How to Send Someone to Collections: A Step-by-Step Guide

Learn how to send someone to collections the right way. Step-by-step process, agency costs, and legal rules.

Wondering how to send someone to collections? You are not alone. The average US small business with outstanding invoices is owed $17,500 in unpaid debts. When months pass without payment, turning to a collection agency may be your best option to recover what you are owed.

Nobody starts a business hoping to chase down payments through collection agencies. You became a plumber to fix pipes, a designer to create beautiful work, a consultant to solve problems. Yet here you are, staring at an invoice that has been outstanding for months, wondering if it is time to take that final step.

Sending someone to collections feels like admitting defeat. It feels confrontational, uncomfortable, and maybe even a little aggressive. But sometimes, it is the right business decision.

This guide walks you through the entire debt collection process: when collections makes sense, how to choose a collection agency for your small business, what to expect, and the legal considerations you need to understand. Just as importantly, we cover alternatives to try first, because collections should genuinely be your last resort, not your first instinct when frustration peaks.

When to Send Someone to Collections

Not every unpaid invoice belongs in collections. Before escalating, ask yourself these critical questions:

Is the Debt Amount Worth Pursuing?

Collection agencies typically keep 25-50% of what they recover. If your outstanding invoice is $200, you might recover $100-150 at best, and that is if they collect at all. For small amounts, the time and energy may not be worth it.

Debt thresholds to consider:

- Under $500: Often not worth pursuing through collections

- $500-$2,000: Consider based on principle and recovery likelihood

- Over $2,000: Usually worth pursuing if other methods have failed

Have You Exhausted Other Collection Options?

Collections should come after you have made genuine attempts to resolve the situation. If you have not sent reminders, made phone calls, or attempted to negotiate, you are skipping important steps. For detailed guidance on pre-collection efforts, see our guide on how to handle late-paying clients without losing the relationship.

Can the Client Actually Pay?

Collections cannot squeeze money from someone who genuinely has none. If your client’s business has failed or they are facing bankruptcy, a collection agency will not change that reality. Research the situation before investing in a process that may yield nothing.

How Long Has the Invoice Been Overdue?

Most collection agencies want accounts that are 60-90 days past due. Sending a 30-day overdue invoice to collections is premature and may damage a relationship that could have been salvaged.

Recovery rates by debt age:

- Under 90 days overdue: 70-80% recovery rate

- 90-180 days overdue: 50-60% recovery rate

- Over 6 months overdue: 30-40% recovery rate

The sooner you act, the better your chances of successful unpaid invoice collection.

Alternatives to Try Before Sending to Collections

Before taking the collections step, ensure you have genuinely tried these approaches:

Direct Phone Communication

Sometimes the simplest approach works. A direct phone call, not an email that can be ignored, often breaks through when written reminders have not. Call and say: “I need to discuss the outstanding balance. What is preventing payment, and how can we resolve this?”

Listen to their response. Many late payments stem from temporary cash flow issues, billing disputes, or administrative problems that can be solved with a conversation.

Offer a Payment Plan

If the client wants to pay but cannot pay in full, offer a payment plan. Getting 50% now and 50% in 30 days is better than fighting for months over the full amount. Document any payment arrangement in writing.

Negotiate a Discounted Settlement

Sometimes accepting 70-80% of what you are owed is the smartest business decision. If offering a discount for immediate full payment resolves the issue, you have saved the time and emotional energy of a prolonged collection process, and avoided the collection agency’s cut.

Send a Final Demand Letter

Before engaging a collection agency, send a formal final demand letter. Make it clear that this is the last step before formal collection action. Include:

- The exact amount owed

- The original invoice date and due date

- A deadline for payment (typically 7-10 days)

- A clear statement that the account will be referred to collections if not resolved

Some clients pay at this stage simply because they realize you are serious.

Consider Small Claims Court

For amounts within your jurisdiction’s small claims limit (typically $5,000-$12,500 depending on the state), you can pursue the debt yourself without an attorney. This is more work than using a collection agency, but you keep 100% of what you recover.

