Business Overhead Expenses Explained: What Counts and How to Track Them

Business overhead expenses explained with real examples. Learn cost types, calculate your overhead rate, and track profit.

Business overhead expenses explained simply: they are the hidden costs that eat into every dollar you earn, whether you complete one job or fifty this month. Understanding overhead is the difference between running a profitable operation and wondering why your bank account never grows despite staying busy.

Many small business owners and contractors focus on direct job costs — materials and labor — while overlooking the indirect costs silently consuming their margins. A plumber finishes a $500 job thinking they made $150 in profit. But after accounting for van payments, insurance, fuel, and software subscriptions, the real profit might be half that amount.

This guide breaks down business overhead expenses explained in practical terms. You will learn exactly what qualifies as overhead, the three types of overhead costs, how to calculate your overhead rate for accurate pricing, and straightforward methods to track expenses without complicated accounting software.

Table of Contents

- What Are Overhead Expenses?

- Overhead Expenses vs Operating Expenses

- Three Types of Overhead Expenses

- Common Overhead Expenses by Category

- How Overhead Affects Your Pricing and Profitability

- What Is a Good Overhead Ratio?

- How to Track Overhead Expenses Effectively

- Common Overhead Tracking Mistakes to Avoid

- 5 Ways to Reduce Your Overhead Costs

- Connecting Expense Tracking to Your Invoicing

- Frequently Asked Questions

What Are Overhead Expenses?

Overhead expenses are the ongoing costs of running your business that are not directly tied to producing a specific product or completing a particular job. These indirect costs keep your business operational regardless of how much work you complete in a given month.

Think of it this way: if you are a plumber, the copper pipe you install at a customer’s house is a direct cost. But your work van, insurance, phone bill, and the gas you use driving between jobs? Those are overhead costs.

Direct costs change based on your work volume. Overhead costs exist whether you complete one job or fifty jobs this month.

Here is a quick comparison:

| Direct Costs | Overhead Costs |

|---|---|

| Materials for a specific job | Monthly rent or lease |

| Subcontractor labor for a project | Business insurance premiums |

| Permits pulled for a client | Software subscriptions |

| Job-specific equipment rental | Fuel and vehicle payments |

Understanding this distinction matters because overhead expenses directly impact:

- How you price your services

- Your actual profit margin on each job

- Your profitability ratios and long-term sustainability

- Tax deductions you can claim

Overhead Expenses vs Operating Expenses

These terms get confused constantly, and the distinction matters for accurate financial tracking.

Operating expenses include everything you spend running your business — both direct costs (materials, direct labor) and indirect costs. Overhead expenses are a subset of operating expenses that includes only the indirect costs.

In other words, all overhead is an operating expense, but not all operating expenses are overhead. When you set up your chart of accounts, keeping these categories separate makes your financial reports far more useful.

Here is how they relate:

- Operating Expenses = Direct Costs + Overhead Costs

- Overhead Costs = Only indirect costs not tied to specific jobs

For a contractor, lumber purchased for a deck build is an operating expense but not overhead. The contractor’s truck payment is both an operating expense and an overhead cost.

Three Types of Overhead Expenses

Not all overhead costs behave the same way. Understanding these three categories helps you predict cash flow and make smarter business decisions.

Fixed Overhead Expenses

Fixed expenses remain constant regardless of business activity. You pay the same amount whether you are swamped with work or experiencing a slow month.

Examples of fixed overhead:

- Monthly rent or lease payments

- Business insurance premiums

- Equipment loan payments

- Software subscriptions

- Licensing fees

- Base salary for administrative staff

A landscaping company pays the same $800 monthly rent for their equipment storage yard whether they service 50 properties or 150 properties. These fixed expenses are the easiest to budget for because they remain predictable from month to month.

Variable Overhead Expenses

Variable overhead expenses fluctuate based on business activity. As your workload increases, these variable costs increase proportionally.

