How Long to Keep Business Records: Complete Retention Schedule

How long to keep business records for IRS compliance. Complete retention schedule for invoices, tax returns, and more.

That box of receipts from 2018 sitting in your garage. The folder of old invoices cluttering your desktop. The stack of bank statements you are afraid to throw away. You know you should keep business records, but how long to keep business records is a question most small business owners cannot answer with confidence.

Getting this wrong creates real problems. Keep records too long and you waste space, time, and energy managing documents you no longer need. Dispose of them too early and you could face IRS penalties, lose an audit, or lack documentation for a legal dispute.

This guide provides clear answers on business record retention based on IRS requirements, state regulations, and practical business needs. You will walk away with a specific document retention schedule and actionable organization strategies for your small business tax records.

Why Business Record Retention Matters for Small Businesses

The IRS can audit your tax returns for up to three years from the filing date in most cases. However, certain situations extend this window to six or even seven years, and some documents need to be kept indefinitely.

Beyond taxes, you may need financial record keeping documentation for:

- Insurance claims requiring proof of assets or business history

- Legal disputes with clients, vendors, or partners

- Loan applications requiring financial documentation

- Business sale due diligence requiring historical records

- Employee disputes involving payroll or HR documentation

Understanding how long to keep business records protects you from compliance issues while preventing unnecessary document hoarding. If you are starting a new business, establishing a retention policy from day one saves significant time down the road.

The Complete Document Retention Schedule

Different documents have different retention requirements. This schedule consolidates IRS document requirements with practical business recommendations so you know exactly what to keep and for how long.

Keep for 3 Years

These documents align with the standard IRS audit window:

- Bank statements and deposit slips

- Canceled checks for routine expenses

- Credit card statements

- Monthly financial statements

- Inventory records

- Purchase invoices for non-capital items

- Sales invoices and receipts

- Shipping and receiving reports

- Utility bills and routine business expenses

Tip: Even at three years, that is a lot of paper. Creating professional invoices digitally from the start eliminates the need to scan and organize paper copies later.

Keep for 4 Years

The IRS has a specific requirement many small business owners miss:

- Employment tax records: The IRS requires these for at least 4 years after the date the tax becomes due or is paid, whichever is later. This includes Forms 941, 940, state unemployment records, and deposit records.

Keep for 7 Years

The IRS can audit returns up to six years back if they suspect underreported income by 25% or more. Adding a one-year buffer provides protection. Most accountants consider seven years the safe default for important small business tax records:

- Annual financial statements

- Accounts payable and receivable records

- Business expense records

- Contracts after expiration or termination

- Employee payroll records (W-2 forms, 1099 forms)

- Insurance policies after expiration

- Invoices for significant transactions

- Tax returns and all supporting documentation

- Bad debt write-offs and worthless securities claims

- Depreciation schedules

Keep Indefinitely

Some documents should never be destroyed, regardless of how old they are:

- Business formation documents: Articles of incorporation, partnership agreements, LLC operating agreements

- Annual meeting minutes and corporate resolutions

- Stock certificates and ownership records

- Property deeds and titles

- Trademark and patent registrations

- Audit reports from external auditors

- Tax returns (while the IRS only requires 7 years, keeping returns permanently provides historical reference and helps prepare future filings)

- Legal settlements and court judgments

Keep for Specific Periods

Some records have unique retention requirements based on their nature:

| Document Type | Retention Period | Reason |

|---|---|---|

| Employee personnel files | 7 years after termination | Potential legal claims |

| Accident reports and workers’ comp | 10 years | Statute of limitations |

| OSHA records | 5 years | Regulatory requirement |

| Contracts | 7 years after expiration | Dispute resolution |

| Asset purchase records | Life of asset + 7 years | Depreciation documentation |

| Loan documents | 7 years after payoff | Proof of satisfaction |

| Insurance claims | Life of policy + 7 years | Potential reopening |

| Sales tax records | 4-6 years | State requirements vary |

| Hiring and recruitment records | 1-3 years | EEOC and state regulations |

IRS Document Requirements You Need to Know

The IRS provides specific guidance on financial record keeping that goes beyond general recommendations. Understanding these requirements is essential for every small business owner.

