How Does Stripe Work for Small Business? Complete Guide

Discover how Stripe works for small business: setup, fees (2.9% + $0.30), payouts, and integration options.

Table of Contents

- What Is Stripe and Why Small Businesses Choose It

- How Stripe Payment Processing Works: The 5-Step Flow

- Stripe Setup Guide: Getting Started in 15 Minutes

- Understanding Stripe Fees: Complete Cost Breakdown

- Stripe Payout Timing: When You Actually Get Paid

- Handling Stripe Disputes and Chargebacks

- Stripe Integration Options for Small Businesses

- Stripe vs. Alternatives: Comparing Small Business Payment Solutions

- Is Stripe Right for Your Small Business?

- Frequently Asked Questions

How does Stripe work for small business owners who want to accept payments without the complexity of traditional merchant accounts? If you’ve been researching small business payment solutions, you’ve likely encountered Stripe—and for good reason.

Accepting payments should be simple. You provide a service, send an invoice, and get paid. But for many small business owners, the world of payment processing feels unnecessarily complicated—merchant accounts, payment gateways, interchange fees, PCI compliance. It is enough to make you wish clients still paid in cash.

Stripe has become the go-to payment processor for over 1.35 million businesses precisely because it cuts through this complexity. But what will Stripe payment processing really cost you? And is it the right choice for your specific situation?

This Stripe setup guide breaks down everything you need to know about using Stripe for your small business, from initial setup to handling your first dispute.

What Is Stripe and Why Small Businesses Choose It

Stripe is a payment processing platform that allows businesses to accept credit cards, debit cards, and other payment methods online and in person. Founded in 2010, it has processed over $1 trillion in transactions for businesses ranging from one-person operations to Fortune 500 companies.

For small businesses, Stripe solves several critical problems:

No merchant account required. Traditional payment processing required setting up a separate merchant account with a bank—a process that could take weeks and required extensive documentation. Stripe acts as a payment facilitator, meaning you can start accepting payments within minutes.

Transparent, predictable pricing. Instead of complex interchange-plus pricing with dozens of rate categories, Stripe charges a flat percentage per transaction. You know exactly what you will pay before you process your first payment.

Developer-friendly but accessible. While Stripe is known for its powerful API that developers love, it also offers no-code solutions that any business owner can set up without technical knowledge.

Built-in fraud protection. Stripe Radar, their machine learning fraud prevention system, analyzes millions of data points to block fraudulent transactions automatically—protecting your revenue without requiring you to become a fraud expert.

How Stripe Payment Processing Works: The 5-Step Flow

Understanding how money moves from your customer to your bank account helps you set realistic expectations and troubleshoot issues when they arise.

Step 1: Customer Initiates Payment

When a customer pays you through Stripe—whether by clicking a payment link, entering card details on a checkout page, or paying an invoice—Stripe captures their payment information securely.

Step 2: Authorization and Capture

Stripe communicates with the customer’s bank (the issuing bank) to verify the card is valid and has sufficient funds. This happens in seconds. If approved, the funds are “authorized”—essentially reserved for your transaction.

Step 3: Stripe Processes the Transaction

Stripe batches authorized transactions and sends them through the card networks (Visa, Mastercard, etc.) to the issuing banks for settlement. Stripe deducts its processing fee at this stage.

Step 4: Funds Land in Your Stripe Account

The money appears in your Stripe balance, typically within 1-2 business days after the transaction.

Step 5: Payout to Your Bank

Stripe automatically transfers your available balance to your connected bank account according to your payout schedule (more on this below).

This entire process is invisible to your customers. They see a seamless payment experience; you see money in your account.

Stripe Setup Guide: Getting Started in 15 Minutes

Getting started with Stripe takes about 15 minutes. Here is the process:

Create Your Stripe Account

Visit stripe.com and click “Start now.” You will need:

- Business email address

- Business type (sole proprietor, LLC, corporation, etc.)

- EIN or Social Security Number (for tax reporting)

- Business address

- Bank account for payouts

- Government-issued ID for verification

Complete Identity Verification

Stripe verifies your identity to comply with financial regulations and prevent fraud. This typically involves:

- Confirming your personal information

- Uploading a photo ID

- Sometimes answering additional questions about your business

Most verifications complete instantly. If Stripe needs additional information, they will email you within 1-2 business days.

