How to Write a Receipt of Payment: Step-by-Step Guide (2025)

Learn how to write a receipt of payment in 7 steps. Includes free templates, required elements, and examples for contractors.

You just finished a job. The client hands you cash or runs their card. Now comes the awkward pause - scrambling for a receipt book, scribbling illegibly on a scrap of paper, or worse, promising to “email one later” and forgetting entirely.

A professional receipt of payment does more than confirm a transaction. It protects you legally, builds client trust, and keeps your bookkeeping clean. Yet most small business owners and freelancers either skip receipts altogether or create ones missing critical information.

This guide shows you exactly how to write a receipt of payment that looks professional, meets legal requirements, and takes seconds to create. You will find step-by-step instructions, industry-specific receipt of payment examples, and payment receipt templates you can use immediately.

Table of Contents

- What Is a Receipt of Payment?

- Receipt of Payment vs. Invoice: Key Differences

- 7 Required Elements of a Payment Receipt

- Optional Elements That Add Professionalism

- How to Write a Receipt of Payment: 7 Steps

- Receipt of Payment Examples by Industry

- Common Receipt Mistakes to Avoid

- Payment Receipt Templates

- Digital vs. Paper Receipts: Which Is Better?

- Frequently Asked Questions

What Is a Receipt of Payment?

A receipt of payment is a written document that acknowledges money has changed hands between two parties. Unlike an invoice (which requests payment), a receipt confirms payment has already been received.

This payment confirmation document serves three essential purposes:

- Legal protection - Proves the transaction occurred if disputes arise

- Tax documentation - Provides records for both parties’ accounting and IRS requirements

- Professional credibility - Shows clients you run a legitimate operation

Whether you are a plumber collecting payment after a repair, a photographer receiving a session deposit, or a consultant billing for advisory hours, a proper receipt of payment protects everyone involved.

Receipt of Payment vs. Invoice: Key Differences

Understanding when to use each document prevents confusion:

| Feature | Invoice | Receipt of Payment |

|---|---|---|

| Purpose | Requests payment | Confirms payment received |

| Timing | Sent before payment | Issued after payment |

| Legal status | Payment request | Proof of transaction |

| Required info | Payment terms, due date | Payment method, date received |

| Who receives | Buyer/client | Buyer/client (as confirmation) |

Key point: An invoice asks for money. A receipt of payment proves money was paid.

7 Required Elements of a Payment Receipt

Every payment receipt must include these seven elements to be legally valid and practically useful:

1. Receipt Number

A unique identifier for tracking and reference. Use a sequential numbering system (REC-001, REC-002) or date-based format (2024-0115-01 for the first receipt on January 15, 2024). The same numbering best practices that apply to invoices work for receipts.

2. Date of Payment

The exact date payment was received - not the service date or invoice date. This matters for accounting periods and potential disputes.

3. Payer Information

The full name or business name of the person or entity making the payment. For business-to-business transactions, include their address and contact information.

4. Payee Information (Your Business Details)

Your business name, address, phone number, and email. If you have a business license or tax ID number, include it for transactions over certain thresholds (requirements vary by jurisdiction).

5. Payment Amount

The exact amount received, including:

- Subtotal before tax

- Tax amount (if applicable)

- Total payment received

- Currency (especially important for international transactions)

6. Payment Method

How the payment was made:

- Cash

- Check (include check number)

- Credit/debit card (include last four digits only)

- Bank transfer

- Digital payment (PayPal, Venmo, Zelle, etc.)

7. Description of Goods or Services

A clear statement of what the payment covers. Be specific enough that both parties can reference it later without confusion.

Optional Elements That Add Professionalism

While not legally required, these additions elevate your receipts from basic to professional receipt format:

Business Logo - Visual branding that reinforces your legitimacy

Payment Terms Confirmation - Note if this payment completes the balance or if more is owed

Original Invoice Reference - Link the receipt to the corresponding invoice number

Signature Line - Space for your signature or electronic verification

Thank You Message - A brief appreciation note that strengthens client relationships

Refund Policy - Particularly important for retail and service deposits

Next Steps - Warranty information, follow-up appointment details, or maintenance reminders

How to Write a Receipt of Payment: 7 Steps

Follow this step-by-step process every time you receive payment to ensure consistent, professional documentation:

Step 1: Gather Transaction Details

Before writing anything, confirm:

- The exact amount received

- The payment method used

- What the payment covers (full invoice, partial payment, deposit)

- The client’s correct name and contact information

Step 2: Add Your Business Header

Place your business details prominently at the top:

[Your Business Name]

[Address]

[Phone | Email]

[Business License/Tax ID if applicable]

RECEIPT OF PAYMENT

Receipt #: [Number]

Date: [Payment Date]Step 3: Include Client Information

Received From:

[Client Name]

[Client Address]

[Client Phone/Email]Step 4: Document Payment Details

Payment Amount: $[Amount]

Payment Method: [Cash/Check/Card]

Reference: [Check number, card last 4 digits, or transaction ID]Step 5: Describe What Was Paid

Payment For:

[Detailed description of services or goods]

Invoice Reference: [Invoice number if applicable]Step 6: Show Balance Information

Original Amount Due: $[Total]

This Payment: $[Amount]

Remaining Balance: $[Balance or "PAID IN FULL"]Step 7: Add Closing Elements

Received By: [Your name or business]

Signature: ______________________

Thank you for your business!Receipt of Payment Examples by Industry

Different industries have different documentation needs. Here are tailored receipt of payment examples for three common scenarios:

Contractor Receipt of Payment Example

SUMMIT HOME REPAIRS LLC

1234 Builder's Way, Denver, CO 80202

(303) 555-0147 | info@summithomerepairs.com

License #CR-789456

RECEIPT OF PAYMENT

Receipt #: SHR-2024-0892

Date: January 15, 2024

RECEIVED FROM:

Michael Thompson

892 Oak Street

Denver, CO 80203

PAYMENT DETAILS:

Amount Received: $2,450.00

Payment Method: Check #4521

WORK PERFORMED:

Kitchen sink replacement and garbage disposal installation

at 892 Oak Street on January 14, 2024.

- Materials: Kohler undermount sink, InSinkErator disposal

- Labor: 4 hours

- Permits included

Invoice Reference: INV-2024-0341

Status: PAID IN FULL

Warranty: 1-year labor warranty on installation

Next maintenance recommended: January 2025

Thank you for choosing Summit Home Repairs!

_______________________

James Rivera, OwnerFreelancer Receipt of Payment Example

SARAH CHEN PHOTOGRAPHY

Portland, OR | sarah@sarahchenphotography.com

(503) 555-0198

PAYMENT RECEIPT

Receipt #: SCP-0156

Date: January 15, 2024

CLIENT:

Westwood Marketing Agency

Attn: David Park

500 NW Couch St, Suite 300

Portland, OR 97209

PAYMENT RECEIVED:

Amount: $1,800.00

Method: Credit Card (ending 4829)

Transaction ID: TXN-9847562

SERVICES:

Product photography session - Winter catalog shoot

- 6 hours on-location shooting

- 45 edited images, full commercial license

- Delivery via cloud storage

Related Invoice: INV-2024-012

Total Project Fee: $3,600.00

Previous Deposit: $1,800.00

This Payment: $1,800.00

Balance: $0.00 - PAID IN FULL

Image files delivered to: david@westwoodmarketing.com

Thank you for a great collaboration!

Sarah ChenService Business Receipt of Payment Example

PRECISION HVAC SERVICES

24/7 Emergency Heating & Cooling

Phoenix, AZ 85001

(480) 555-0123 | ROC #298745

RECEIPT OF PAYMENT

Receipt: HVAC-24-1847

Date: January 15, 2024

Time: 2:45 PM

CUSTOMER:

Jennifer Walsh

4521 E Camelback Road

Phoenix, AZ 85018

SERVICE PERFORMED:

Emergency AC repair - replaced capacitor and recharged

refrigerant. System tested and operational.

Service Date: January 15, 2024

Technician: Marcus Johnson

PAYMENT:

Diagnostic Fee: $89.00

Parts (capacitor): $125.00

Refrigerant (2 lbs): $160.00

Labor (1.5 hrs): $195.00

Subtotal: $569.00

Tax (8.6%): $48.93

TOTAL PAID: $617.93

Payment Method: Visa ending 8847

Equipment: Trane XR15, Serial #W184756239

Next recommended service: Filter change in 90 days

Questions? Call (480) 555-0123

Thank you for choosing Precision HVAC!Common Receipt Mistakes to Avoid

Even experienced business owners make these errors that can cause problems later:

Missing or vague descriptions - “Services rendered” tells no one anything. Be specific: “Website redesign - homepage and 4 interior pages” gives clarity if questions arise months later.