How to Choose a Collection Agency for Small Business

If you have decided collections is the right path, selecting the right agency matters significantly.

Types of Collection Agencies

First-party agencies work as an extension of your business, often under your company name initially. They tend to use softer approaches and maintain client relationships where possible.

Third-party agencies operate independently under their own name. They are typically more aggressive and are what most people picture when they think of debt collectors.

Contingency agencies only get paid if they collect. They will take 25-50% of what they recover but charge nothing upfront. This is the most common model for small businesses.

Flat-fee agencies charge upfront regardless of results. They are typically used for lower-balance accounts where contingency percentages do not make economic sense. Flat fees typically range from $15-50 per account.

Questions to Ask Before Hiring a Collection Agency

Before signing with any agency, ask:

What is your success rate for debts similar to mine? Ask specifically about debts in your dollar range and industry.

What are your fees? Understand exactly what percentage they will keep or what flat fees apply.

How do you approach collection? Some agencies are aggressive; others focus on negotiation. Make sure their approach aligns with your values.

Are you licensed in the debtor’s state? Collection agencies must be licensed in the states where they operate. Verify their credentials.

Do you provide regular reporting? You should receive updates on collection efforts and any payments received.

What happens if you cannot collect? Understand whether the account returns to you, whether there are additional fees, and what documentation you will receive.

Red Flags When Choosing a Collection Agency

Be wary of agencies that:

- Guarantee specific collection rates (no agency can guarantee results)

- Require large upfront payments with no contingency option

- Cannot provide references from businesses similar to yours

- Are vague about their methods or licensing

- Pressure you to sign immediately without reviewing terms

The Debt Collection Process: Step-by-Step

Once you engage a collection agency, here is the typical timeline:

Week 1-2: Debt Verification The agency reviews your documentation and verifies the debt. They will confirm the amount owed, the debtor’s contact information, and the validity of your claim.

Week 2-4: Initial Contact Phase Initial contact attempts begin. This typically starts with letters and progresses to phone calls, emails, and text messages. The debtor is informed that the account has been placed with a collection agency.

Month 2-3: Escalated Collection Efforts If initial attempts fail, collection efforts continue with increased frequency and firmness. The agency may attempt skip-tracing if the debtor has become difficult to reach.

Month 3-6: Legal Action Consideration For persistent cases, the agency may recommend legal action or credit reporting. At this stage, you will need to decide whether to invest further in pursuing the debt.

Important: You lose some control once you engage an agency. The debtor’s experience with that agency reflects on your business, even indirectly. Choose carefully.

Legal Requirements for Debt Collection

Debt collection is heavily regulated. Understanding the basics protects you from liability.

Fair Debt Collection Practices Act (FDCPA) Rules

This federal law governs how third-party collectors can operate. Key provisions include:

- Collectors cannot call before 8 AM or after 9 PM in the debtor’s time zone

- They cannot use abusive, threatening, or harassing language

- They must stop contacting debtors who request in writing

- They must verify the debt if the debtor disputes it within 30 days

- They cannot discuss the debt with third parties (except spouses or attorneys)

While the FDCPA applies to third-party collectors (not you directly), any agency you hire must comply. You could face liability for engaging an agency that violates these rules.

State Debt Collection Laws

Many states have additional debt collection laws that are stricter than federal requirements. Some states require collection agencies to obtain specific licenses, limit collection fees, or provide additional debtor protections.

Statute of Limitations on Debt

Every state has a statute of limitations on debt, typically 3-6 years for most contracts. After this period, debts become “time-barred,” meaning they are unenforceable through the courts. Collection agencies can still attempt to collect, but they cannot threaten legal action on time-barred debts.

Check your state’s limitations before pursuing old debts. Attempting to collect time-barred debts can create legal complications.

