Invoice Payment Terms Examples: The Complete Guide to Net 30, Net 60, and Due on Receipt

Invoice payment terms examples explained: Net 30, Net 60, Due on Receipt, 2/10 discounts. Learn which terms get you paid faster.

You finished the job. The client is happy. Now comes the part that actually keeps your business running: getting paid.

Understanding invoice payment terms examples helps you choose the right terms for every situation. The payment terms you put on your invoice directly impact when money hits your account. Choose the wrong terms, and you could wait 60 days or longer for payment on work you completed in January. Choose wisely, and you create predictable cash flow that lets you take on more projects, pay your own bills on time, and sleep better at night.

This guide breaks down every common payment term with real-world invoice payment terms examples, explains when to use each one, and gives you a practical framework for choosing the right terms based on your industry, client relationship, and project size.

What Are Invoice Payment Terms?

Invoice payment terms define when payment is due and under what conditions. They establish a clear agreement between you and your client about payment expectations before work begins.

Standard payment terms include:

- When payment is due (immediately, 15 days, 30 days, etc.)

- Accepted payment methods (check, bank transfer, credit card)

- Early payment incentives (discounts for paying ahead of schedule)

- Late payment consequences (interest charges, fees)

Clear payment terms reduce confusion, prevent awkward conversations about money, and give you legal standing if you need to pursue unpaid invoices.

Invoice Payment Terms Examples Explained

Net 30 Payment Terms

What it means: Payment is due 30 calendar days from the invoice date.

Net 30 is the most common payment term in business invoicing. When you send an invoice dated March 1st with Net 30 terms, payment is due by March 31st.

Invoice payment terms example: A marketing agency completes a brand identity project on February 15. They invoice the client on February 15 with Net 30 terms. Payment is due by March 17.

Best for:

- Established client relationships with payment history

- B2B transactions with larger companies

- Ongoing service agreements

- Projects over $1,000

Industries that commonly use Net 30:

- Marketing and creative agencies

- IT consulting

- Wholesale suppliers

- Professional services

The reality: While Net 30 is standard, many businesses actually pay closer to 45 days. According to payment data, the average B2B invoice is paid 8 days late. Factor this into your cash flow planning.

Net 60 Payment Terms

What it means: Payment is due 60 calendar days from the invoice date.

Net 60 gives clients two full months to pay. This extended timeline is typically reserved for large corporations, government contracts, or industries where longer payment cycles are standard.

Invoice payment terms example: A manufacturing supplier ships $50,000 in materials to a Fortune 500 company. The corporate client’s procurement department requires Net 60 terms for all vendors. Payment arrives 58 days after invoicing.

Best for:

- Large corporate clients with rigid payment cycles

- Government contracts

- Manufacturing and wholesale orders

- Clients ordering large volumes

The tradeoff: You are essentially extending a two-month interest-free loan to your client. Only offer Net 60 if your cash reserves can handle the wait, and consider whether the client relationship justifies it.

Net 15 Payment Terms

What it means: Payment is due 15 calendar days from the invoice date.

Net 15 accelerates your payment timeline while still giving clients reasonable time to process the invoice. It works well for smaller projects and clients who pay promptly.

Invoice payment terms example: A freelance consultant completes a half-day strategy session. They invoice $750 with Net 15 terms. The client pays within 10 days because the amount is small and the terms create mild urgency.

Best for:

- Smaller projects under $500

- New client relationships

- Recurring services (monthly retainers)

- Clients who have demonstrated fast payment habits

Net 7 Payment Terms

What it means: Payment is due 7 calendar days from the invoice date.

Net 7 creates urgency without demanding immediate payment. Use it when you need faster cash flow but want to maintain some flexibility.

Best for:

- Rush projects with quick turnarounds

- Materials-heavy jobs where you fronted costs

- Clients with previously slow payment history

- Seasonal businesses during peak periods

Due on Receipt Payment Terms

What it means: Payment is expected immediately upon receiving the invoice.

Due on Receipt is the fastest payment term. It signals that you expect payment right away, typically within 1-3 business days. This term works best when you deliver the invoice at the same time as the completed work.

Invoice payment terms example: An HVAC technician completes a furnace repair at a customer’s home. Before leaving, they present the invoice on their phone showing “Due on Receipt.” The customer pays with a credit card on the spot.

Best for:

- Field service work (HVAC, plumbing, electrical, landscaping)

- One-time projects with new clients

- Retail and consumer transactions

- Small jobs under $200

- Clients with no established credit history

Why field service professionals prefer Due on Receipt: When you complete a repair at a customer’s home, handing them an invoice before you leave dramatically increases collection rates. The job is fresh in their mind, they see the value you provided, and payment happens before other priorities take over.