The Statute of Limitations for IRS Audits

Knowing when the IRS can audit you determines your minimum retention periods:

- 3 years: Standard audit window from filing date

- 6 years: If income is underreported by 25% or more

- 7 years: If you claim a loss from worthless securities or bad debt deduction

- Indefinite: If you file a fraudulent return or fail to file

Returns filed before the due date are treated as filed on the due date. For example, a 2025 return filed in February 2026 starts the statute of limitations clock on April 15, 2026.

What Records the IRS Requires

For income verification, maintain:

- Gross receipts documentation (invoices, deposit slips, cash register records)

- Source documents for all income items

- Digital payment records from processors like Stripe or PayPal

For expense deduction support:

- Receipts showing amount, date, place, and business purpose

- Canceled checks or electronic payment records

- Account statements reconciled with receipts

- Mileage logs for vehicle deductions

For asset and depreciation records:

- Purchase documentation including date, cost, and seller

- Improvement records over the asset’s life

- Disposition records when sold or retired

The UPPBRA Default Rule

Eight states have adopted the Uniform Preservation of Private Business Records Act (UPPBRA), which sets a default 3-year retention period for business records unless a specific law requires longer. Even if your state has adopted UPPBRA, federal IRS requirements and industry-specific regulations may still demand longer retention.

State Variations in Record Retention

While federal requirements provide baseline standards, state laws may impose longer retention periods for your small business tax records.

Employment records: Some states require keeping employee records for 10 years or longer. California requires maintenance of payroll records for at least three years and personnel records for the duration of employment plus three years.

Sales tax documentation: States with sales tax often require records be kept for 4-6 years from the date of the transaction. New York, for example, requires sales tax records for at least three years from the due date of the return or the date it was filed, whichever is later.

Industry-specific regulations: Certain professions like healthcare (HIPAA requires 6 years), legal services, and construction may have extended retention requirements under state licensing boards.

Check with your state’s department of revenue and any applicable licensing boards for requirements specific to your location and industry.

Practical Organization Systems for Financial Record Keeping

Knowing how long to keep business records means nothing without a system for actually managing them. Here is how to build a document retention schedule that works.

Digital-First Approach

Paper records create storage headaches and retrieval challenges. Converting to digital systems offers significant advantages:

- Searchability: Find specific invoices or receipts in seconds

- Space efficiency: Eliminate filing cabinets and storage boxes

- Disaster protection: Cloud backups protect against fire, flood, or theft

- Automatic organization: Modern invoicing software organizes documents by date, client, and type

