How to Get Customers to Pay Invoices Faster: 15 Strategies

Learn 15 proven strategies to get customers to pay invoices faster. Invoice timing, payment options, and follow-up tips.

Want to get customers to pay invoices faster? You’re not alone. Late payments cost small businesses more than money. They cost time spent chasing invoices, stress over cash flow gaps, and sometimes relationships with otherwise good clients. According to recent data, small businesses in the U.S. are owed an average of $84,000 in unpaid invoices at any given time—money that could be funding growth, paying employees, or simply providing peace of mind.

If you’ve ever finished a job, sent an invoice, and then waited… and waited… and waited some more, you know the frustration. The electrician who completes emergency repairs on a Friday shouldn’t be chasing payment three weeks later. The graphic designer who delivered a brand package on deadline shouldn’t be wondering if the client forgot about the invoice sitting in their inbox.

Here’s what the data consistently shows: how and when you invoice matters more than most business owners realize. The businesses that collect payments faster aren’t necessarily the ones with the strictest policies or the most aggressive collections—they’re the ones who’ve optimized their entire invoicing process from start to finish.

This guide covers 15 proven invoice payment strategies to accelerate your payment collection while maintaining strong client relationships. These aren’t theoretical concepts—they’re practical techniques used by successful freelancers, contractors, and small business owners to speed up invoice payments.

Before You Invoice: Setting the Stage for Faster Invoice Payments

The work you do before sending an invoice has an outsized impact on how quickly you get paid. These foundational strategies address payment expectations and processes before money ever becomes an issue.

Strategy 1: Discuss Payment Terms Before Starting Work

The biggest mistake business owners make is treating payment terms as an afterthought. By the time a client sees your invoice, they should already know exactly when payment is due, what methods you accept, and what happens if payment is late.

Implementation steps:

- Include payment terms in your proposals and contracts, not just invoices

- Verbally confirm payment expectations during the project kickoff conversation

- For larger projects, specify milestone payments in writing before work begins

- Ask clients about their payment process—many companies have specific billing cycles or approval workflows

For field service professionals, this might mean discussing payment at the time of scheduling. A simple “We collect payment at the time of service—do you prefer card or check?” sets expectations clearly.

For freelancers working with larger companies, ask: “What’s your typical payment timeline, and is there anything I need to include on invoices to ensure smooth processing?” Some companies require purchase order numbers, specific formatting, or submission through vendor portals. See our invoice payment terms guide for more guidance.

Strategy 2: Require Deposits on Larger Projects

Deposits serve two purposes: they provide immediate cash flow and they create psychological commitment. A client who has already invested money in a project is significantly more likely to pay the remaining balance promptly.

Recommended deposit structures:

- Under $500: Full payment upfront or upon completion

- $500-$2,000: 50% deposit, 50% on completion

- $2,000-$10,000: 50% deposit, 25% at midpoint, 25% on completion

- Over $10,000: Consider monthly progress billing or milestone-based payments

Creative freelancers and contractors benefit especially from milestone payments. A web designer might collect 50% to begin design, 25% upon design approval, and 25% at launch. This keeps cash flowing throughout longer projects and reduces the risk of a large outstanding balance.

Strategy 3: Verify Client Information and Payment Capability

This sounds basic, but incomplete or incorrect client information causes significant payment delays. Before starting work with a new client:

- Confirm the legal business name for invoicing

- Get the correct billing address and contact

- Ask who approves invoices and their email address

- For B2B clients, understand their accounts payable process

- Consider running a basic credit check for very large projects

For contractors and field service professionals, this is especially relevant for commercial clients. The property manager you’re working with may not be the person who approves payments—billing the wrong contact means your invoice sits unopened.

Invoice Design and Delivery: Making Payment Easy

How your invoice looks, what information it contains, and how you deliver it all influence payment speed. These invoice payment strategies focus on removing friction from the payment process.