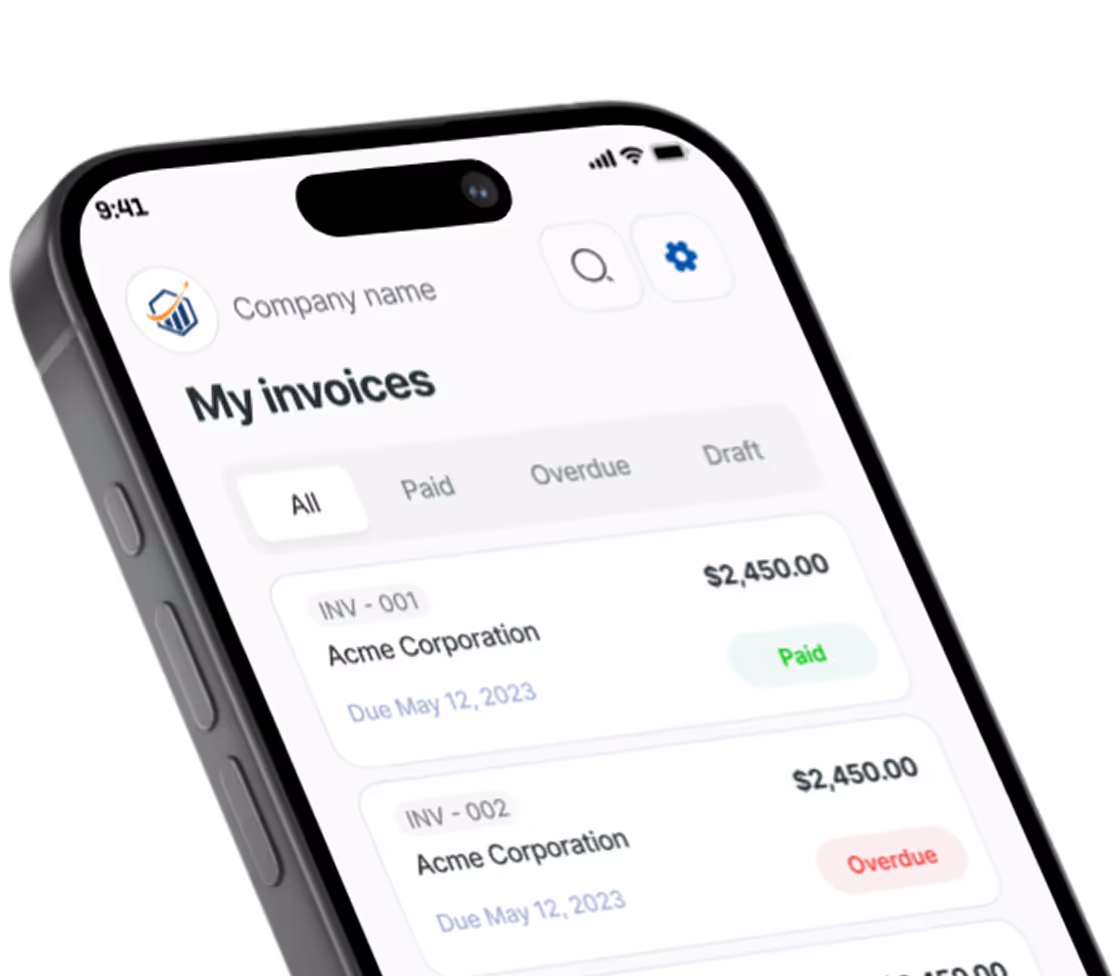

Mobile invoicing tools like Pronto Invoice let field service professionals create and deliver professional invoices on-site, immediately after completing work. This eliminates the gap between service delivery and payment request that causes so many collection problems.

Upon Completion Payment Terms

What it means: Payment is due when the project or milestone is finished.

This term ties payment directly to deliverables rather than calendar dates. It works well for project-based work with clear completion criteria.

Best for:

- Construction projects

- Creative projects with defined deliverables

- Consulting engagements

- Any project with scope creep risk

Early Payment Discount Terms (2/10 Net 30 Explained)

Early payment discounts incentivize clients to pay faster by offering a small percentage off the total if they pay ahead of schedule. These terms use a specific format:

2/10 Net 30 Example

What it means: The client receives a 2% discount if they pay within 10 days. Otherwise, the full amount is due in 30 days.

Invoice payment terms example: You invoice a client $5,000 with 2/10 Net 30 terms. If they pay within 10 days, they only owe $4,900. If they wait until day 30, they pay the full $5,000.

For many businesses, that $100 discount is worth prioritizing your invoice over others in their queue.