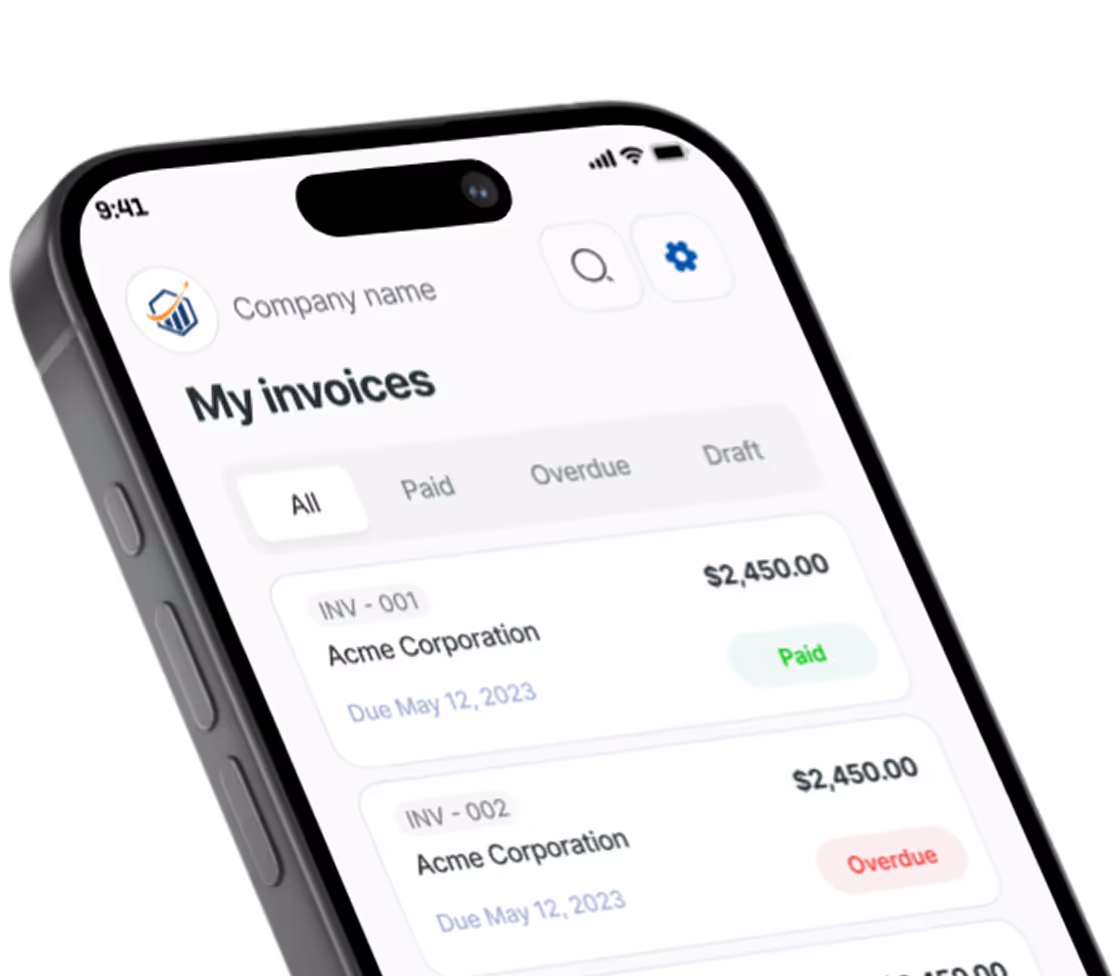

When you create invoices digitally from the start, you eliminate the scanning step entirely. Mobile invoicing apps like Pronto Invoice automatically store every invoice you create, building an organized digital archive without extra effort. Each document is timestamped, categorized, and searchable — exactly what you need when the IRS asks for records from three years ago.

The IRS accepts digital copies of records as long as they are legible and you can produce them upon request. You do not need to keep paper originals if you have accurate digital versions.

Folder Structure for Digital Records

Organize digital files for easy retrieval during your business record retention cycle:

Business Records/

├── Tax Returns/

│ └── [Year]/

├── Financial Statements/

│ └── [Year]/

├── Invoices/

│ ├── Sent/

│ └── Received/

├── Bank Statements/

│ └── [Year]/

├── Contracts/

│ ├── Active/

│ └── Expired/

├── Payroll/

│ └── [Year]/

├── Employment Records/

│ └── [Employee Name]/

└── Asset Records/

└── [Asset Name or Category]/Annual Purge Process

Schedule a yearly review of your document retention schedule, ideally after tax filing:

- Identify records that have passed their retention period

- Verify no pending audits, disputes, or claims require the documents

- Shred physical documents containing sensitive information

- Delete digital files and empty cloud storage trash folders

- Document what was destroyed and when (keep a destruction log)

- Back up all remaining digital records to a secondary location

Special Considerations for Field Service Businesses

Contractors, plumbers, electricians, and other field service professionals face unique record-keeping challenges. You are creating invoices on job sites, tracking material costs across multiple projects, and managing records while working with your hands.

