Mobile Payment Methods for Small Business: A Complete Guide

Best mobile payment methods for small business: payment apps, card readers, contactless pay, and mobile invoicing.

You just finished a three-hour HVAC repair. The customer is happy, the system is running, and now comes the awkward moment: getting paid.

“Do you take Venmo?” the customer asks. Or maybe they want to pay by card, but you forgot your card reader at the office. Or worse, you are stuck telling them you only accept checks and will invoice them later, knowing that “later” often turns into weeks of waiting and follow-up emails.

The right mobile payment methods for small business eliminate these friction points entirely. Whether you are a plumber finishing a job, a photographer delivering photos, or a consultant wrapping up a project, you can now accept payment on the spot using nothing more than your smartphone.

But with so many mobile payment solutions available, which one actually makes sense for your business? The answer depends on your transaction size, customer expectations, and how you want to present your business.

This guide breaks down every major mobile payment option, compares the real processing costs, and helps you choose the right approach for your specific situation.

Why Mobile Payments Matter for Small Businesses

The ability to accept payments anywhere is not just convenient. It directly impacts your cash flow and how quickly you get paid.

Research consistently shows that invoices paid at the point of service are collected days or weeks faster than those sent after the fact. When you finish a job and request payment right there, the value of your work is fresh in the customer’s mind. They are engaged, satisfied, and ready to pay.

Wait until you get back to the office, send an invoice the next day, and suddenly you are competing with their other bills, their busy schedule, and the natural human tendency to procrastinate.

For field service professionals especially, mobile payment acceptance is no longer optional. Customers expect it. A recent survey found that over 70% of consumers prefer businesses that offer multiple payment options, and 53% now use digital wallets more often than any other payment method.

Beyond customer expectations, mobile payment methods solve real operational problems for small business owners:

No more chasing checks. Paper checks get lost, delayed, and require bank visits to deposit.

Faster cash flow. Mobile payments typically deposit within 1-2 business days.

Reduced no-pays. Collecting payment before leaving a job site eliminates the risk of non-payment.

Professional presentation. Modern payment acceptance signals that you run a legitimate, organized business.

4 Types of Mobile Payment Methods for Small Business

Mobile payment methods for small business fall into four main categories, each with distinct advantages and limitations.

| Payment Type | Best For | Typical Cost | Payment Speed |

|---|---|---|---|

| Payment Apps | Small, casual transactions | 1.75% - 2.9% | Instant to 3 days |

| Mobile Card Readers | In-person card acceptance | 2.3% - 2.75% | 1-2 days |

| Contactless/NFC | Fast tap-to-pay transactions | 2.5% - 2.9% | 1-2 days |

| Invoice-Based | Professional billing, larger amounts | 2.4% - 2.9% | 1-2 days |

Understanding these categories helps you choose the right tool for each situation, and many small businesses use a combination of mobile payment methods.

Payment Apps: Quick Peer-to-Peer Mobile Payments

Small business payment apps like Venmo, Cash App, Zelle, and PayPal have become household names. Customers already have them installed and understand how to use them.

How Peer-to-Peer Payment Apps Work

The customer sends money from their app to your account using your username, phone number, or QR code. The transaction processes instantly, and funds appear in your app balance immediately.

Popular Small Business Payment App Options

Venmo for Business

- Fee: 1.9% + $0.10 for business accounts

- Pros: High customer familiarity, social payment features, QR code support

- Cons: Perceived as casual, requires business account for seller protection

Cash App for Business

- Fee: 2.75% for business transactions

- Pros: Simple setup, instant transfers available

- Cons: Limited business features, less professional appearance

Zelle

- Fee: Free (most banks include it)

- Pros: No fees, direct bank-to-bank transfers

- Cons: No dispute protection, transactions are final

PayPal

- Fee: 2.99% + $0.49 for standard transactions

- Pros: Strong brand recognition, buyer and seller protection

- Cons: Higher fees, occasional account holds

When Payment Apps Make Sense for Small Business

Payment apps work well for:

- Transactions under $500

- Customers who specifically request them

- Casual or recurring clients who prefer the convenience

- Side businesses or low-volume operations

Limitations to Consider

Payment apps present several challenges for serious business use:

Professional image. Asking customers to “Venmo you” can feel less professional than presenting an invoice with embedded payment options.

