How to Handle Late Paying Clients Without Losing the Relationship

Handle late paying clients without losing the relationship. Proven scripts, a 30-day escalation timeline, and prevention tactics.

Table of Contents

- Why Clients Pay Late

- The 30-Day Late Payment Escalation Framework

- When to Stop Work on Ongoing Projects

- Phone Scripts for Collecting Unpaid Invoices

- How Invoicing Software Eliminates Collection Guesswork

- Preventing Late Payments Before They Start

- The Mindset Shift: You Are Not Asking for a Favor

- When the Client Relationship Is Not Worth Saving

- Your Late Payment Action Plan

You finished the job two weeks ago. The invoice went out the next day. Payment was due last Friday.

Now you need to know how to handle late paying clients without damaging relationships you have spent years building. According to the Federal Reserve’s Small Business Credit Survey, 64% of small businesses experience delayed customer payments. You are not alone in this struggle.

Your bank account is feeling the squeeze. You need that money to cover materials for the next project, pay your own bills, and maybe grab dinner that does not come from a microwave.

But here is what stops you from picking up the phone: this client has been great. They referred you to two other customers last year. You do not want to damage the relationship by coming across as aggressive or desperate.

This tension between needing your money and preserving valuable relationships is one of the most uncomfortable parts of running a business. The good news is that you can do both. This guide gives you the exact words to say, the timeline to follow, and strategies to prevent late payments from becoming a pattern.

Why Clients Pay Late (It Is Rarely Personal)

Before you craft your approach, understanding why payments get delayed helps you respond appropriately. A QuickBooks study found that 73% of businesses are negatively impacted by late payments, yet most delays stem from simple, fixable issues.

Common reasons for late payment:

They simply forgot. Your invoice got buried in their inbox or lost in a stack of paperwork. This is the most common reason and the easiest to resolve.

Cash flow timing. They have the money, just not right now. Many businesses batch payments on specific days of the month.

Invoice confusion. Something about the invoice is unclear, or they are waiting for approval from someone else in their organization.

Dissatisfaction with work. They have concerns about the deliverables but have not communicated them to you.

Disorganization. Some clients genuinely struggle with administrative tasks. It is not malicious; it is just chaos.

Intentional delay. Unfortunately, some clients stretch payments as long as possible as a cash management strategy.

Knowing which category your client falls into shapes your entire approach. A forgetful client needs a gentle nudge. A client with concerns about your work needs a conversation about expectations. A chronic delayer needs firmer boundaries.

The 30-Day Late Payment Escalation Framework

Having a systematic approach removes the emotional guesswork from late payment collection. Here is a timeline that balances persistence with professionalism for collecting unpaid invoices.

Days 1-3 After Due Date: The Friendly Reminder

Most overdue invoice follow-up efforts resolve at this stage. Your tone should assume the best: they forgot or the email went to spam.

Email Script:

Subject: Quick reminder: Invoice #[NUMBER] due [DATE]

Hi [NAME],

Hope you are doing well. Just a quick note that invoice #[NUMBER] for $[AMOUNT] was due on [DATE].

I have attached another copy for convenience. Let me know if you have any questions or if there is anything you need from me to process this.

Thanks, [YOUR NAME]

Why this works: No accusation, no pressure. You are simply providing information and making it easy for them to pay.

Days 7-10: The Direct Follow-Up Call

If the friendly reminder did not work, it is time for a more direct approach. A phone call or text often works better than email at this stage for client payment reminders.

Phone Script:

“Hi [NAME], this is [YOUR NAME]. I wanted to touch base about invoice #[NUMBER] for the [PROJECT] work. I sent it over on [DATE], and I wanted to make sure you received it and see if there is anything holding up payment on your end.”

Then listen. Their response tells you everything about how to proceed.

If they forgot: “No problem at all. When do you think you can get that processed?”

If they have cash flow issues: “I understand. Can we set up a payment plan that works for both of us?”

If they have concerns about the work: “I want to make sure you are completely satisfied. Can you tell me more about what is not meeting expectations?”

Days 14-21: The Formal Written Notice

At this point, you need documentation for your professional payment request. Switch to written communication that clearly states the situation and consequences.

Email Script:

Subject: Overdue Invoice #[NUMBER] - Action Required

Dear [NAME],

This is a formal notice regarding invoice #[NUMBER] for $[AMOUNT], originally due on [DATE]. The balance is now [X] days overdue.

Please remit payment within the next 7 days to avoid additional late fees as outlined in our agreement.

If there are circumstances preventing payment, please contact me immediately so we can discuss options.

I value our working relationship and want to resolve this promptly.

Sincerely, [YOUR NAME]

Day 30+: Final Notice and Next Steps

If you have reached this point without payment or communication, you need to protect your business. Research shows that the likelihood of collecting payment drops significantly after 60 days.