The solution is building financial record keeping into your daily workflow rather than treating it as back-office paperwork. When you invoice clients immediately upon job completion using a mobile app, you create the documentation you need at the moment it happens. No lost receipts, no forgotten details, no weekend data entry sessions.

Digital invoicing tools with offline capability ensure you can create and store records even on job sites without reliable internet. The records sync automatically when connectivity returns, maintaining your documentation trail without extra effort.

Field service-specific records to track:

- Material receipts for each job (keep for 3-7 years depending on project type)

- Permits and inspection reports (keep for life of the structure)

- Subcontractor agreements and 1099s (keep for 7 years)

- Vehicle mileage and maintenance logs (keep for 7 years)

- Licensing and certification renewals (keep indefinitely)

What Happens If You Cannot Produce Records

If the IRS requests documentation you cannot provide, the consequences depend on the situation:

- Denied deductions: Without supporting records, claimed expenses may be disallowed

- Estimated assessments: The IRS may estimate your income and taxes owed, often unfavorably

- Penalties: Failure to maintain adequate records can result in accuracy-related penalties of 20% of the underpayment

- Criminal liability: In extreme cases involving fraud, inadequate records can contribute to criminal charges

The cost of proper business record retention is minimal compared to these potential consequences.

Building Your Document Retention Schedule

Understanding how long to keep business records is the first step. Implementation requires action:

- Audit your current records: Identify what you have, where it is stored, and what is missing

- Establish digital workflows: Shift from paper-first to digital-first documentation

- Create your folder structure: Organize files for easy retrieval and retention management

- Label everything with dates: Tag documents with creation date and earliest disposal date

- Set calendar reminders: Schedule annual purge reviews for after tax season

- Create a written retention policy: Document your rules so employees and bookkeepers follow them consistently

- Train your team: Ensure everyone understands what to keep and where to store it

The businesses that handle audits smoothly are not necessarily larger or better funded. They simply have systems that make documentation retrieval straightforward.

Frequently Asked Questions

How long does the IRS require you to keep business records?

The IRS requires you to keep business records for at least 3 years from the filing date in standard situations. This extends to 6 years if you underreport income by more than 25%, 7 years if you claim a bad debt or worthless securities loss, and indefinitely if you file a fraudulent return or fail to file.

What business records should I keep permanently?

Keep business formation documents (articles of incorporation, LLC operating agreements, partnership agreements), corporate meeting minutes, stock certificates, property deeds and titles, trademark and patent registrations, audit reports, and legal settlements permanently. Many accountants also recommend keeping filed tax returns indefinitely as a best practice.

How long should I keep business invoices and receipts?

Keep routine sales invoices, purchase receipts, and bank statements for at least 3 years. Invoices for significant transactions, annual financial statements, and expense records tied to tax deductions should be kept for 7 years. Invoices related to capital asset purchases should be kept for the life of the asset plus 7 years.

What happens if you cannot produce business records for an IRS audit?

If you cannot produce records during an IRS audit, claimed deductions may be denied, the IRS may estimate your income unfavorably, you may face accuracy-related penalties of 20% of any underpayment, and in extreme cases involving fraud, you could face criminal liability.

How long do I need to keep employee payroll records?

The IRS requires employment tax records for at least 4 years after the tax becomes due or is paid, whichever is later. However, most accountants recommend keeping payroll records, W-2 forms, and 1099 forms for 7 years to cover the extended audit window for underreported income.

Ready to build better records automatically? Start with your invoicing. Pronto Invoice creates a complete, searchable archive of every invoice you send — organized by date, client, and amount. No filing, no scanning, no boxes in the garage. Just compliant records created as a natural part of getting paid.

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Handyman Services Invoice Guide: How to Bill for Multiple Small Jobs

Complete handyman invoice guide for billing multiple small jobs. Learn minimum charges, itemization strategies, and material markups.

How to Write a Painting Invoice That Gets You Paid Fast

Learn how to write a painting invoice that gets paid fast. Covers square footage billing, paint vs labor costs, and prep work itemization.