Record-keeping. Transaction records are separate from your invoicing and accounting systems, creating reconciliation headaches.

Fees add up. While individual transactions seem cheap, 2.75% on a year’s worth of revenue is significant. Understanding credit card processing fees helps you evaluate the true cost.

No invoice trail. Payment apps do not generate invoices, making documentation and tax preparation more difficult.

Mobile Card Readers: Accept Card Payments on Your Phone

Mobile card readers plug into your smartphone or connect via Bluetooth, turning your phone into a point-of-sale terminal. This mobile payment method lets you accept credit and debit cards anywhere you have a cellular signal.

Top Mobile Card Reader Options for Small Business

Square Reader

- Hardware cost: Free (basic magstripe reader) or $49-59 (chip/contactless)

- Processing fee: 2.6% + $0.10 per tap/dip/swipe

- Strengths: Robust ecosystem, free POS software, excellent reliability

PayPal Zettle

- Hardware cost: $29-79 for card readers

- Processing fee: 2.29% + $0.09 per transaction

- Strengths: Lower processing rates, PayPal integration

Clover Go

- Hardware cost: $49-99 for readers

- Processing fee: 2.3% - 2.6% + $0.10

- Strengths: Advanced features, integrates with Clover ecosystem

Stripe Terminal

- Hardware cost: $59-249 for readers

- Processing fee: 2.7% + $0.05 per transaction

- Strengths: Powerful integration capabilities, developer-friendly

Advantages of Mobile Card Readers

Lower processing fees. Card-present transactions cost less than keyed-in or online payments because fraud risk is lower.

Customer convenience. Many customers prefer paying with cards. Having a reader means you never turn away a sale.

Professional appearance. A card reader signals you are a legitimate business prepared to accept modern payments.

Immediate authorization. You know instantly whether the payment succeeded.

Limitations of Mobile Card Readers

Hardware dependency. Forget the reader, and you cannot accept cards. Dead battery? Same problem.

Connectivity required. Most readers need an internet connection or cellular signal to process transactions.

Not ideal for invoicing. Card readers work for immediate payment but do not help with sending invoices for work to be paid later.

Contactless Payments: NFC and Tap-to-Pay for Small Business

Contactless payments use NFC (Near Field Communication) technology. Customers tap their card, phone, or smartwatch against a reader to pay. This mobile payment method has seen dramatic adoption growth, with a Mastercard survey reporting that 79% of global respondents now use contactless payments.

Types of Contactless Mobile Payments

Tap-to-pay cards. Credit and debit cards with the contactless symbol work with compatible readers.

Digital wallets. Apple Pay, Google Pay, and Samsung Pay allow customers to pay with their phones. These digital wallets now account for over 53% of consumer payment preferences.

Wearables. Apple Watch and other smartwatches support contactless payments.

Why Contactless Payments Matter for Small Business

Contactless payment adoption accelerated dramatically in recent years. For customers who use Apple Pay or Google Pay daily, tap-to-pay feels natural and expected.

The transaction speed is also notable. A contactless tap completes in 1-2 seconds compared to 5-10 seconds for chip insertion. For high-volume businesses, this adds up. Additionally, contactless payments offer enhanced security through tokenization, which replaces sensitive card data with a unique, encrypted code for each transaction.

Hardware Requirements for Accepting Contactless Payments

To accept contactless payments, you need a reader with NFC capability. Most modern Square, Clover, and Stripe readers include contactless functionality. Basic magstripe-only readers do not support tap-to-pay. Some newer solutions, like Apple Tap to Pay and Android Tap to Pay, let you accept contactless payments directly on your smartphone without any additional hardware.

Investment: $0 (tap-on-phone) to $99 for a dedicated NFC reader.

Best Use Cases for Contactless Payments

Contactless payments work well for:

- Retail and food service with high transaction volume

- Customers who prefer digital wallets

- Situations where speed matters (events, busy service days)

For most field service professionals and freelancers, contactless is a nice-to-have rather than essential. The transaction speed benefit matters less when you are billing one customer per job rather than dozens per hour.

