Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

You just finished a plumbing repair at a customer’s home. They ask for “the bill,” but you hand them an “invoice.” This raises the question: bill vs invoice, what’s the difference? Are those the same thing? Does it matter?

For many small business owners and freelancers, the terms “bill” and “invoice” get used interchangeably. And while casual conversation might forgive the mix-up, using the wrong terminology in your business documents can confuse clients, create accounting headaches, and even cause legal complications.

This guide breaks down the differences between bills, invoices, receipts, and statements so you always know which document to create and when.

What Is an Invoice?

An invoice is a formal document sent by a seller to a buyer requesting payment for goods or services provided. It details what was delivered, the agreed-upon price, payment terms, and due date.

Invoices are primarily used in business-to-business (B2B) transactions and are issued after goods or services have been delivered.

Key characteristics of an invoice:

- Created by the seller or service provider

- Sent before payment is received

- Includes itemized list of products or services

- Specifies payment terms (Net 15, Net 30, due upon receipt)

- Contains a unique invoice number for tracking (learn invoice number best practices)

- Serves as a legal record of the transaction

Example: An electrician completes a panel upgrade and sends the homeowner an invoice for $2,400, payable within 30 days.

What Is a Bill?

A bill is essentially the same document as an invoice, but viewed from the buyer’s perspective. When you receive an invoice from someone, you might call it “the bill” because it represents money you owe.

Bills are more commonly used in business-to-consumer (B2C) transactions where immediate payment is expected, such as restaurants, utilities, and healthcare.

Key characteristics of a bill:

- The same document as an invoice, different perspective

- Refers to what the buyer or customer owes

- Often used in retail and utility contexts

- Common in restaurants, utilities, and healthcare

- Typically requests immediate payment

Example: That same $2,400 electrician invoice becomes “the bill” when the homeowner discusses it with their spouse.

The simple distinction: You send an invoice. You receive a bill.

Bill vs Invoice: Key Differences at a Glance

Understanding the bill vs invoice distinction helps you communicate professionally and manage your accounting correctly.

| Aspect | Invoice | Bill |

|---|---|---|

| Perspective | Seller’s term (you send it) | Buyer’s term (you receive it) |

| Primary use | B2B transactions | B2C transactions |

| Payment timing | Often includes extended terms (Net 30) | Usually due immediately |

| Detail level | Comprehensive with line items | May be simplified |

| Who creates it | Seller or service provider | Same document, buyer’s view |

| Purpose | Request payment | Represents amount owed |

What Is a Receipt?

A receipt is proof that payment has been made. Unlike invoices and bills, which request payment, a receipt confirms that the transaction is complete.

Key characteristics of a receipt:

- Created after payment is received

- Serves as proof of purchase

- Important for returns, warranties, and tax records

- May include payment method and date

Example: After the homeowner pays the $2,400, the electrician provides a receipt showing the payment was processed.

What Is a Statement?

A statement of accounts is a summary document showing account activity over a period of time. It typically lists multiple invoices, payments received, credits applied, and the current balance owed.

Key characteristics of a statement:

- Summarizes account activity over time

- Shows multiple transactions (invoices, payments, credits)

- Displays current balance due

- Often sent monthly to ongoing clients

- Useful for accounts receivable management

Example: A landscaping company sends a monthly statement to a commercial property management client showing all maintenance visits, partial payments received, and the remaining balance.

Quick Comparison: Bill vs Invoice vs Receipt vs Statement

| Document | Who Creates It | When It’s Created | Purpose | Payment Status |

|---|---|---|---|---|

| Invoice | Seller/Provider | After goods or services delivered | Request payment | Unpaid |

| Bill | Same as invoice (buyer’s term) | After goods or services delivered | Owed amount | Unpaid |

| Receipt | Seller/Provider | After payment received | Confirm payment | Paid |

| Statement | Seller/Provider | Periodically (monthly) | Summarize account activity | May include unpaid and paid items |

Why Does the Bill vs Invoice Distinction Matter?

Using incorrect terminology might seem harmless, but it can create real problems for your business.

Client Confusion

When you tell a customer you’re sending their “receipt” but actually send an invoice, they may think they’ve already paid. This leads to delayed payments and awkward follow-up conversations.

A contractor once shared how a client ignored three “receipt” emails because the client assumed the attached documents confirmed payment rather than requested it. The invoice went unpaid for 60 days before the confusion was discovered.