Strategy 4: Invoice Immediately—The Same Day When Possible

The single most effective strategy for faster invoice payments is reducing the time between completing work and sending the invoice. Data consistently shows that invoices sent on the same day as service completion are paid significantly faster than those sent days or weeks later.

Why immediate invoicing works:

- The value of your work is fresh in the client’s mind

- Details are accurate because you haven’t forgotten anything

- Clients expect the invoice and are ready to process it

- You avoid the backlog of invoicing that accumulates over time

For field service professionals, this means invoicing on-site before leaving the job. Mobile invoicing apps make this straightforward—you can create and send a professional invoice in under a minute while the client watches. The plumber who hands a client their invoice (or sends it to their phone) before leaving the driveway gets paid weeks faster than one who invoices from the office later that week.

For freelancers and consultants, invoice on the day you deliver final work. Attach the invoice to the same email as the deliverables, or send it within the hour.

Strategy 5: Make Invoices Crystal Clear

Confusing invoices cause delays. When a client has to figure out what they’re paying for or why the total is different than expected, they set the invoice aside. Clear invoices get processed immediately.

Essential invoice elements:

- Your business name and contact information

- Client’s correct legal name and billing address

- Unique invoice number

- Invoice date and due date (prominently displayed)

- Itemized list of services with descriptions clients can understand

- Clear total amount due

- Accepted payment methods

- Payment instructions (especially for ACH or check payments)

Avoid vague line items like “Services rendered” or “Consulting.” Instead, be specific: “Kitchen faucet replacement—parts and labor” or “Brand identity design—logo, business card, and letterhead.”

Strategy 6: Offer Multiple Payment Methods

Every barrier to payment slows collection. When you only accept checks, you’re adding steps: the client has to find a checkbook, write the check, find an envelope and stamp, and actually mail it. At any of those steps, they might get distracted and your payment gets delayed.

Payment methods to consider:

- Credit and debit cards: Fastest payment method, clients can pay instantly

- ACH bank transfers: Lower processing fees, excellent for recurring clients (learn more about ACH payments for small business)

- Digital wallets: PayPal, Venmo, Apple Pay for consumer-facing businesses

- Payment links: Direct links in invoices that take clients straight to payment

- Checks: Still necessary for some clients, but shouldn’t be your only option

The cost of payment processing (typically 2.5-3% for credit cards) is almost always offset by faster payment and reduced collection time. A 3% fee on a $1,000 invoice costs you $30—but if accepting cards means you get paid in 2 days instead of 30, that’s a worthwhile trade for most businesses. Explore mobile payment methods to find the right fit.

Strategy 7: Shorten Your Payment Terms

Net-30 payment terms (payment due within 30 days) became standard in business-to-business transactions decades ago. But there’s no law requiring you to offer 30-day terms, and many small businesses have successfully shortened their payment windows to reduce payment delays.

Consider these alternatives:

- Due upon receipt: Payment expected immediately, appropriate for smaller invoices and on-site service

- Net-7: Payment due within one week

- Net-14: Two-week payment window, a reasonable middle ground

- Net-15: Standard for many small businesses

Research from payment platforms shows that invoices with shorter payment terms are paid faster on average—even accounting for the shorter window. An invoice due in 7 days creates more urgency than one due in 30 days.

Start with net-14 for new clients and adjust based on your industry norms and client expectations. Established clients with reliable payment history might earn net-30 terms as a relationship benefit. Check our complete guide to invoice payment terms for more options.

Strategy 8: Send Invoices Electronically with Payment Links

Paper invoices sent by mail are slow to arrive, easy to lose, and require extra steps to pay. Electronic invoices with embedded payment links are the standard for fast-paying businesses.