Configure Your Account Settings

Once verified, customize your setup:

- Business name and statement descriptor: What customers see on their credit card statements

- Payout schedule: Daily, weekly, or monthly transfers to your bank

- Email notifications: Which alerts you want to receive

- Team access: If you have employees who need account access

Choose How to Accept Payments

Stripe offers multiple payment acceptance methods:

Payment Links: Generate a shareable link for any product or service. No website required—send via email, text, or social media. Learn more about getting paid faster with payment links.

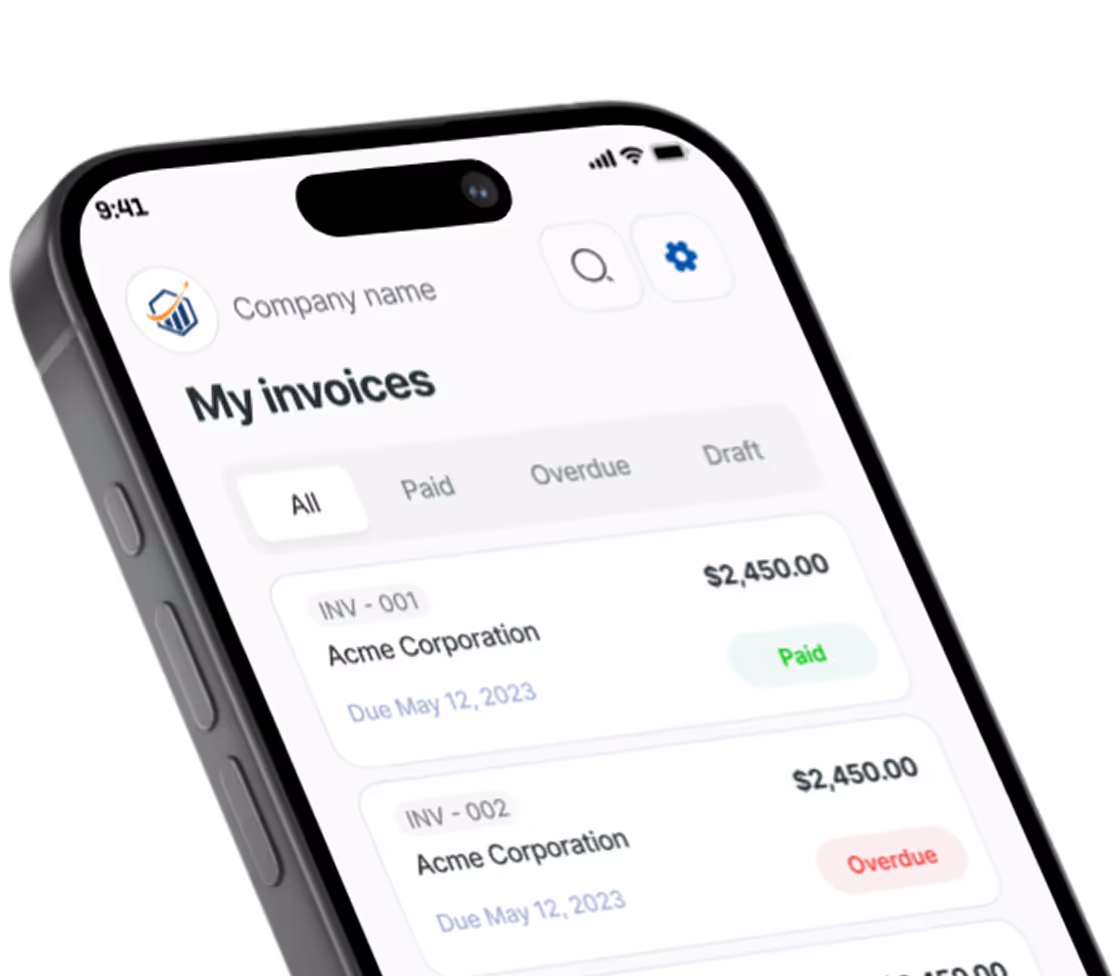

Stripe Invoicing: Create and send professional invoices with built-in payment buttons. Customers pay directly from the invoice.

