooks-Grade Accounting Alternative

Xero is a full cloud accounting platform and FreshBooks’ closest competitor in terms of features. It’s especially popular in UK, Australian, and New Zealand markets, and offers one key advantage FreshBooks can’t match: unlimited users on every plan.

If you like what FreshBooks does but want better pricing for teams, Xero is the most direct replacement.

Standout Features

- Full double-entry accounting with bank reconciliation

- Unlimited users on all plans (FreshBooks charges $11/user/month)

- 1,000+ third-party integrations

- Inventory tracking

- Multi-currency support on all plans

- Payroll (region-dependent availability)

- Purchase orders and bills

Pricing

| Plan | Monthly |

|---|---|

| Starter | $20/mo |

| Standard | $37/mo |

| Premium | $54/mo |

Xero occasionally offers introductory pricing. Prices shown are regular rates.

Pros

- Unlimited users on all plans — saves significantly over FreshBooks’ $11/user/month add-on

- Strong international support (multi-currency, regional tax compliance)

- Massive integration ecosystem (1,000+ apps)

- Excellent bank feed and reconciliation tools

- Full accounting at comparable or lower pricing than FreshBooks

Cons

- No AI invoice creation — form-based entry only

- No offline mode

- Not focused on invoicing — it’s a full accounting platform with a learning curve

- Can be complex for users who only need simple invoicing

- No free plan (trial only)

- Mobile app is functional but designed as a companion to the desktop experience

Best For

Businesses that want full accounting similar to FreshBooks but with unlimited users included in the price and stronger international support. Particularly strong for teams and businesses outside North America.

How We Chose These Alternatives

We evaluated each FreshBooks alternative based on:

- Pricing transparency — Is the pricing straightforward, or hidden behind promotional rates and per-user charges?

- Invoice limits — How many invoices and clients can you have on each tier?

- Mobile experience — Is the mobile app a fully native experience or a web wrapper?

- AI and automation — Does the tool reduce manual data entry with smart features?

- Offline support — Can you create invoices without an internet connection?

- Accounting depth — Does it include bookkeeping, or is it invoicing-only? (Both are valid — depends on your needs.)

- Integrations — Does it connect to tools you already use, especially QuickBooks?

- User reviews — What do real users say on the App Store, Google Play, G2, and Capterra?

We tested or researched each tool and verified pricing and feature availability on official websites. Because FreshBooks is a full accounting platform, we included a mix of invoicing-focused tools and accounting alternatives to cover the full range of users who might be looking for a switch.

All pricing and feature information was last verified February 2026.

Frequently Asked Questions

What is the cheapest FreshBooks alternative?

Wave is completely free for invoicing and accounting with no limits. Pronto Invoice, Invoice Ninja, and Zoho Invoice also offer free plans. Pronto Invoice’s free plan includes 10 invoices/month with full mobile app access and AI features. For unlimited invoices, Pronto Invoice’s Growth plan ($12/mo) is significantly cheaper than FreshBooks’ Lite plan ($19/mo) — and it comes with no client limits.

Which FreshBooks alternative has the best mobile app?

Pronto Invoice is the only alternative built mobile-first with fully native iOS and Android apps, one-handed operation, offline mode, and voice input. It’s designed for people who invoice from their phone — on job sites, in their truck, or between client meetings. Other tools have mobile apps, but they’re companions to a desktop experience, not the primary product.

Is there a free alternative to FreshBooks?

Yes. Wave offers completely free invoicing and accounting with no limits. Pronto Invoice has a free plan with 10 invoices/month. Invoice Ninja is free for up to 5 clients (or unlimited if you self-host). Zoho Invoice is free for up to 5 clients. If you need full accounting for free, Wave is the best option. If you need fast mobile invoicing for free, Pronto Invoice’s free plan is the strongest choice.

Which FreshBooks alternative works offline?

Pronto Invoice is the only alternative with full offline support. You can create invoices, add clients, manage items, and preview PDFs without any internet connection. Everything syncs automatically when you reconnect. This matters for field service professionals — HVAC techs in basements, electricians in new construction, plumbers in crawl spaces — who often work where cell signal doesn’t reach.

Which invoicing app has AI features?

Pronto Invoice is the only invoicing app with conversational AI invoice creation. Describe your work in natural language — “Invoice Sarah Chen $1,200 for kitchen remodel, 3 hours labor plus materials” — and the AI builds the complete invoice. It matches existing clients, suggests catalog items, applies tax rates, and learns your patterns over time. No other FreshBooks alternative currently offers this capability.

Can I switch from FreshBooks to another app?

Yes. Your historical data stays in FreshBooks (you can export invoices as PDFs and client lists as CSV). Most alternatives don’t offer a direct FreshBooks import, so you’ll rebuild your client list and item catalog in the new tool. With Pronto Invoice, the AI learns your clients and items quickly — after a few invoices, it autocompletes most fields. If you use QuickBooks alongside FreshBooks, Pronto Invoice’s QuickBooks sync can pull in your existing client and item data.

Do I need full accounting software, or is invoicing enough?

It depends on your business. If you file your own taxes, track inventory, or manage payroll, you likely need accounting software (QuickBooks, Xero, or Wave). If you primarily need to send invoices and get paid — and your accountant or tax preparer handles the books — a dedicated invoicing tool like Pronto Invoice is faster, simpler, and cheaper. Many Pronto Invoice users pair it with QuickBooks through real-time sync, getting the speed of a dedicated invoicing app with the depth of full accounting.

Ready to Try a Better Way to Invoice?

Create your first invoice in 60 seconds. No credit card required.

Compare Pronto Invoice to FreshBooks side by side: Pronto Invoice vs FreshBooks

All pricing and feature information verified on each product’s official website as of February 2026. FreshBooks pricing reflects regular (non-promotional) rates unless otherwise noted. Pricing and features may have changed. Visit each product’s website for the most current information.

There is always something more to read

7 Best Billdu Alternatives in 2026

Looking for a Billdu alternative? Compare 7 invoicing apps by pricing, free plans, AI features, and QuickBooks integration.

7 Best InvoiceHome Alternatives in 2026

Looking for an InvoiceHome alternative? Compare 7 invoicing apps by pricing, features, AI capabilities, and mobile experience.

7 Best Invoice Simple Alternatives in 2026

Looking for an Invoice Simple alternative? Compare 7 invoicing apps by pricing, features, AI capabilities, and mobile experience.