Accounting Errors

Your bookkeeper or accountant relies on document types to categorize transactions correctly. In accounting software like QuickBooks, invoices represent money coming in (accounts receivable), while bills represent money going out (accounts payable). Mislabeling an invoice as a receipt could show revenue as collected when it hasn’t been, throwing off cash flow projections and financial reporting.

Legal and Tax Implications

In disputes or audits, having properly labeled documents matters. An invoice establishes a legal obligation to pay. A receipt proves payment occurred. Mixing these up could weaken your position if you ever need to pursue unpaid invoices or defend your tax filings.

Professional Perception

Using correct terminology signals professionalism. Clients, especially in B2B contexts, expect vendors to understand basic business documentation. Consistently using proper terms builds trust and credibility.

Real-World Examples by Industry

Service Business Example: HVAC Repair

- Technician completes AC repair at customer’s home

- Invoice sent immediately after service: Lists parts, labor, total of $650, payment due in 14 days

- Customer pays via credit card on the spot

- Receipt generated confirming $650 payment received

- For ongoing maintenance customers, monthly statement shows all visits and current balance

Retail Example: Custom Furniture Shop

- Customer orders custom dining table, pays 50% deposit

- Receipt provided for $1,500 deposit

- Table completed and delivered

- Invoice sent for remaining $1,500 balance

- Customer pays balance

- Final receipt provided

B2B Example: Marketing Consultant

- Consultant completes monthly retainer work

- Invoice sent on the 1st for $3,000, Net 30 terms

- Client’s accounts payable processes payment

- Receipt sent upon payment clearing

- Quarterly statement summarizes all invoices, payments, and any outstanding balances

When to Use Each Document Type

Send an Invoice When:

- You’ve completed work or delivered products

- You need to request payment

- You want to establish payment terms and due dates

- You need a trackable document number for your records

Provide a Receipt When:

- Payment has been received and processed

- Customer requests proof of payment

- Transaction involves cash where documentation is important

- Customer may need records for taxes, warranties, or reimbursement

Send a Statement When:

- You have ongoing client relationships with multiple transactions

- You want to remind clients of outstanding balances

- Monthly or quarterly account summaries are expected

- You need to show a complete picture of account activity

Practical Tips for Getting It Right

Create Documents at the Right Time

The most common mistake is timing. Invoices go out immediately after delivering goods or services, not before and not weeks later. Receipts are generated the moment payment clears. Getting this timing right prevents confusion and accelerates your cash flow.

Use Clear Labels

Make sure your documents are clearly titled. “INVOICE” should appear prominently on payment requests. “RECEIPT” or “PAYMENT CONFIRMATION” on proof of payment. Don’t assume customers will figure it out from context.

Include Essential Information

Every invoice should include your business name and contact info, customer name, unique invoice number, date, itemized list of goods or services, total amount, payment terms, and accepted payment methods. For a full breakdown, see our guide on essential invoice fields.