Wrong date - Using the invoice date instead of the actual payment date creates accounting headaches and can cause legal issues.

No receipt number - Without unique identifiers, tracking payments becomes impossible at scale.

Incomplete payment information - Noting “card payment” without the last four digits or transaction reference makes verification difficult.

Illegible handwriting - If you use paper receipts, unclear handwriting defeats the purpose entirely.

Forgetting to note partial payments - When clients pay in installments, each receipt must show the remaining balance to avoid disputes.

Not providing copies - Both parties need records. Digital receipts solve this instantly.

Delaying receipt creation - Writing receipts “later” often means forgetting details or never writing them at all.

Payment Receipt Templates

Here is a clean, adaptable payment receipt template you can customize for your business:

[BUSINESS NAME]

[Address] | [Phone] | [Email]

[License/Tax ID if applicable]

RECEIPT OF PAYMENT

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Receipt Number: _______________

Date Received: _______________

RECEIVED FROM:

Name: _________________________

Address: ______________________

_______________________________

PAYMENT DETAILS:

Amount: $______________________

Method: _______________________

Reference #: __________________

FOR:

_______________________________

_______________________________

_______________________________

Invoice #: ____________________

Total Due: $___________________

This Payment: $_________________

Remaining Balance: $___________

Status: [ ] Partial Payment [ ] Paid in Full

AUTHORIZED BY:

Signature: ____________________

Print Name: ___________________

[Optional: Warranty/Policy/Thank You]Digital vs. Paper Receipts: Which Is Better?

The days of carbon-copy receipt books are numbered. Today’s clients expect digital receipts instantly - and your accounting system needs them too.

Paper Receipt Advantages

- No technology required

- Works without internet

- Familiar to older clients

Digital Receipt Advantages

- Automatic backup and organization

- Easy search and retrieval for tax time

- Integration with accounting software

- Professional appearance that builds credibility

- Elimination of lost or illegible paper receipts

- Instant delivery to clients

The Best Solution: Mobile Receipt Apps

The biggest challenge for service professionals is creating receipts on-site, immediately after payment. You are standing in a client’s driveway, hands dirty from the job, and they just paid you in cash. Fumbling with paper or promising to “send something later” looks unprofessional.