Examples of variable overhead:

- Fuel and vehicle maintenance

- Office supplies

- Subcontractor payments

- Credit card processing fees

- Shipping costs

- Utilities in some cases

An HVAC technician spends more on fuel during busy summer months when they are running between emergency AC repair calls all day. During slower winter months, fuel costs drop accordingly.

Semi-Variable Overhead Expenses

Semi-variable expenses have both fixed and variable components. There is a base cost plus additional costs based on usage.

Examples of semi-variable overhead:

- Utility bills (base charge plus usage)

- Phone and internet (base plan plus overages)

- Vehicle costs (insurance is fixed, maintenance varies)

- Marketing expenses (retainer plus campaign costs)

An electrical contractor pays a fixed $200 monthly for their contractor software, but pays an additional $5 per user when they bring on seasonal help.

Common Overhead Expenses by Category

Here is a comprehensive list of overhead expenses organized by category. Use this as a checklist to ensure you are capturing all your indirect costs and not leaving money unaccounted for.

Facility Costs

- Rent or mortgage payments

- Property taxes

- Utilities (electric, gas, water)

- Maintenance and repairs

- Cleaning services

- Security systems

Vehicle and Transportation

- Vehicle payments or leases

- Auto insurance

- Fuel costs

- Maintenance and repairs

- Parking fees

- Toll charges

Insurance and Licensing

- General liability insurance

- Professional liability insurance

- Workers compensation

- Business licenses

- Professional certifications

- Bond premiums

Technology and Equipment

- Software subscriptions

- Phone and internet service

- Computer equipment

- Tool maintenance and replacement

- Equipment leases

- Cloud storage

Administrative Costs

- Bookkeeping and accounting services

- Legal fees

- Bank fees and merchant account charges

- Office supplies

- Postage and shipping

- Professional memberships and dues

Marketing and Sales

- Website hosting and maintenance

- Advertising costs (online and print)

- Business cards and marketing materials

- Trade show expenses

- Customer relationship management tools

- Referral program costs

How Overhead Affects Your Pricing and Profitability

Many service professionals make a critical pricing mistake: they calculate job costs based on materials and labor alone, forgetting that overhead consumes a portion of every dollar earned. This is how businesses stay busy but never become profitable.

Calculating Your Overhead Rate

To price jobs accurately, you need to know your overhead rate per billable hour. Here is a straightforward method:

Step 1: Add up all monthly overhead expenses.

Step 2: Calculate your total billable hours per month (exclude admin time, travel downtime, and breaks).

Step 3: Divide total overhead by billable hours.

Example for an independent electrician:

| Overhead Category | Monthly Cost |

|---|---|

| Van payment | $450 |

| Insurance | $300 |

| Fuel | $400 |

| Phone and software | $150 |

| Tools and supplies | $200 |

| Marketing | $200 |

| Miscellaneous | $100 |

| Total Monthly Overhead | $1,800 |

Billable hours per month: 120 hours

Overhead cost per hour: $15

This means every hour this electrician works must cover $15 in overhead before generating any actual profit. If their labor rate is $75 per hour, only $60 goes toward labor costs and profit. When setting your invoice payment terms, understanding this number helps you choose terms that keep cash flowing to cover these ongoing costs.

The Profitability Reality Check

Consider this scenario:

A contractor charges $500 for a job.

- Materials cost: $150

- Labor (5 hours at $40/hr): $200

- Overhead allocation (5 hours at $15/hr): $75

Actual profit: $75 (not $150 as they might assume without tracking overhead)

Without tracking overhead, this contractor thinks they are making 30% profit. In reality, they are making 15%. Multiply that miscalculation across hundreds of jobs per year, and you have a business that looks busy but cannot afford to grow or survive a slow season.

What Is a Good Overhead Ratio?