Final Notice Email:

Subject: Final Notice: Invoice #[NUMBER] - Immediate Action Required

Dear [NAME],

Despite multiple attempts to contact you, invoice #[NUMBER] for $[AMOUNT] remains unpaid, now [X] days overdue.

If payment is not received within 7 days, I will need to [specific consequence: pause ongoing work, pursue formal collection, report to credit agencies, etc.].

I am still open to discussing payment arrangements if needed. Please contact me at [PHONE] to resolve this matter.

Sincerely, [YOUR NAME]

When to Stop Work on Ongoing Projects

This is one of the hardest decisions for service providers dealing with late paying customers. Here is a framework to guide you.

Stop work immediately if:

- The overdue amount exceeds what you can afford to lose

- The client is unresponsive to all communication attempts

- You have clear contract language allowing work stoppage for non-payment

Continue work (with caution) if:

- The client has communicated openly about the delay

- You have a payment plan in writing

- The relationship value significantly exceeds the current invoice

Before stopping work, always:

- Document everything in writing

- Give a specific deadline for payment

- Clearly state that work will pause if payment is not received

- Follow through on your stated consequence

Failing to follow through trains clients that your deadlines are negotiable.

Phone Scripts for Collecting Unpaid Invoices

Email is easy, but phone calls resolve payment issues faster. Here are scripts for common scenarios when handling late paying clients.

For the Forgetful Client

“Hey [NAME], just calling to check on invoice #[NUMBER]. I know things get busy. Do you have a minute to look it up and let me know when I can expect payment?”

For the Client With Cash Flow Issues

“I hear you. Running a business means cash does not always line up perfectly. What if we split this into two payments? I can work with you, but I do need a commitment I can count on.”

For the Client Who Is Avoiding You

Leave a voicemail, then follow up with a text:

“Hi [NAME], tried calling about the outstanding invoice. I would much rather work this out between us than take next steps. Can you give me a call back today?”

For the Chronic Late Payer

“I noticed the last three invoices have all gone past due. I want to keep working together, but I need to adjust our terms going forward. What if we move to deposits before each project?”

How Invoicing Software Eliminates Collection Guesswork

One of the most stressful parts of late payment collection is uncertainty. Did they receive the invoice? Have they opened it? Should you follow up or wait?

Modern invoicing tools solve this problem. When you send invoices through a system that tracks opens and views, you know exactly when a client has seen your invoice. This eliminates the “maybe it went to spam” excuse and gives you confidence in your follow-up timing.