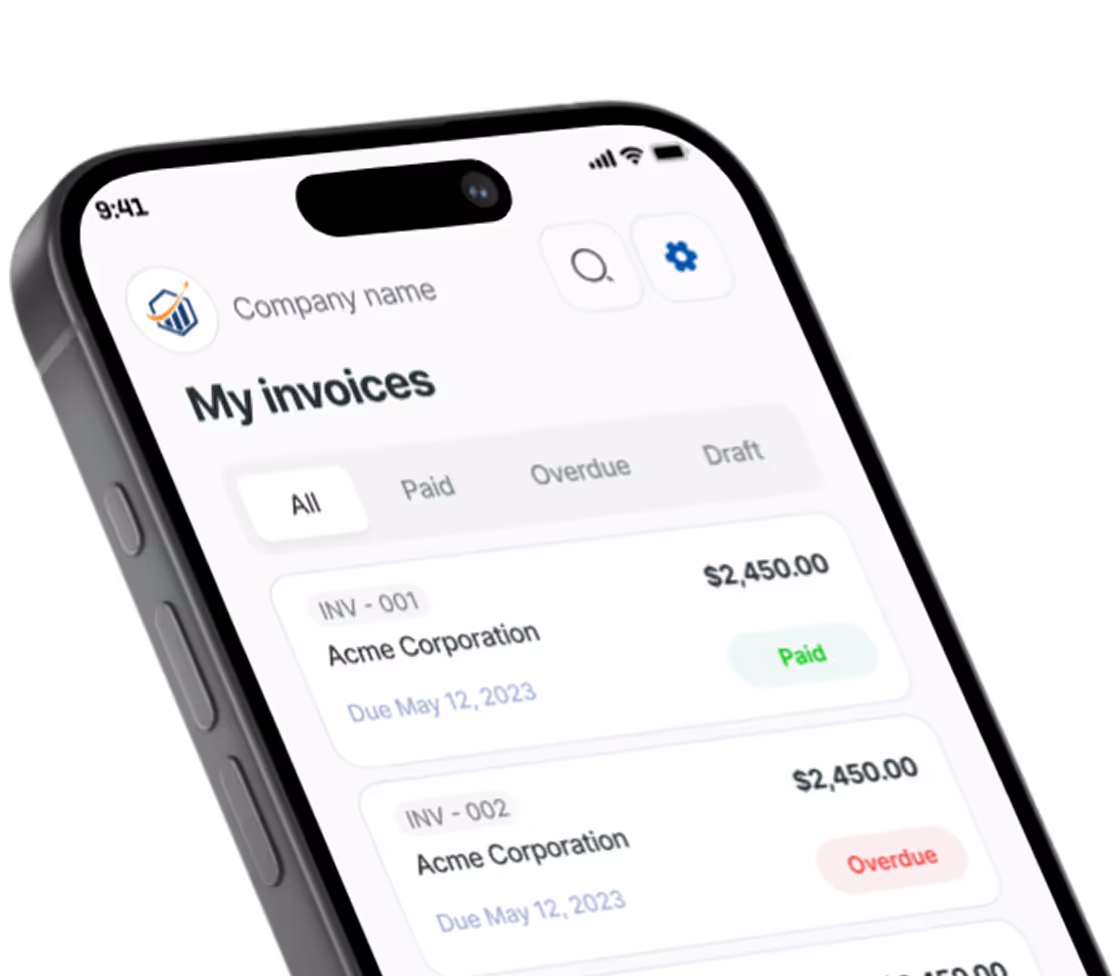

Leverage Mobile Invoicing Tools

Field service professionals like plumbers, electricians, and contractors often need to create documents on the job site. Having the ability to generate a proper invoice immediately after completing work, rather than waiting until you’re back at the office, means faster payments and fewer administrative headaches.

Mobile invoicing apps like Pronto Invoice let you create and send the right document type directly from your phone, whether you’re on a rooftop or in a client’s basement. You can instantly switch between generating invoices before payment and receipts after payment, eliminating the terminology confusion that delays collections.

Frequently Asked Questions

What is the difference between a bill and an invoice?

The difference between a bill and an invoice is primarily about perspective. An invoice is what a business sends to request payment for goods or services. A bill is the same document from the customer’s viewpoint, representing what they owe. You send invoices; you receive bills. Both documents contain the same information but are named differently based on which side of the transaction you’re on.

Is an invoice a receipt?

No, an invoice is not a receipt. An invoice is sent before payment to request money owed. A receipt is provided after payment to confirm the transaction is complete. Confusing these documents can cause significant problems: clients may think they’ve already paid when they haven’t, leading to collection delays.

When should I use a bill instead of an invoice?

Use the term “bill” when referring to documents you receive from vendors or suppliers. Use “invoice” when creating payment requests to send to your own customers. In B2C contexts like restaurants or utilities, “bill” is more common because payment is expected immediately. In B2B contexts with payment terms, “invoice” is the standard term.

What is the difference between a bill and an invoice in QuickBooks?

In QuickBooks and similar accounting software, invoices and bills serve opposite functions. An invoice tracks money owed to you (accounts receivable) and represents income. A bill tracks money you owe to vendors (accounts payable) and represents expenses. This distinction is critical for accurate financial reporting.

Can I use “bill” and “invoice” interchangeably?

While many people use “bill” and “invoice” interchangeably in casual conversation, using the correct term in business documentation is important. Mislabeling documents can confuse clients, create accounting errors, and appear unprofessional. For best practices, use “invoice” for documents you send requesting payment and “bill” for documents you receive indicating what you owe.

Key Takeaways

- Invoice = Payment request from seller (what you send)

- Bill = Same document from buyer’s perspective (what you owe)

- Receipt = Proof that payment was made

- Statement = Summary of account activity over time

Using the correct document at the right time keeps your clients informed, your accounting accurate, and your business running professionally. When you’re working in the field, having the right mobile tools to generate proper invoices immediately after completing work eliminates the terminology confusion and gets you paid faster.

Next time a customer asks for “the bill,” you’ll know exactly what they mean and exactly which document to provide.

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.

12 Essential Fields Every Professional Estimate Must Include

Learn the 12 essential fields every professional estimate needs to win projects, build trust, and prevent disputes.