Your overhead ratio tells you what percentage of revenue goes toward indirect costs. The formula is:

Overhead Ratio = (Total Monthly Overhead / Total Monthly Revenue) x 100

Most financial advisors recommend keeping your overhead ratio below 35% of total revenue. Here are benchmarks by business type:

| Business Type | Target Overhead Ratio |

|---|---|

| Field service contractors | 20% - 30% |

| Freelancers and consultants | 15% - 25% |

| Small businesses (with employees) | 25% - 35% |

| Retail and product businesses | 30% - 40% |

If your overhead ratio consistently exceeds 35%, it is time to either increase revenue, reduce indirect costs, or both. Track this number alongside your other profitability ratios to get a complete picture of your financial health.

How to Track Overhead Expenses Effectively

Business expenses tracking does not require complex accounting systems. What matters is consistency and connecting your expenses to your actual revenue.

Method 1: The Category Spreadsheet

Create a simple spreadsheet with categories matching the list above. Each week, spend 15 minutes logging expenses. At month end, total each category.

Pros: Simple, free, full control Cons: Manual entry, easy to forget, no automation

Method 2: Dedicated Business Banking

Open a separate business checking account and credit card. Every business expense goes through these accounts, creating an automatic paper trail. This is one of the first things to do when starting a small business.

Pros: Automatic tracking, clean separation, easier tax prep Cons: Requires discipline to use only business accounts

Method 3: Expense Tracking Apps

Use mobile expense tracking that captures receipts and categorizes spending automatically. The best solutions integrate with your invoicing so you can see true job profitability.

Pros: Real-time tracking, receipt capture, reporting Cons: Monthly cost, learning curve

Method 4: Integration with Invoicing

The most effective approach connects expense tracking directly to your invoicing system. When you can see expenses alongside revenue, true profitability becomes clear.

For field service professionals, this integration is particularly valuable. You can capture expenses on-site, photograph receipts immediately, and tie costs to specific jobs or clients.

