Get Paid Faster With Payment Links: A Small Business Guide

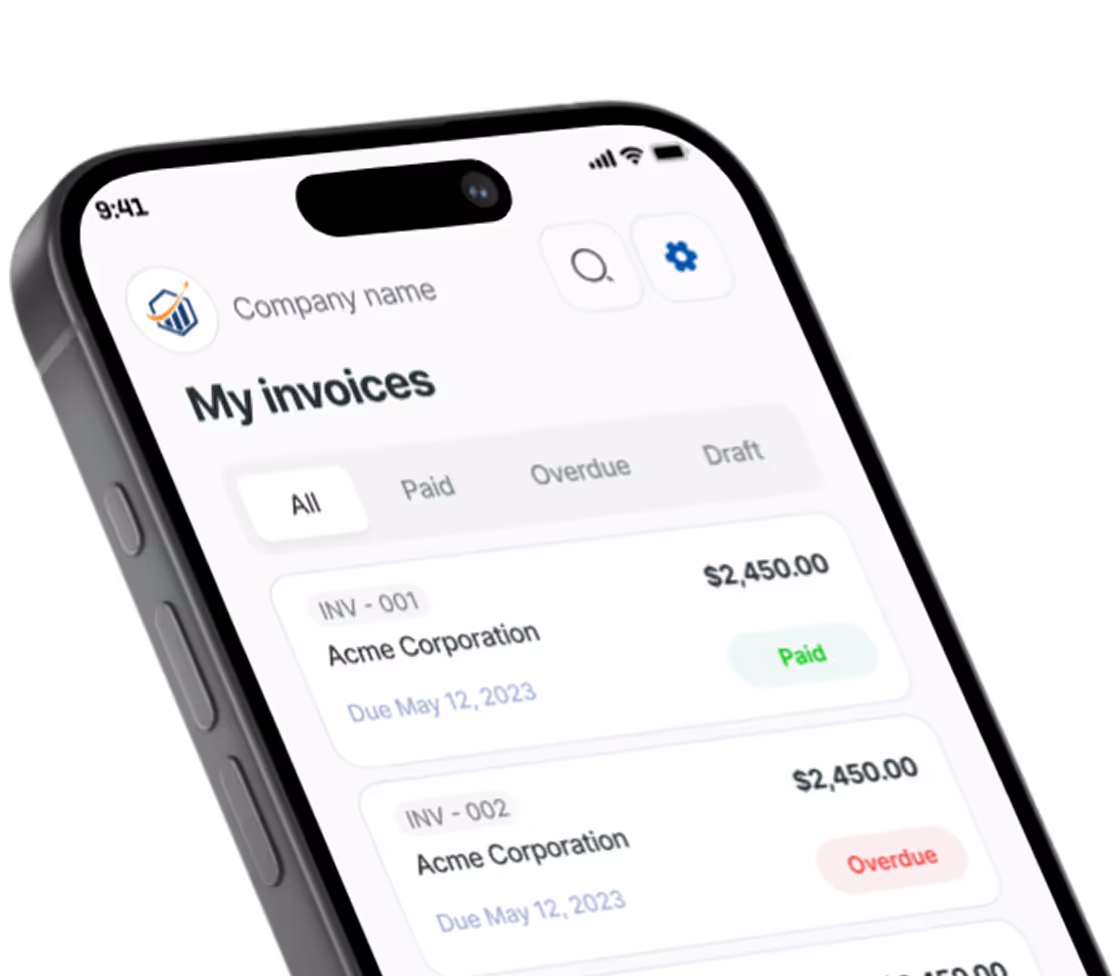

Get paid faster with payment links in invoices. 40% of clients pay within 24 hours. Placement tips and setup guide.

You sent the invoice three days ago. The client opened it — you can see that in your tracking. But the payment? Still sitting at $0.

Here is the frustrating truth: your client probably intended to pay. They opened your invoice, maybe even reviewed the line items, then got distracted. A phone call. An email notification. A kid walking through the door. By the time they remembered, your invoice was buried under 47 other tabs.