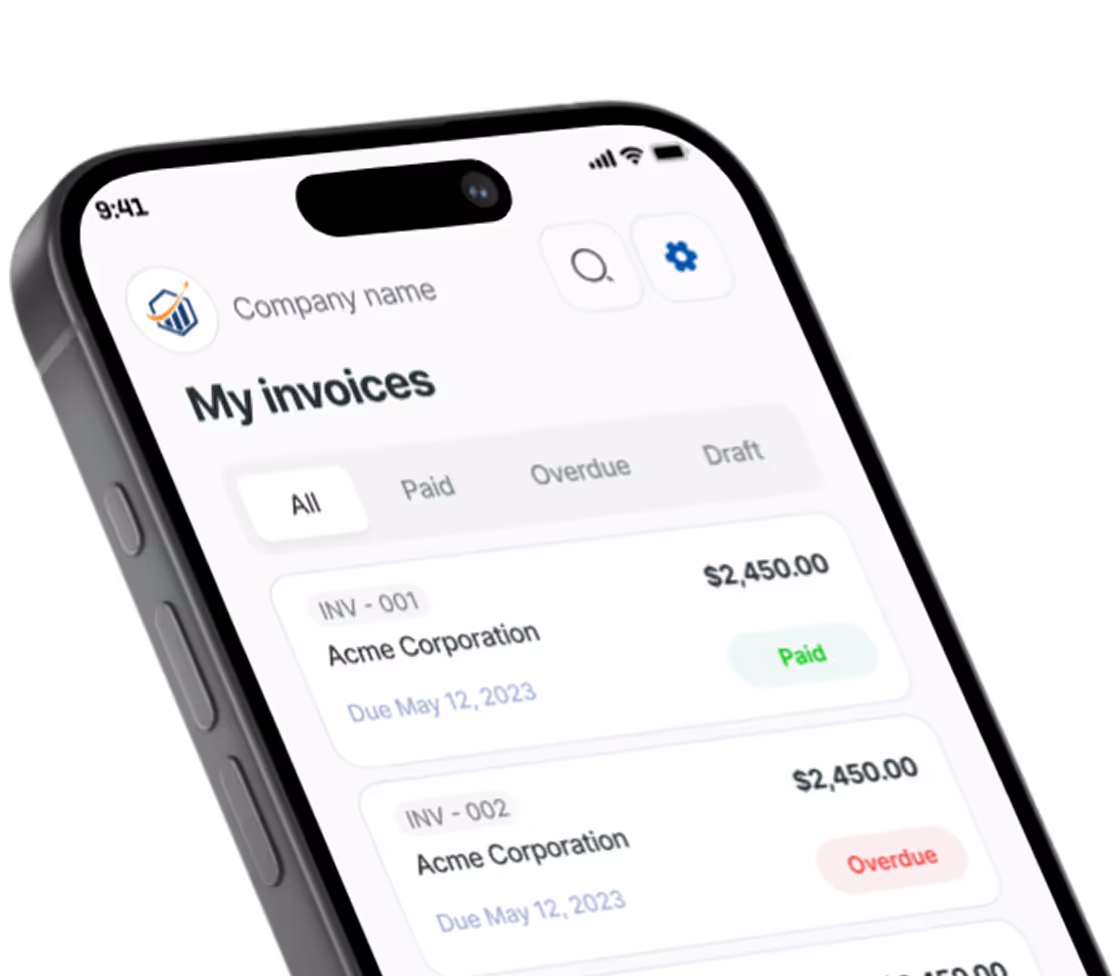

Mobile invoicing apps have solved this problem. With tools like Pronto Invoice, you can generate a professional receipt of payment in seconds right from your phone - even without internet connection. The client gets a PDF or text confirmation immediately, and your records update automatically.

For field service professionals especially, being able to create receipts one-handed while holding a clipboard or equipment makes a real difference in daily operations.

Frequently Asked Questions

How long should I keep payment receipts?

According to the IRS, businesses should keep receipts for at least three years. If you claimed a loss for any tax year, keep those receipts for seven years. See our complete guide on how long to keep business records for more detail.

Is a receipt of payment legally binding?

Yes. A receipt of payment serves as legal proof that a transaction occurred and payment was received. This documentation is essential for disputes, audits, and tax filings.

Can I write a receipt by hand?

Yes, handwritten receipts are legally valid as long as they include all required elements: receipt number, date, payer and payee information, amount, payment method, and description of goods or services.

What is the difference between a receipt and a payment confirmation?

These terms are often used interchangeably. Both serve as documentation that payment was received. A payment confirmation document typically refers to digital or automated acknowledgments, while “receipt” can apply to both paper and digital formats.

Do I need to provide a receipt for cash payments?

Yes. Cash payments especially require receipts since there is no bank record of the transaction. A receipt of payment protects both you and your client.

Can I email a receipt of payment?

Absolutely. Digital receipts sent via email are legally valid and often preferred by clients. They provide instant delivery and create automatic records for both parties.

Take Action Today

A professional receipt of payment protects your business, satisfies your clients, and keeps your books clean. Here is how to implement what you have learned:

Choose your format - Decide between paper templates, spreadsheet-based receipts, or a mobile app solution based on your volume and workflow.

Establish a numbering system - Create a consistent receipt numbering format and stick with it.

Create your template - Use the payment receipt template above to build a receipt format that includes all required elements plus the optional ones relevant to your industry.

Make it accessible - Whether that is keeping a receipt book in your truck or installing an app on your phone, ensure you can create receipts whenever you receive payment.

Build the habit - Generate a receipt for every payment, every time. No exceptions.

Your receipt of payment is often the last impression you make on a client after completing work. Make it count. A professional receipt format reinforces that they made the right choice hiring you - and makes them more likely to call again.

There is always something more to read

Invoice Number Best Practices: The Complete Guide for Small Businesses

Master invoice number best practices with our guide to 4 numbering systems. Stay audit-ready and avoid costly mistakes.

How to Format an Invoice Properly: The Complete Checklist for 2025

Learn how to format an invoice properly with our checklist. Get professional format tips, layout best practices, and avoid delays.

What Does Invoice Date Mean? A Complete Guide to Invoice Dates and Payment Terms

What does invoice date mean? Learn how the invoice date differs from due date and service date, plus how proper dating accelerates your payments.