Best practices for electronic invoicing:

- Send invoices directly from your invoicing software, not as email attachments

- Include a prominent “Pay Now” button that links directly to payment

- Ensure invoices display correctly on mobile devices (many clients check email on phones)

- Use a professional invoice template that looks trustworthy

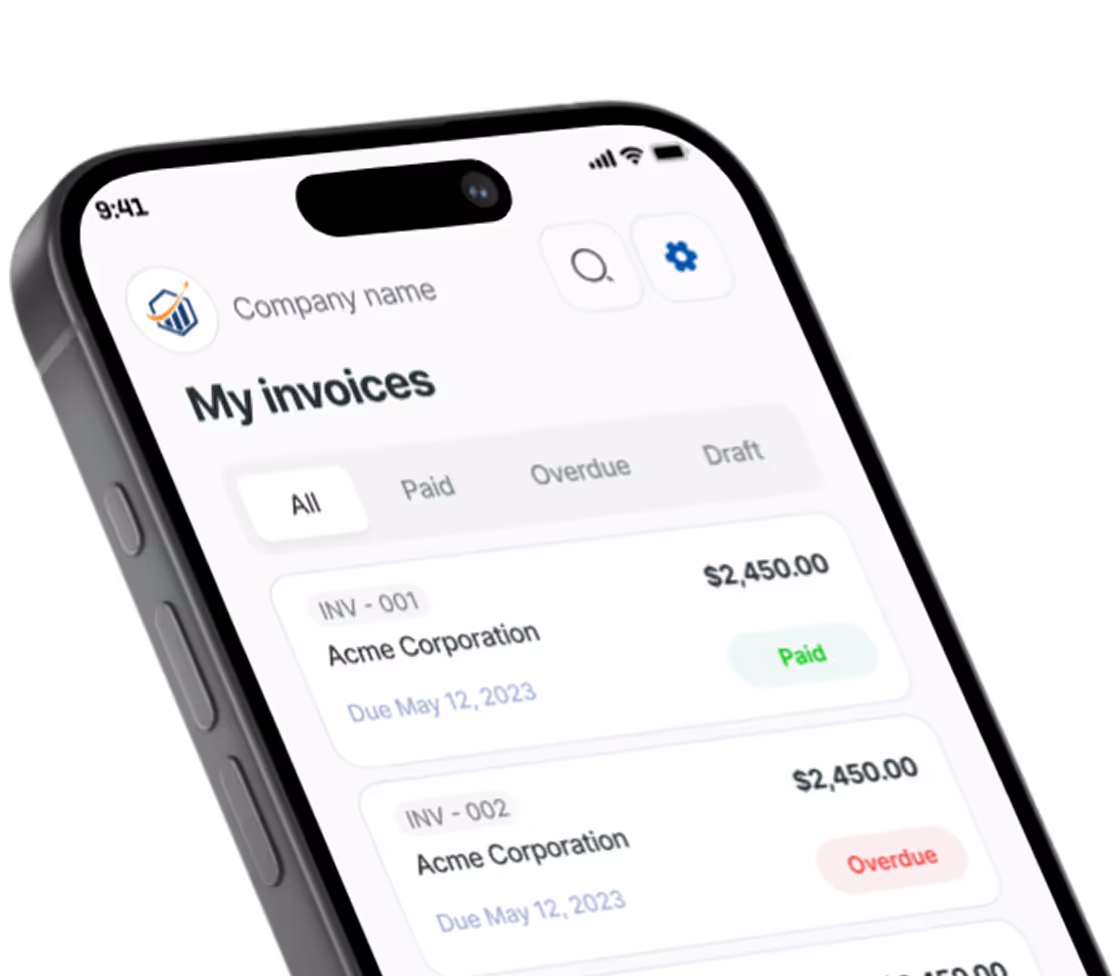

Modern invoicing tools like Pronto Invoice generate mobile-friendly invoices with integrated payment links. Clients receive the invoice, tap to pay, and complete the transaction in seconds—all from their phone. For field service professionals invoicing on-site, this means clients can pay before you leave the job.

After Sending: Follow-Up and Collection Strategies

Even with perfect invoicing practices, some payments will be delayed. These strategies help you collect payments faster without damaging client relationships.