You are not alone. According to recent industry data, 56% of small businesses are owed money for unpaid invoices, with the average past-due amount sitting at $17,500. Nearly half of those businesses have invoices more than 30 days overdue.

This is where invoice payment links change everything. When paying is as simple as tapping a single button, you remove every excuse standing between your invoice and your bank account. Businesses that get paid faster with payment links see collection times drop by 30% or more — and 40% of clients who receive a payment link pay within 24 hours.

Let us break down exactly how payment links work, where to place them for maximum impact, and how to optimize your approach for faster online invoice payments.

What Are Invoice Payment Links and How Do They Work?

A payment link is a direct URL that takes your client straight to a secure payment page. No logging into a portal. No searching for your bank details. No writing checks or finding stamps.

When a client clicks your payment link, they land on a pre-filled payment page showing:

- The exact amount owed

- Your business name and invoice details

- Multiple payment options (credit card, debit card, ACH bank transfer)

- A secure checkout experience

The entire process takes 30 seconds or less. Compare that to the traditional approach: client receives invoice, writes down bank details, opens their banking app, enters your information manually, double-checks the amount, and finally submits. Each step is an opportunity for delay or abandonment.

Payment links can be shared through virtually any digital channel: email, SMS text messages, social media, or messaging apps. No website or e-commerce platform is required. This makes them ideal for freelancers, contractors, and solopreneurs who want to collect online invoice payments without building complex payment infrastructure.

The Psychology Behind One-Click Payments

Payment friction is not just inconvenient — it directly impacts your cash flow. Research from the Baymard Institute shows that complicated checkout processes cause 17% of cart abandonments in e-commerce. Invoice payments work the same way. In fact, 1 in 4 customers abandon a transaction due to complex payment methods.

Every additional step you add to the payment process:

- Increases the chance of distraction

- Creates opportunities for errors

- Allows time for buyer hesitation

- Reduces the urgency to act now

One-click payments compress all those steps into a single action. See button, click button, enter card, done.

Where to Place Embedded Payment Buttons for Maximum Impact

Strategic placement matters. You can get paid faster with payment links, but only if clients actually see and click them.

Primary Placement: Top of the Invoice

The most effective position for your embedded payment buttons is above the fold — visible without scrolling. Most invoicing platforms default to placing payment buttons at the bottom, after all the line items and totals. This forces clients to scroll past information they may not care about.

Move your primary payment call-to-action to the top. A prominent “Pay Now” button should be the first thing clients see when they open your invoice.

Secondary Placement: After the Total

Your second payment link belongs immediately after the total amount due. This is the natural decision point where clients think “okay, I owe $2,400 — now what?” Give them an immediate answer with a payment button right there.

Third Placement: Email Body

Do not rely solely on the invoice attachment or link. Include a payment button directly in the email body. Many clients never open the actual invoice document — they scan the email, see the amount in the subject line, and want to pay immediately.

Your invoice email should include:

- Subject line with amount and due date

- Brief summary in email body (2-3 sentences)

- Prominent payment button

- Link to full invoice for those who want details

Fourth Placement: SMS and Text Messages

A growing channel for payment link delivery is SMS. According to a Twilio study, 67% of consumers prefer to receive payment links via text message. Text messages have a 98% open rate compared to roughly 20% for marketing emails, making SMS an effective channel for time-sensitive invoices.

For field service professionals who invoice on-site — plumbers, electricians, HVAC technicians — texting a payment link before leaving the job site can dramatically accelerate collection.

How to Get Paid Faster With Payment Links on Mobile

Over 60% of emails are opened on mobile devices. If your payment link leads to a desktop-optimized page that requires pinching and zooming, you have already lost. Mobile-optimized payment links see 45% higher completion rates than desktop-only options.

Mobile optimization for invoice payment links requires:

- Responsive payment pages: The layout must adapt to any screen size automatically

- Thumb-friendly buttons: Tap targets at least 44x44 pixels so users do not miss

- Minimal form fields: Auto-format inputs and offer digital wallet shortcuts

- Digital wallet support: Apple Pay and Google Pay let mobile users pay in one tap without entering card details

The best mobile invoicing solutions, like Pronto Invoice, generate one-tap payment links that are optimized for on-the-go payments from the start. For field service professionals collecting payment at the job site, this is the difference between getting paid today and chasing an invoice for weeks.