Checkout integration: Embed Stripe’s pre-built checkout form on your website.

Custom integration: Use Stripe’s API to build a fully customized payment experience.

For most small businesses, Payment Links or Stripe Invoicing provide the fastest path to accepting payments without any technical setup.

Understanding Stripe Fees: Complete Cost Breakdown

Stripe fees for small business are straightforward compared to traditional payment processors. Understanding the full cost structure helps you price your services appropriately. For a deeper dive, see our complete guide to credit card processing fees.

Standard Processing Fees

| Payment Type | Fee |

|---|---|

| Online card payments (domestic) | 2.9% + $0.30 per transaction |

| In-person payments (Stripe Terminal) | 2.7% + $0.05 per transaction |

| ACH Direct Debit | 0.8% (capped at $5) |

| Card-present (keyed-in) | 3.4% + $0.30 per transaction |

| International cards | Additional 1.5% |

| Currency conversion | Additional 1% |

Real-World Fee Examples

Example 1: $500 plumbing invoice paid by credit card

- Fee: ($500 x 2.9%) + $0.30 = $14.80

- You receive: $485.20

- Effective rate: 2.96%

Example 2: $150 design project paid by credit card

- Fee: ($150 x 2.9%) + $0.30 = $4.65

- You receive: $145.35

- Effective rate: 3.1%

Example 3: $2,000 consulting invoice paid by ACH

- Fee: $2,000 x 0.8% = $16 (but capped at $5)

- You receive: $1,995

- Effective rate: 0.25%

Notice how the fixed $0.30 component makes smaller transactions proportionally more expensive. For invoices under $50, the effective rate exceeds 3.5%. For larger invoices, ACH payments can significantly reduce your processing costs.

Additional Fees to Know

| Fee Type | Cost |

|---|---|

| Disputed payments (chargebacks) | $15 per dispute (refunded if you win) |

| Stripe Invoicing | Free for first 25/month, then $0.40-$0.50 |

| Instant payouts | 1% of payout amount (min $0.50) |

| Radar for Fraud Teams | $0.02-$0.07 per screened transaction |

No Hidden Fees

Unlike many traditional processors, Stripe does not charge:

- Monthly fees or minimums

- Setup or activation fees

- Cancellation fees

- PCI compliance fees

- Gateway fees

You only pay when you process payments.

Stripe Payout Timing: When You Actually Get Paid

Understanding payout timing prevents cash flow surprises and helps you plan accordingly.

Standard Payout Schedule

| Scenario | Payout Arrives |

|---|---|

| Payment received Monday | Wednesday |

| Payment received Friday | Tuesday (skips weekend) |

| New account (first 60-90 days) | 7-14 day initial hold possible |

For new Stripe accounts, payouts typically follow a 2-business-day rolling schedule. After you establish a processing history (typically 60-90 days with consistent volume), you may qualify for faster payouts.

Factors That Affect Payout Timing

Account age and history: New accounts may experience 7-14 day initial holds while Stripe verifies your business activity.

Business type: Higher-risk industries (subscription services, professional services with delayed delivery) may have longer standard payout windows.

Transaction patterns: Sudden spikes in volume or transaction size can trigger temporary holds while Stripe verifies the activity is legitimate.

Disputes: Active disputes may result in holds on portions of your balance.

Payout Options

| Option | Speed | Cost |

|---|---|---|

| Standard payouts | 2 business days | Free |

| Instant payouts | Within minutes | 1% fee |

| Manual payouts | You control timing | Free |

For field service professionals who invoice upon job completion, standard 2-day payouts generally work well. If you need faster access to funds—say, to purchase materials for the next job—instant payouts provide that flexibility for a small fee.

Handling Stripe Disputes and Chargebacks

Disputes happen. A customer might not recognize your business name on their statement, claim they never received a service, or simply want their money back. Understanding the process helps you respond effectively.