Collection Agency Costs and Fee Structures

Contingency-Based Collection Fees

Most small businesses use contingency collection, where the agency only gets paid if they collect. Typical rates:

| Debt Age | Contingency Fee |

|---|---|

| Under 90 days | 25-35% |

| 90-180 days | 35-45% |

| Over 180 days | 40-50% |

On a $3,000 debt with a 35% contingency fee, you would receive approximately $1,950 if the full amount is collected.

Flat-Fee Collection Services

Some agencies offer flat-fee collection letters or calls, typically $15-50 per account. These work best for:

- Lower-balance accounts where contingency does not make sense

- Accounts where a formal collection letter might prompt payment

- Situations where you want to try collections without committing to a full contingency arrangement

Legal Collection Costs

If the agency recommends litigation, you will typically need to pay court costs and filing fees upfront ($200-500 depending on jurisdiction). Attorney fees may be contingency-based or hourly.

Documentation Required for Collections

Before engaging a collection agency, gather:

- Original invoice(s) with dates and amounts

- Contract or agreement showing the client accepted your terms

- Proof of delivery or service completion

- All correspondence including emails, texts, and notes from phone calls

- Payment history showing any partial payments received

- Client contact information including any known alternate addresses or phone numbers

The more documentation you provide, the stronger the agency’s position in collecting.

How to Prevent Future Unpaid Invoice Problems

The best collection strategy is never needing one. These practices dramatically reduce the chance of invoices becoming collection cases:

Establish Clear Payment Terms from the Start

Establish payment expectations before work begins. When clients know your terms upfront, and agree to them, disputes become less likely.

Request Deposits on Larger Projects

Collecting 25-50% before beginning work reduces your exposure if a client ultimately does not pay.

Send Invoices Immediately After Service

The data is clear: invoices sent immediately after service are paid faster and more reliably. Delays in invoicing create delays in payment, and increase the risk of non-payment entirely.