Strategy 9: Send Reminder Notices Before the Due Date

A friendly reminder sent 2-3 days before the due date can prevent late payments entirely. Many late payments aren’t intentional—clients simply forgot or the invoice slipped through the cracks.

Sample pre-due-date reminder:

Subject: Friendly reminder: Invoice #1234 due Friday

Hi [Client],

Just a quick reminder that invoice #1234 for $[amount] is due this Friday, [date].

You can pay online here: [payment link]

Let me know if you have any questions!

Automate these reminders through your invoicing software so they’re sent consistently. The goal isn’t to pressure—it’s to ensure your invoice doesn’t get overlooked in a busy inbox. See our guide on invoice payment reminders that work for more templates.

Strategy 10: Implement a Systematic Follow-Up Schedule

When invoices do become overdue, consistent follow-up is essential. The key is having a system rather than sending sporadic reminders when you remember.

Recommended follow-up schedule:

- Due date: Invoice is due

- 3 days overdue: First gentle reminder via email

- 7 days overdue: Second reminder, slightly more direct

- 14 days overdue: Phone call or more urgent email

- 21 days overdue: Final notice before late fees or collection action

- 30+ days overdue: Consider collection procedures

Each contact should escalate slightly in urgency while remaining professional. Your first reminder might say “Just checking in on invoice #1234”—your 14-day follow-up should be more direct: “Invoice #1234 is now two weeks overdue. Please remit payment by [date] to avoid late fees.”

Automating reminders through invoicing software ensures consistency and saves you the mental burden of tracking who needs follow-up.

Strategy 11: Pick Up the Phone for Overdue Invoices

Email is easy to ignore. Phone calls are not. If an invoice is more than 7-10 days overdue, a polite phone call is often more effective than another email.

Phone call approach:

- Be friendly and assume positive intent: “Hi [name], I’m calling to check in on invoice #1234—I wanted to make sure you received it and see if there’s anything you need from me to process payment.”

- Listen for underlying issues: budget constraints, approval delays, disputed charges

- Offer solutions: payment plans, alternative payment methods, correcting any errors

- Get a specific commitment: “When can I expect payment?” followed by a confirmation email

Many slow-paying clients aren’t avoiding you—they’re dealing with their own cash flow issues, waiting for internal approvals, or simply disorganized. A phone call often uncovers these issues and opens the door to solutions. Learn more about how to handle late-paying clients.

Strategy 12: Offer Early Payment Discounts

If cash flow is your priority, paying clients to pay early can be cost-effective. A 2% discount for payment within 10 days (often written as “2/10 net 30”) costs less than the interest on a line of credit you might need to cover cash flow gaps.

How to structure early payment discounts:

- 2% discount for payment within 10 days

- 1.5% discount for payment within 7 days

- Flat dollar amount off for same-day payment

Mention the discount prominently on the invoice: “Pay by [date] and save $50!” For some clients, the savings incentive is enough to prioritize your invoice over others in their payment queue.

This strategy works best with larger invoices where the percentage discount is meaningful and with clients who are good payers but just not fast payers.

Strategy 13: Charge Late Payment Fees (And Actually Enforce Them)

Late fees create a consequence for delayed payment. But they only work if you disclose them upfront and actually apply them consistently.

Late fee best practices:

- Disclose late fees in contracts and on invoices before work begins

- Typical late fees: 1.5% per month (18% annually) or a flat fee of $25-50

- Check your state’s usury laws—some states cap late fees

- Apply fees consistently—making exceptions trains clients that your terms are negotiable

- Send a notice before applying fees: “Invoice #1234 is now 15 days past due. A late fee of $X will be added on [date] if payment is not received.”

The goal isn’t to profit from late fees—it’s to make late payment unappealing enough that clients pay on time. Many businesses find that simply having late fee language on invoices reduces payment delays, even if they rarely enforce the fees.

Relationship and Communication Strategies

Getting paid faster isn’t just about systems and policies—it’s also about relationships. These strategies focus on the human side of payment collection.