What Happens When a Customer Disputes a Charge

- Customer contacts their bank claiming the charge is unauthorized or goods/services were not as described

- The bank opens a dispute and provisionally refunds the customer

- Stripe notifies you and debits your account for the disputed amount plus a $15 fee

- You have 7-21 days to submit evidence supporting the charge

- The bank reviews evidence and makes a final decision (typically within 60-90 days)

- If you win, the charge and $15 fee are returned to you

Preventing Disputes

The best dispute is one that never happens:

Clear statement descriptors: Use your recognizable business name, not a corporate entity name customers would not recognize.

Detailed invoices: Include service dates, descriptions, and your contact information so customers can reach you directly with questions.

Responsive communication: Many disputes start when customers cannot get answers from the business and turn to their bank instead.

Proof of delivery/completion: For service businesses, document job completion with photos, signed work orders, or confirmation emails.

Winning Disputes You Cannot Prevent

When disputes do occur, thorough documentation wins cases:

- Signed contracts or work orders

- Email correspondence confirming the service

- Photos of completed work

- Delivery confirmation

- Your refund and cancellation policy

- Evidence the customer has used or benefited from the service

Stripe provides a dashboard that walks you through submitting evidence in the format banks expect.

Stripe Integration Options for Small Businesses

How you integrate Stripe depends on your business model and technical resources.

No-Code Solutions

Stripe Payment Links Generate a link for any amount or product. Share via email, text, or embed in your website. Best for: quick payments, deposits, one-off purchases.

Stripe Invoicing Create professional invoices with payment buttons built in. Customers pay directly from the invoice email. Best for: service businesses billing after work completion.

Stripe Checkout (hosted) Redirect customers to a Stripe-hosted payment page. Requires minimal website integration. Best for: e-commerce with limited technical resources.

Integrated Solutions

Many business tools offer built-in Stripe integrations, allowing you to accept payments without building anything custom:

Invoicing and accounting software often connects to Stripe for seamless payment collection. When clients pay invoices, the payment syncs automatically with your financial records. This eliminates manual data entry and reconciliation headaches.

For instance, invoicing tools like Pronto Invoice integrate directly with Stripe, allowing mobile businesses to send invoices on-site and collect credit card payments without switching between apps. The payment posts to both Stripe and your invoicing system simultaneously.

E-commerce platforms (Shopify, WooCommerce, Squarespace) include Stripe as a standard payment option.

Scheduling and booking tools (Calendly, Acuity) use Stripe for appointment deposits and payments.

Custom API Integration

For businesses with developers or technical co-founders, Stripe’s API enables fully customized payment experiences. This makes sense when:

- You need complex payment flows (subscriptions with usage-based components, marketplace payments)

- Your brand experience requires a completely custom checkout

- You are building payment functionality into your own software product

Most small businesses do not need custom development—the no-code and integrated options cover the vast majority of use cases.

Stripe vs. Alternatives: Comparing Small Business Payment Solutions

Stripe is not the only option. Here is how it stacks up against common alternatives:

Stripe vs. PayPal

| Factor | Stripe | PayPal |

|---|---|---|

| Standard fee | 2.9% + $0.30 | 2.99% + $0.49 |

| Brand recognition | Lower | Higher (customers trust PayPal) |

| Checkout options | More flexible | Includes PayPal wallet |

| Dispute fees | $15 | $20 |

| International | Strong | Strong |

Best for: PayPal wins when customers prefer paying with their PayPal balance. Stripe wins for lower fees and more integration flexibility.

Stripe vs. Square

| Factor | Stripe | Square |

|---|---|---|

| Online fee | 2.9% + $0.30 | 2.9% + $0.30 |

| In-person fee | 2.7% + $0.05 | 2.6% + $0.10 |

| Hardware | Basic | Excellent ecosystem |

| Invoicing | Good | Good (free) |

| Point of sale | Limited | Robust |

Best for: Square wins for retail and food service with heavy in-person sales. Stripe wins for online payments and developer integrations.

Stripe vs. Traditional Merchant Accounts

| Factor | Stripe | Traditional |

|---|---|---|

| Setup time | Minutes | Days to weeks |

| Monthly fees | None | $10-$50+ |

| Pricing model | Flat rate | Interchange-plus |

| Contract | None | Often 1-3 years |

| Effective rate | 2.9-3.1% | 2.0-2.5% (high volume) |

Best for: Traditional merchant accounts can offer lower rates for established businesses processing $10,000+ monthly. Stripe wins for simplicity, speed, and businesses under that threshold.