1/10 Net 30 Example

A smaller incentive: 1% discount for payment within 10 days, full amount due in 30 days.

Invoice payment terms example: On a $3,000 invoice, the client saves $30 by paying early. This works well for lower-margin businesses that cannot afford larger discounts.

3/10 Net 60

For longer payment terms: 3% discount for payment within 10 days, full amount due in 60 days.

Do early payment discounts work?

Research shows that offering early payment discounts can accelerate payment by 10-15 days on average. Whether it makes financial sense depends on your margins and cash flow needs.

Quick math: A 2% discount for payment 20 days early equals an annualized return of 36.7% for the client. That is why many corporate finance departments actively seek out early payment discounts.

Early Payment Discount Comparison Table

| Term | Discount | Payment Window | Full Payment Due | Best For |

|---|---|---|---|---|

| 2/10 Net 30 | 2% | 10 days | 30 days | Standard B2B transactions |

| 1/10 Net 30 | 1% | 10 days | 30 days | Lower-margin businesses |

| 2/10 Net 45 | 2% | 10 days | 45 days | Larger corporate clients |

| 3/10 Net 60 | 3% | 10 days | 60 days | Extended payment scenarios |

| 5/10 Net 90 | 5% | 10 days | 90 days | Major contracts, government |

Milestone and Progress Payment Terms

For larger projects, milestone payments break the total into smaller amounts tied to project phases. This approach protects both parties and keeps cash flowing throughout the project.

Common Milestone Payment Structures

50/50 Split:

- 50% deposit before work begins

- 50% upon completion

Thirds:

- 33% deposit

- 33% at midpoint

- 34% upon completion

Quarters:

- 25% deposit

- 25% at each of three milestones

- 25% upon completion

Invoice Payment Terms Examples by Industry

| Industry | Common Terms | Typical Invoice Size | Notes |

|---|---|---|---|

| HVAC/Plumbing | Due on Receipt | $150-$2,000 | Collect before leaving job site |

| Electrical | Due on Receipt, Net 15 | $200-$5,000 | Larger jobs may use deposits |

| General Contracting | 50% deposit, balance on completion | $5,000-$50,000+ | Milestone payments for large projects |

| Landscaping | Due on Receipt, Net 15 | $100-$3,000 | Seasonal work often paid immediately |

| Graphic Design | Net 30, 50% deposit | $500-$10,000 | Deposits common for new clients |

| Photography | Net 15, Due on Receipt | $300-$5,000 | Event photography often paid upfront |

| Consulting | Net 30 | $2,000-$20,000+ | Monthly retainers paid in advance |

| Web Development | Milestone-based | $5,000-$100,000+ | 3-4 milestone payments typical |

| Marketing Agency | Net 30 | $3,000-$50,000+ | Monthly retainers common |

| Wholesale/Distribution | Net 30, Net 60 | Varies | Extended terms for volume buyers |

How to Choose the Right Payment Terms for Your Business

Selecting payment terms requires balancing several factors. Use this framework to make the right choice for each client and project.

Factor 1: Client Relationship History

New client, no payment history:

- Start with stricter terms (Due on Receipt, Net 15)

- Require deposits for larger projects

- Prove reliable payment before extending terms

Established client, good payment history:

- Offer standard terms (Net 30)

- Consider early payment discounts

- Flexible on occasional requests

Established client, slow payment history:

- Tighten terms (Net 15, Due on Receipt)

- Require deposits

- Consider declining future work

Factor 2: Project Size

Small projects (under $500):

- Due on Receipt or Net 15

- Full payment, no deposits

- Quick turnaround expected

Medium projects ($500-$5,000):

- Net 15 or Net 30

- Consider 50% deposit

- Clear payment schedule

Large projects (over $5,000):

- Milestone payments

- Significant deposit (25-50%)

- Written payment schedule in contract

Factor 3: Industry Norms

Research what competitors in your industry typically offer. Going too far outside norms can cost you business (terms too strict) or hurt your cash flow (terms too generous).

Factor 4: Your Cash Flow Needs

Be honest about your business finances:

- Can you wait 30-60 days for payment?

- Do you have reserves to cover expenses during payment gaps?

- Are you financing materials or subcontractors?

If cash flow is tight, shorter terms protect your business.

Factor 5: Client Size and Type

Small businesses and individuals:

- Often prefer clear, short terms

- May pay faster than large companies

- Due on Receipt works well

Large corporations:

- Often have fixed payment cycles (Net 45, Net 60)

- Slow to change established processes

- May be worth the wait for volume

Government agencies:

- Notoriously slow payment cycles

- Net 60 or longer common

- Factor this into pricing

Payment Terms Decision Flowchart

Ask yourself these questions in order:

Is this a new client?