Tracking Payment Link Conversion: Your Payment Funnel

Smart business owners track more than just who paid. They track the entire payment journey to understand where clients drop off.

Key Metrics to Monitor

Open rate: What percentage of clients open your invoice emails? Industry average is 70-80% for invoice emails — significantly higher than marketing emails because clients expect them.

Click-through rate: Of those who open, how many click the payment link? This tells you whether your email design and button placement are effective.

Payment conversion rate: Of those who click, how many complete payment? If this number is low, there may be issues with your payment page — too many fields, limited payment options, or trust concerns.

Time to payment: How long between invoice delivery and payment completion? Track this over time to see if your optimizations are working. According to Xipster’s data, invoices with payment links get paid within 20 minutes on average.

What Low Payment Link Conversion Tells You

If clients are clicking but not completing payment, investigate these common issues:

- Too many form fields: Only ask for essential information

- Limited payment options: Some clients prefer credit cards, others want ACH bank transfers. Offer both

- Security concerns: Ensure your payment page shows SSL certificates and trusted payment processor logos

- Unexpected fees: If you pass on processing fees, disclose them before the payment page. According to the Baymard Institute, 48% of abandoned checkouts happen because of unexpected costs

Modern invoicing platforms provide these analytics automatically. Pronto Invoice, for example, shows you exactly when invoices are viewed and tracks payment link engagement, so you know which clients need a follow-up payment reminder and which are already in process.

Optimizing One-Click Payments for Higher Conversion

Getting clients to the payment page is half the battle. Converting them is the other half. Here is how to optimize every element.

Reduce Form Fields to the Minimum

Every field you add costs you conversions. For returning clients, the best payment experiences remember their information and offer true one-click payment.

For new clients, only require:

- Card number

- Expiration date

- CVV

- Billing zip code

Skip the full billing address unless your payment processor requires it. Skip the phone number. Skip everything that does not directly process the payment.

Offer Multiple Payment Methods

Different clients prefer different payment methods. Your payment link should support:

- Credit and debit cards: The most common choice for convenience

- ACH bank transfer: Lower fees, preferred by larger businesses. See our complete ACH payments guide

- Digital wallets: Apple Pay and Google Pay for mobile users

Stripe and similar processors make it easy to accept all these methods through a single integration. When evaluating mobile payment methods, prioritize those that offer seamless one-tap experiences.

Create Urgency Without Pressure

Your payment button copy matters. “Pay Now” outperforms “Submit Payment” because it is action-oriented. Consider testing:

- Pay Now

- Pay $X Now

- Complete Payment

- Pay Securely

Adding the specific amount (“Pay $2,400 Now”) can increase conversion by making the action feel more concrete and reducing uncertainty.

Personalize the Payment Experience

Personalization builds trust and improves payment link conversion. Address clients by name in the email or text message containing the link. Include your business logo and brand colors on the payment page so clients recognize the experience as legitimate.

Name recognition is a proven sales strategy. When a client sees their name and your branding, the payment feels like a continuation of your professional relationship rather than a generic transaction.

Set Clear Payment Terms

Payment links work best when combined with clear payment terms. Clients who understand when payment is due and what happens if they miss that date are more likely to click immediately rather than postponing.

Pro tip: invoices sent on a Thursday are statistically more likely to get paid faster than invoices sent on other days of the week. Time your delivery for maximum impact.

Payment Link Security and PCI Compliance

Security is not optional when handling payment data. Clients need to trust your payment link before they will enter card information.

What Secure Payment Links Require

- HTTPS encryption: Every payment link should direct to a page secured with SSL/TLS encryption. Look for the padlock icon

- PCI DSS compliance: Your payment processor must adhere to Payment Card Industry Data Security Standards. Processors like Stripe handle this automatically

- Single-use or expiring links: Prevent reuse by setting expiration dates on payment links. This protects against fraud if a link is shared or intercepted

- Trusted processor branding: Display recognizable logos (Stripe, Visa, Mastercard) on the payment page to build confidence

Best Practices for Payment Link Security

- Use a reputable payment processor that provides PCI-compliant hosted payment pages

- Never store raw card data on your own systems

- Enable two-factor authentication on your invoicing and payment dashboard

- Review payment activity regularly for suspicious patterns such as multiple failed attempts or mismatched geographic data

When clients feel secure, they are far more likely to complete the payment. Trust signals directly impact your payment link conversion rate.