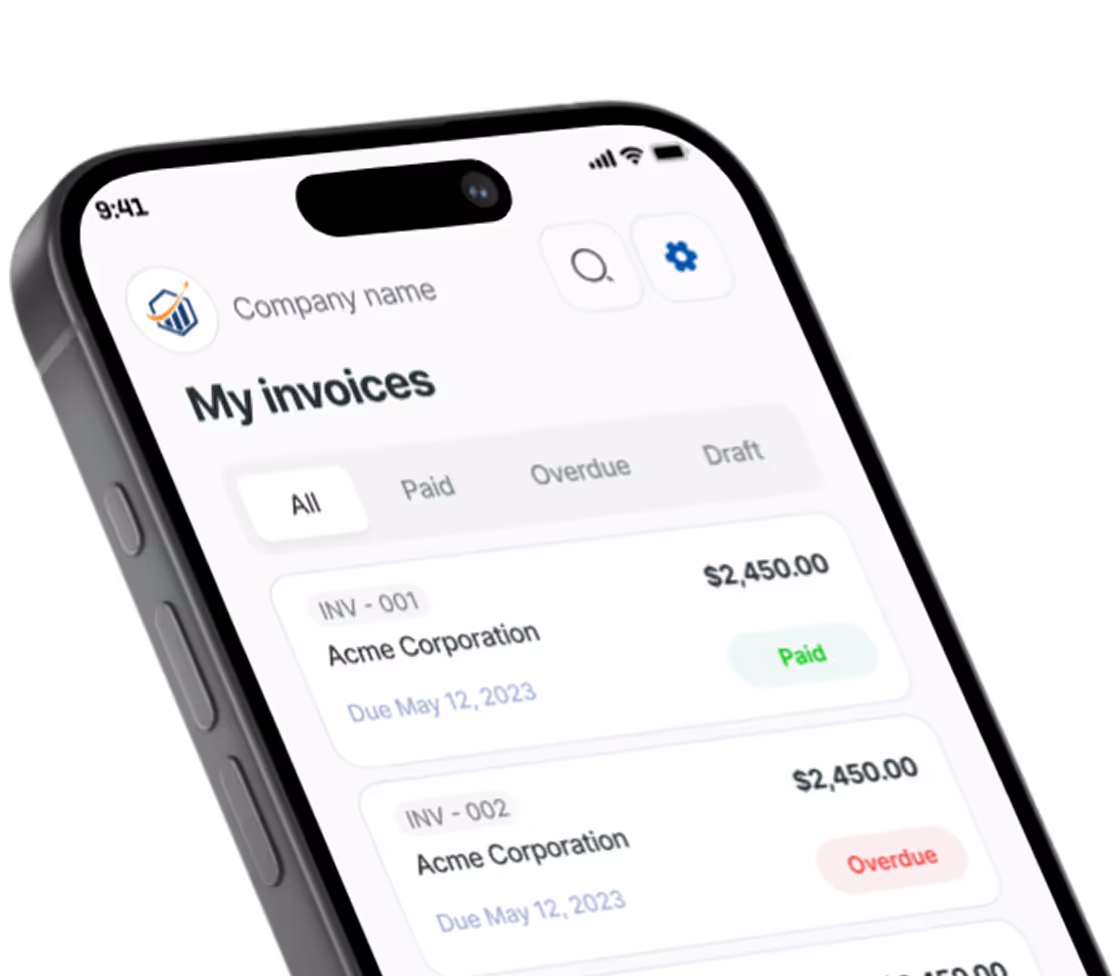

For field service professionals, this means invoicing on-site before leaving the job. Mobile invoicing tools like Pronto Invoice let you create and send professional invoices in under 60 seconds, complete with payment links that let clients pay immediately. When you can invoice from the customer’s driveway, you dramatically reduce the chances of ever needing a collection agency.

Implement Systematic Payment Follow-Up

Automated reminders ensure no invoice gets forgotten, by you or your client. A friendly reminder before the due date, followed by escalating follow-ups for late payments, catches problems before they become collection cases. See our guide on automated invoice reminders that work for templates and timing strategies.

Know When to Stop Work

For ongoing relationships, stop work when invoices become significantly overdue. Continuing to provide services to a non-paying client just increases your losses.

Making the Decision to Send an Invoice to Collections

Sending someone to collections is a business decision, not a moral judgment. Consider:

The financial math: Will the likely recovery (after agency fees) justify the process?

The relationship: Is this a relationship worth preserving, or has the non-payment revealed a client you are better off without?

Your emotional investment: The collection process takes time and mental energy. Are you prepared for that investment?

The precedent: How you handle non-payment affects how future clients perceive your business. Clients who know you take collections seriously may pay more reliably.

There is no shame in using a collection agency when you have genuinely exhausted other options and the debt is significant enough to warrant it. You provided value. You deserve payment. Sometimes, enforcing that requires professional help.

But collections should remain what they are: a last resort after you have done everything reasonable to resolve the situation directly. Better invoicing practices, clearer terms, and systematic follow-up prevent most collection situations before they start. The best collection agency is the one you never need to call.

Frequently Asked Questions

How long should I wait before sending someone to collections? Most experts recommend waiting 60-90 days after the invoice due date before engaging a collection agency. This gives the client reasonable time to pay while keeping the debt fresh enough for higher recovery rates.

Will sending someone to collections damage my business relationship? Usually, yes. Once you escalate to collections, the relationship is typically over. However, if someone has not paid for 90+ days despite multiple attempts, the relationship may already be damaged beyond repair.

What does it cost to send someone to collections? Contingency-based agencies charge 25-50% of what they recover, with fees increasing for older debts. Flat-fee services range from $15-50 per account. You pay nothing if the contingency agency does not collect.

Can I send someone to collections without a signed contract? Yes, but it is harder. You need documentation proving the debt is valid, such as invoices, delivery confirmations, email correspondence, or any written acknowledgment of the debt.

What happens to the debtor’s credit score? Collection accounts can significantly damage credit scores and remain on credit reports for up to seven years. This is one reason many debtors settle once contacted by an agency.

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.