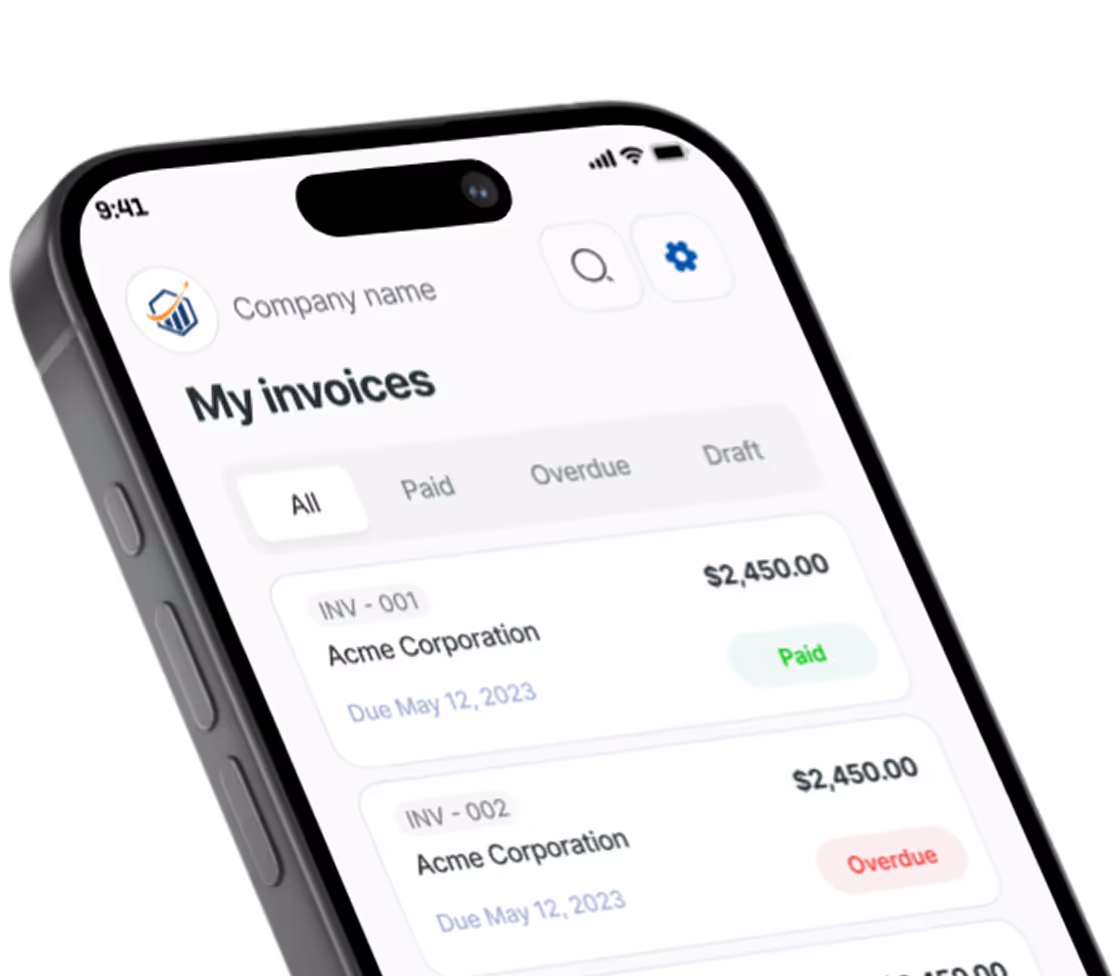

Pronto Invoice, for example, shows you when invoices are viewed and lets you set up automatic payment reminders. Instead of manually tracking due dates and wondering when to follow up, the system handles the routine reminders while you focus on the conversations that actually require a personal touch.

The best approach combines automated client payment reminders for routine follow-ups with personal outreach when those reminders do not work. Let technology handle the first nudge so you can reserve your energy for the conversations that matter.

Preventing Late Payments Before They Start

The best collection strategy is not needing to collect at all. According to a Fundbox survey, small business owners who implement prevention strategies report 79% fewer payment delays. These practices dramatically reduce late payments.

Get Payment Terms in Writing Upfront

Before starting any project, establish clear payment terms and make sure clients understand:

- When payment is due

- What happens if payment is late (fees, work stoppage)

- Accepted payment methods

Request Deposits for Large Projects

For projects over a certain threshold, collect 25-50% upfront. This reduces your risk and confirms the client is serious about the engagement.

Make Paying Easy

Accept multiple payment methods. Every barrier you add gives clients an excuse to delay. If you only accept checks and your client needs to find their checkbook, address an envelope, and get to a mailbox, you have built in a week of delay.

Invoice Immediately After Completing Work

The faster you send the invoice, the faster you get paid. Waiting until the end of the month to batch your invoicing means waiting an extra 2-4 weeks for payment.

Set Up Automatic Payment Reminders

A friendly reminder 3 days before the due date prevents many late payments entirely. Studies show that pre-due-date reminders can reduce late payments by 25-40%. Most clients appreciate the heads-up.

The Mindset Shift: You Are Not Asking for a Favor

Here is the truth many business owners struggle to internalize: requesting payment for completed work is not rude, aggressive, or pushy. It is professional.

You delivered value. You held up your end of the agreement. Expecting timely compensation is not only reasonable, it is essential for running a sustainable business.

Think about it this way: would you work for an employer who paid your salary whenever they felt like it? Of course not. Your clients are not doing you a favor by paying on time. They are fulfilling their contractual obligation.

Reframing overdue invoice follow-up from “asking for money” to “maintaining professional boundaries” changes everything. You are not the bad guy for expecting payment. You are a business owner protecting your livelihood.

When the Client Relationship Is Not Worth Saving

Not every client relationship deserves preservation. Some warning signs indicate you should collect payment and move on:

- Repeated late payments despite conversations and accommodations

- Disrespectful communication when you follow up

- Constant scope creep combined with payment delays

- Promises that never materialize

For these clients, your goal shifts from preservation to clean separation. Get your money, complete any contractual obligations, and decline future work.

A simple script for declining future projects:

“Thanks for thinking of me for this project. Unfortunately, my schedule will not allow me to take on new work with you at this time. I would be happy to recommend another provider if that would be helpful.”

No drama. No burned bridges. Just a professional boundary.

Your Late Payment Action Plan for This Week

Audit your outstanding invoices. Know exactly what is owed and how overdue each invoice is.

Set up a tracking system. Whether it is a spreadsheet or invoicing software with built-in tracking, you need visibility into invoice status.

Create your escalation templates. Customize the scripts in this guide for your business and save them where you can access them quickly.

Send one overdue follow-up today. Start with your oldest outstanding invoice. Use the appropriate script based on how overdue it is.

Update your client agreements. Add clear payment terms and late payment consequences to your contracts going forward.

Late payments are an inevitable part of business, but they do not have to damage your relationships or your cash flow. With the right systems and communication strategies, you can collect what you are owed while keeping valuable clients for the long term.

The key is consistency. Follow up every time. Follow through on stated consequences. And never apologize for expecting to be paid for the value you provide.

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.