Real Results: Payment Link Effectiveness Data

The data on online invoice payments through payment links is compelling:

- 40% of clients who receive a payment link pay within 24 hours

- 87% of Stripe invoices with payment links are paid within 24 hours

- Businesses using payment links report 30% reduction in average days sales outstanding (DSO)

- Mobile-optimized payment links see 45% higher completion rates than desktop-only options

- One-click payment options for returning clients achieve 85%+ conversion rates

- Invoices with embedded payment buttons are paid 2x faster than those with manual payment instructions

For field service professionals who need to collect payment before leaving a job site, payment links are particularly powerful. An HVAC technician can send an invoice from their truck and have payment confirmed before they drive away. A plumber finishing a repair can text a payment link and avoid the dreaded “the check is in the mail” delay.

Implementation Checklist: Start Collecting Online Invoice Payments

Ready to get paid faster with payment links? Here is your action plan:

- Audit your current invoices: Where is your payment button positioned? Is it mobile-friendly?

- Enable multiple payment methods: At minimum, offer cards and ACH

- Optimize your email: Add embedded payment buttons to the email body, not just the invoice

- Add SMS delivery: Text payment links for time-sensitive invoices and on-site billing

- Set up tracking: Monitor open rates, clicks, and payment link conversion

- Test your mobile experience: Send yourself a test invoice and try paying from your phone

- Brand your payment page: Add your logo, colors, and business name for trust

- Automate follow-ups: When clicks happen without payment, trigger a payment reminder

Start Collecting Payments Faster Today

Payment links are not just a convenience feature — they are a fundamental shift in how quickly money moves from your clients to your account.

The best part? Implementation takes minutes, not hours. Modern invoicing solutions like Pronto Invoice include one-tap payment links in every invoice automatically. There is no setup, no integration headaches, and no technical knowledge required. Your clients see a prominent payment button, tap it, and you get paid.

If you are serious about getting paid faster, payment links are the single highest-impact change you can make today. Every day you wait is another day of unnecessary payment delays.

Frequently Asked Questions

Do payment links cost money to create?

Most invoicing platforms include payment links at no additional cost — you only pay standard payment processing fees when a client actually pays. For example, credit card transactions typically cost 2.4-2.9% plus $0.30 per transaction, while ACH transfers are significantly cheaper. The payment link itself is free to generate and send.

Are payment links secure?

Yes, when generated through a reputable payment processor. Payment links from providers like Stripe use HTTPS encryption, PCI DSS-compliant hosted payment pages, and tokenization so raw card data never touches your systems. Look for payment links that offer single-use or expiring URLs as an additional layer of fraud prevention.

What types of businesses benefit most from payment links?

Any business that sends invoices benefits from payment links, but they deliver the most impact for field service businesses (contractors, plumbers, electricians), freelancers, and small businesses with fewer than 10 employees. These businesses often deal with delayed payments due to manual collection processes, and payment links eliminate that friction entirely.

Can I send payment links via text message?

Yes. Payment links are simply URLs, so they can be shared through any digital channel including SMS, email, social media, and messaging apps. SMS delivery is particularly effective — text messages have a 98% open rate, and 67% of consumers prefer receiving payment links via text.

How much faster do payment links get invoices paid?

Data varies by platform, but the results are consistent. Stripe reports 87% of invoices with payment links are paid within 24 hours. Across the industry, businesses using payment links see a 30% reduction in days sales outstanding (DSO) and 2x faster payment compared to invoices with manual payment instructions.

What payment methods should my payment link support?

At minimum, support credit cards, debit cards, and ACH bank transfers. For mobile users, adding Apple Pay and Google Pay enables true one-tap payment that dramatically increases conversion. The more options you offer, the fewer excuses clients have to delay.

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.