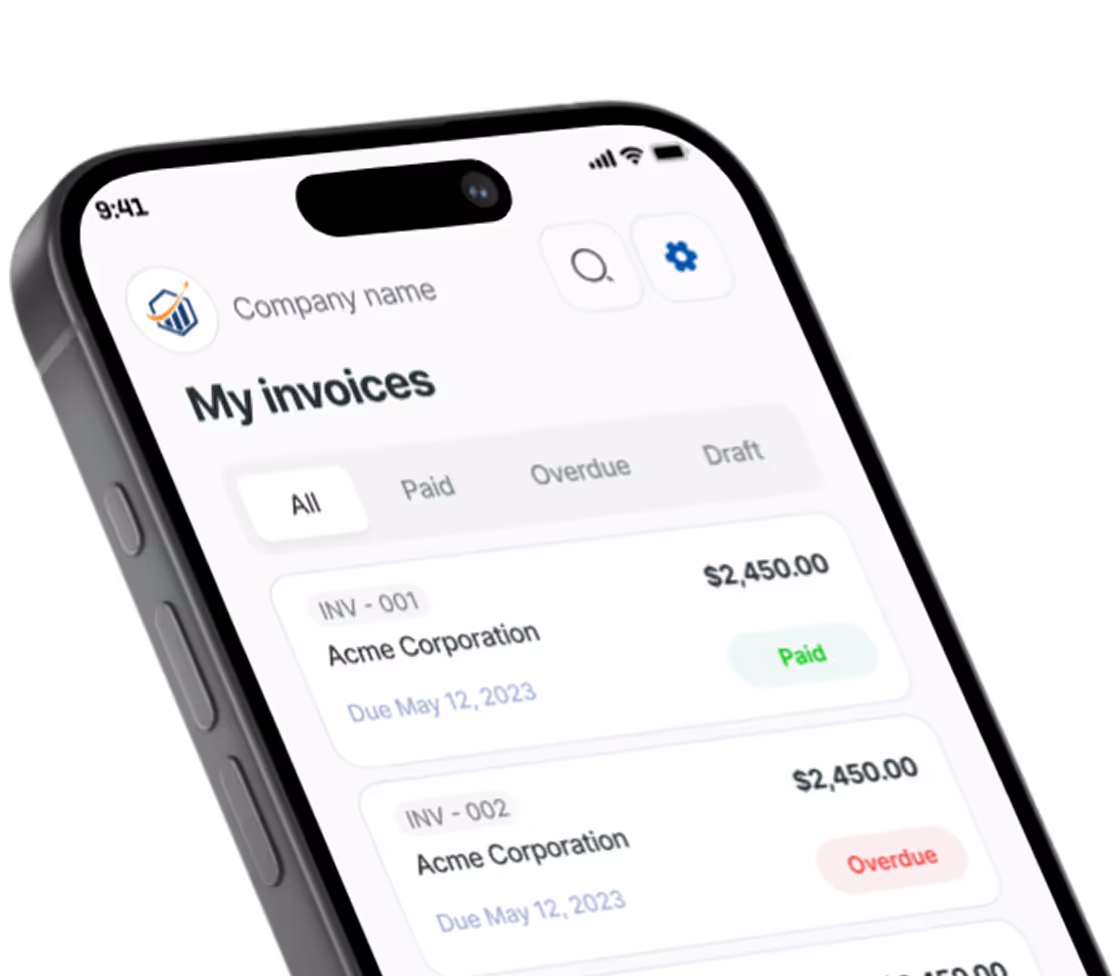

Pronto Invoice connects expense tracking to invoice creation so that when you send an invoice, you can see the associated overhead costs and actual margin. This is especially useful for contractors who need to understand profitability by job type or client — and it works from your phone, right on the job site.

Common Overhead Tracking Mistakes to Avoid

Mistake 1: Mixing Personal and Business Expenses

Using one bank account and credit card for everything creates confusion and potential tax issues. Open dedicated business accounts even if you are a sole proprietor. Your business structure may even require it.

Mistake 2: Ignoring Small Recurring Charges

That $15 software subscription seems insignificant. But 10 small subscriptions add up to $150 monthly or $1,800 annually. Audit your subscriptions quarterly to eliminate tools you no longer use.

Mistake 3: Forgetting Vehicle Depreciation

Your work truck loses value every year. This is a real cost even though you do not write a check for it. Factor depreciation into your overhead calculations for accurate job pricing.

Mistake 4: Not Reviewing Overhead Regularly

Business costs change. Insurance rates increase. You add new tools or software. Review your overhead calculation every quarter to maintain accurate pricing and catch cost creep before it erodes your margins.

Mistake 5: Treating All Jobs Equally

Some jobs consume more overhead than others. A job 45 minutes away burns more fuel than a job 10 minutes away. Consider job-specific overhead allocation for the most accurate pricing, especially if you bill hourly.

Mistake 6: Waiting Until Tax Time

Reconstructing a year of expenses from bank statements and memory is painful and inaccurate. Track expenses weekly to maintain accuracy, reduce stress, and maximize the tax deductions you can claim.

5 Ways to Reduce Your Overhead Costs

Understanding your overhead is the first step. Reducing it is the next. Here are practical strategies:

Audit subscriptions quarterly. Cancel tools you no longer use. Consolidate overlapping software. That CRM, project manager, and note-taking app might be replaceable with one integrated solution.

Negotiate annual contracts. Many software providers and insurance companies offer 10% to 20% discounts for annual payment versus monthly billing. Run the numbers before committing.

Optimize your route planning. For field service professionals, fuel is a major variable cost. Route optimization software or simply batching jobs by geography can reduce fuel expenses by 15% to 25%.

Review insurance annually. Get competing quotes every year. Bundling policies (general liability, commercial auto, workers comp) with one carrier often reduces premiums without sacrificing coverage.

Go paperless where possible. Digital invoicing, cloud storage, and electronic signatures eliminate printing, postage, and physical storage costs. Mobile invoicing tools like Pronto Invoice replace paper processes entirely.