- Yes: Start with Due on Receipt or Net 15, require deposit for projects over $500

- No: Continue to question 2

Has this client paid on time previously?

- No: Tighten terms, require deposit, or decline work

- Yes: Continue to question 3

Is the project over $2,000?

- Yes: Consider milestone payments or significant deposit

- No: Standard terms appropriate

Can your cash flow handle Net 30?

- No: Use Net 15 or Due on Receipt

- Yes: Net 30 acceptable for established clients

Does the client request extended terms?

- If justified by relationship and volume: Consider Net 45 with early payment discount

- If not justified: Hold firm on standard terms

How to Communicate Payment Terms Effectively

Clear communication prevents disputes. Follow these practices:

State terms before work begins: Include payment terms in your quote, proposal, or service agreement. Never surprise clients with terms on the final invoice.

Use plain language: Instead of just “Net 30,” write “Payment due within 30 days of invoice date.”

Highlight important details: Make due dates, accepted payment methods, and late fees easy to find on your invoice.

Send invoices immediately: The longer you wait to invoice, the longer you wait to get paid. For field service work, this means invoicing before you leave the job site.

With Pronto Invoice, you can set your default payment terms once and have them automatically applied to every invoice. When you need different terms for a specific client, changing them takes seconds, even from your phone on a job site.

Follow up proactively: Send a reminder a few days before payment is due, not after it is late. See our guide on automated invoice reminders that work for templates and timing.

Payment Terms Quick Reference Cheat Sheet

For Immediate Payment:

- Due on Receipt

- Payment due upon completion

- COD (Cash on Delivery)

For Short-Term Payment:

- Net 7 (7 days)

- Net 10 (10 days)

- Net 15 (15 days)

For Standard Payment:

- Net 30 (30 days, most common)

- Net 45 (45 days)

For Extended Payment:

- Net 60 (60 days)

- Net 90 (90 days, rare)

For Discounted Early Payment:

- 2/10 Net 30 (2% off if paid in 10 days)

- 1/10 Net 30 (1% off if paid in 10 days)

For Large Projects:

- 50% deposit, 50% on completion

- Progress payments (monthly or milestone-based)

- Retainer + hourly billing

Late Payment Terms to Include

Protect yourself by specifying consequences for late payment:

- Interest charges: 1.5% per month is common (check your state’s usury laws)

- Flat late fees: $25-$50 for invoices under $1,000

- Suspension of work: For ongoing projects with past-due balances

- Collection costs: Client responsible for collection agency fees if needed

Frequently Asked Questions About Invoice Payment Terms

What does Net 30 mean on an invoice?

Net 30 means payment is due 30 calendar days from the invoice date. For example, an invoice dated March 1st with Net 30 terms requires payment by March 31st. It is the most common payment term in B2B transactions.

What is the most common invoice payment term?

Net 30 is the most common payment term in business invoicing, especially for B2B transactions. However, field service professionals (HVAC, plumbing, electrical) often use Due on Receipt to collect payment immediately after completing work on-site.

What does 2/10 Net 30 mean?

2/10 Net 30 means the client receives a 2% discount if they pay within 10 days. Otherwise, the full amount is due in 30 days. On a $5,000 invoice, paying within 10 days saves the client $100. This early payment discount is popular because it motivates faster payment.

Should I use Due on Receipt or Net 30?

Use Due on Receipt for field service work, new clients, and small jobs under $500. Use Net 30 for established B2B relationships, larger companies, and ongoing service agreements where you have positive payment history with the client.

How do I get clients to pay invoices faster?

Invoice immediately after completing work, use shorter payment terms like Net 15 or Due on Receipt, offer early payment discounts like 2/10 Net 30, include multiple payment options (credit card, ACH, PayPal), and send reminders before the due date rather than after.

Taking Action: Set Your Payment Terms Today

The payment terms you choose today affect your cash flow for months. Here is how to implement what you have learned about invoice payment terms examples:

Audit your current terms: Are they working? Check your average days to payment.

Standardize by client type: Create default terms for new clients, established clients, and large projects.

Document everything: Include terms in contracts, quotes, and invoices.

Invoice immediately: Same-day invoicing, especially for field service work, dramatically improves collection times.

Follow up consistently: Gentle reminders before due dates prevent most late payments.

Enforce consequences: Late fees only work if you actually charge them.

The best payment terms balance your cash flow needs with client expectations. Start stricter with new relationships, earn flexibility through reliable payment, and never be afraid to revisit terms that are not working.

Your invoice is more than a bill. It is a professional document that sets expectations and gets you paid. Make sure your payment terms are doing their job.

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.