Is Stripe Right for Your Small Business?

Stripe works exceptionally well for most small businesses, but it is not universally the best choice.

Stripe Is a Great Fit If You:

- Process under $10,000 monthly (flat-rate pricing simplifies accounting)

- Need to start accepting payments quickly

- Want to avoid long-term contracts and monthly fees

- Primarily collect online payments or through invoices

- Value integrations with other business software

- Do not have technical staff to manage complex payment setups

Consider Alternatives If You:

- Process high volumes and can negotiate lower interchange rates

- Need robust in-person point-of-sale functionality (look at Square)

- Want customers to have the PayPal wallet option

- Operate in a high-risk industry that Stripe does not support

Making Payments Seamless

Whatever processor you choose, the key is making payment collection as frictionless as possible—for you and your customers. The faster you get paid, the better your cash flow.

This is where integrated invoicing becomes valuable. When your invoice includes a “Pay Now” button connected to Stripe, customers pay with a single click. No checks to mail, no payment details to enter on a separate site.

Tools like Pronto Invoice take this further for mobile businesses—create an invoice on your phone at the job site, send it before you leave the driveway, and the customer can pay immediately via the integrated Stripe payment link. The payment posts to your account, the invoice marks as paid, and if you use accounting software, that syncs too.

The combination of Stripe’s processing capabilities and smart invoicing tools eliminates the cash flow delays that plague so many small businesses.

Getting Started with Stripe Today

If Stripe fits your business needs, getting started is straightforward:

- Create your account at stripe.com (15 minutes)

- Complete verification by submitting required documentation

- Configure your settings including payout schedule and notifications

- Choose your payment acceptance method—Payment Links for simplicity, integrations for automation

- Process your first payment and verify funds arrive as expected

For ongoing management, the Stripe Dashboard provides clear visibility into payments, payouts, disputes, and customers—all the information you need to manage your payment operations without a finance degree.

The best payment solution is one you can set up, trust to work, and rarely think about. For most small businesses asking how does Stripe work for small business, the answer is: simply and reliably.

Frequently Asked Questions About Stripe for Small Business

How long does it take to set up a Stripe account?

Most small business owners can create and verify a Stripe account in about 15 minutes. You’ll need basic business information, a government-issued ID, and your bank account details. Instant verification is common, though some accounts require 1-2 business days for additional review.

What are the total Stripe fees for a small business?

Stripe charges 2.9% + $0.30 per online transaction for domestic cards. There are no monthly fees, setup fees, or cancellation fees. A $500 invoice would cost $14.80 in processing fees (2.96% effective rate). ACH payments cost only 0.8% capped at $5, making them ideal for larger invoices.

How quickly does Stripe deposit money into my bank account?

Standard payouts arrive in 2 business days at no cost. New accounts may experience 7-14 day holds during the first 60-90 days while Stripe verifies your business activity. Instant payouts are available for 1% of the payout amount if you need funds immediately.

Can I use Stripe without a website?

Yes. Stripe Payment Links let you create shareable payment URLs for any amount. Send them via email, text message, or social media—no website required. Stripe Invoicing also works without a website, allowing you to email professional invoices with built-in payment buttons.

Is Stripe safe for small businesses to use?

Stripe is PCI Level 1 certified, the highest security standard in the payment industry. They use machine learning fraud prevention (Stripe Radar) to automatically block suspicious transactions. Your customers’ card data is encrypted and never stored on your systems, protecting both you and your clients.

There is always something more to read

How to Write a Receipt of Payment: Step-by-Step Guide (2025)

Learn how to write a receipt of payment in 7 steps. Includes free templates, required elements, and examples for contractors.

What Does Invoice Date Mean? A Complete Guide to Invoice Dates and Payment Terms

What does invoice date mean? Learn how the invoice date differs from due date and service date, plus how proper dating accelerates your payments.

Handyman Services Invoice Guide: How to Bill for Multiple Small Jobs

Complete handyman invoice guide for billing multiple small jobs. Learn minimum charges, itemization strategies, and material markups.