Connecting Expense Tracking to Your Invoicing

The ultimate goal of understanding overhead is improving profitability. This requires connecting what you spend to what you earn.

When expense tracking lives separately from invoicing, you get reports that do not tell the complete story. You might know you made $10,000 in revenue last month. You might know you spent $4,000 on expenses. But you cannot easily see which jobs were profitable and which ate into your margins.

Integrated systems solve this problem. You capture an expense, assign it to a job or category, send the invoice, and immediately see the profit or loss. This is what separates businesses that get paid faster and grow from those stuck wondering where the money went.

For field service professionals especially, mobile-first solutions make this practical. You photograph a receipt at the supply house, categorize the expense, and it is immediately associated with the right job. When you send the invoice from the job site, you know exactly what you made.

Pronto Invoice was built with this workflow in mind. The expense tracking connects directly to invoicing, showing true profitability per job. For contractors, plumbers, electricians, and similar professionals who need to understand job-level costs, this integration eliminates guesswork about what you actually earn.

Frequently Asked Questions

What is the difference between overhead expenses and operating expenses?

Operating expenses include everything you spend running your business — both direct costs (materials, direct labor) and indirect costs. Overhead expenses are a subset of operating expenses that includes only indirect costs not tied to specific jobs or products. All overhead is an operating expense, but not all operating expenses are overhead.

What is a good overhead ratio for a small business?

Most financial advisors recommend keeping your overhead ratio below 35% of total revenue. Service businesses typically run 25% to 35%, while contractors and field service professionals should aim for 20% to 30%. Calculate your ratio by dividing monthly overhead by monthly revenue and multiplying by 100.

Are overhead expenses tax deductible?

Yes, most overhead expenses are tax deductible as ordinary and necessary business expenses. This includes rent, insurance, utilities, software subscriptions, vehicle expenses, and professional fees. Keep detailed records and receipts throughout the year to support your deductions at tax time.

How often should I review my overhead costs?

Review overhead expenses quarterly at minimum. Insurance rates change, new subscriptions accumulate, and business conditions shift. A quarterly review ensures your pricing stays accurate and prevents cost creep from eroding your profit margins.

What is the formula for overhead rate?

There are two common formulas. Overhead rate per hour equals total monthly overhead divided by total billable hours. Overhead ratio as a percentage equals total monthly overhead divided by total monthly revenue, multiplied by 100. Service businesses typically use the per-hour formula for pricing individual jobs accurately.

Taking Action on Your Business Overhead Expenses

Understanding business overhead expenses is foundational to running a profitable service business. Here is your action plan:

- This week: List every recurring business expense you can identify using the category checklist above

- Next week: Categorize each expense as fixed, variable, or semi-variable

- This month: Calculate your overhead rate per billable hour and your overhead ratio

- Ongoing: Track expenses weekly and review your overhead rate quarterly

The businesses that thrive are not necessarily the ones with the most revenue. They are the ones that understand their true costs and price accordingly. A contractor earning $150,000 per year with a 25% overhead ratio takes home more than one earning $200,000 with a 45% overhead ratio.

Start with the expense categories in this guide. Build a simple tracking system. Connect that tracking to your invoicing. Within a few months, you will have clarity about your actual profitability that most of your competitors lack.

There is always something more to read

What Does Invoice Date Mean? A Complete Guide to Invoice Dates and Payment Terms

What does invoice date mean? Learn how the invoice date differs from due date and service date, plus how proper dating accelerates your payments.

Handyman Services Invoice Guide: How to Bill for Multiple Small Jobs

Complete handyman invoice guide for billing multiple small jobs. Learn minimum charges, itemization strategies, and material markups.

How to Write a Painting Invoice That Gets You Paid Fast

Learn how to write a painting invoice that gets paid fast. Covers square footage billing, paint vs labor costs, and prep work itemization.