Strategy 14: Make It Easy for Clients to Reach You

Sometimes invoices are delayed because clients have questions or concerns they haven’t raised. Maybe they don’t understand a line item, or they expected a different amount, or they need documentation for their records.

Remove communication barriers:

- Include your phone number and email on every invoice

- Respond quickly to client questions about billing

- If a client disputes a charge, address it immediately rather than letting the invoice age

- For larger projects, do a brief walkthrough of the invoice with the client

Proactive communication also helps. Before invoicing a new client for the first time, consider calling or emailing: “I’ll be sending over the invoice this afternoon—let me know if you have any questions about the charges or need anything specific for your records.”

Strategy 15: Build Relationships Before You Need to Collect

The easiest invoices to collect are from clients who like you, trust you, and want to work with you again. Relationship-building isn’t a payment strategy per se, but it creates goodwill that makes every other strategy more effective.

Relationship practices that support payment:

- Deliver excellent work that clients are happy to pay for

- Communicate proactively during projects so there are no surprises

- Express genuine appreciation for their business

- Be flexible when clients have legitimate issues—offer a payment plan rather than demanding immediate payment during their cash crunch

- Follow up after projects to ensure satisfaction

Clients who see you as a trusted partner rather than just a vendor prioritize your invoices. When they have ten invoices on their desk and limited cash flow, they’ll pay the people they want to maintain relationships with first.

How to Get Customers to Pay Invoices Faster: Your Action Plan

Getting customers to pay invoices faster requires a systematic approach. Here’s how to implement these strategies:

This week:

- Review your current payment terms—are they clearly communicated before work begins?

- Ensure you’re accepting credit card and ACH payments if you’re not already

- Set up automated payment reminders in your invoicing software

This month:

- Create a follow-up schedule and template messages for overdue invoices

- Add late fee language to your invoices and contracts

- Shorten payment terms from net-30 to net-14 for new clients

Going forward:

- Invoice on the day you complete work—same-day for field service, within hours for project work

- Use mobile invoicing so you can bill from anywhere, immediately

- Pick up the phone for any invoice more than 10 days overdue

The businesses that get paid fastest share one common trait: they treat invoicing as a critical business process, not an afterthought. They invoice immediately, make payment easy, follow up consistently, and maintain strong client relationships.

Mobile invoicing tools like Pronto Invoice make immediate invoicing practical for field service professionals and anyone who works away from a desk. When you can create and send a professional invoice in under 60 seconds—from a job site, client meeting, or your truck—you eliminate the delay that causes most late payments in the first place.

Late payments don’t have to be a cost of doing business. With the right invoice payment strategies and tools, you can speed up invoice payments while maintaining the client relationships that grow your business.

Frequently Asked Questions

How can I get customers to pay invoices faster without being pushy?

Focus on making payment easy rather than pressuring clients. Send clear invoices immediately after completing work, offer multiple payment methods including online options, and use automated reminders that feel helpful rather than demanding. Setting clear payment terms upfront prevents awkward conversations later.

What’s the best payment term to get paid faster?

Net-14 or due upon receipt works best for most small businesses. Research shows invoices with shorter payment windows get paid faster, even accounting for the shorter timeline. Reserve net-30 terms for established clients with proven payment history.

Should I charge late fees to get customers to pay invoices faster?

Late fees work best as a deterrent. Clearly disclose them in contracts and on invoices, then apply them consistently. Many businesses find that simply having late fee language reduces payment delays—clients prioritize invoices that will cost more if they wait.

How do I follow up on overdue invoices professionally?

Start with a friendly email 3 days after the due date assuming the client simply forgot. Escalate gradually: second reminder at 7 days, phone call at 14 days, final notice at 21 days. Always offer solutions and assume positive intent until proven otherwise.

What payment methods help collect payments faster?

Credit cards and ACH bank transfers are fastest—clients can pay instantly with a click. Payment links embedded directly in invoices remove friction. While the 2-3% processing fee seems high, getting paid in 2 days instead of 30 more than offsets the cost for most businesses.

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.