Invoice-Based Mobile Payments: Professional and Flexible

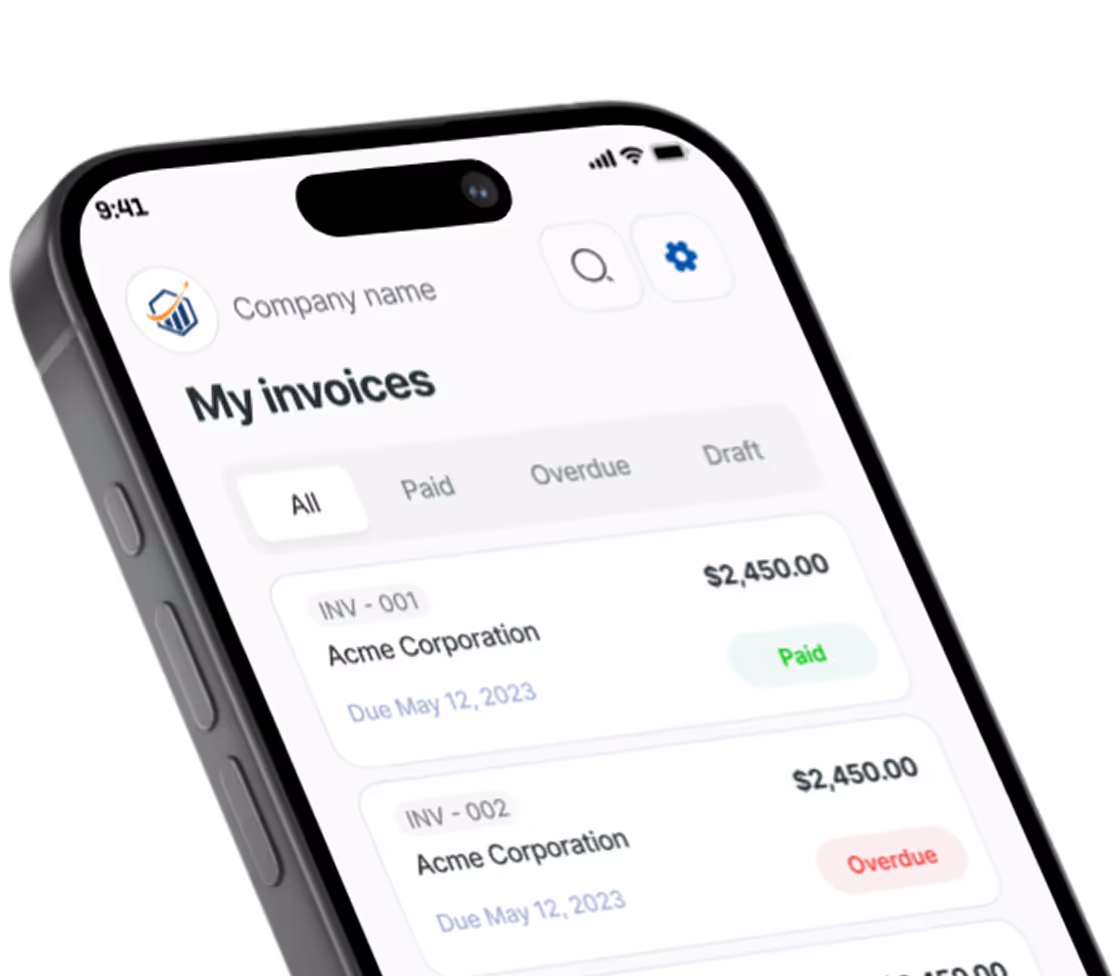

Invoice-based mobile payments combine the convenience of accepting payments on your phone with the professionalism of formal invoicing. You create an invoice on your phone and send it immediately, with payment options built right in.

How Mobile Invoice Payments Work

- Create an invoice on your mobile device (on-site or remotely)

- Send it via email or text message to your customer

- Customer opens the invoice and clicks to pay

- They complete payment using credit card, debit card, or ACH bank transfer

- Funds deposit to your account in 1-2 business days

Advantages of Mobile Invoice Payments for Small Business

Professional presentation. Customers receive a formal invoice, not a payment request through a casual app.

Flexible timing. Invoice immediately after completing work, or send invoices for upcoming projects, deposits, and recurring services. You can even set up specific payment terms to match your business needs.

Built-in payment options. Modern invoicing apps include credit card processing and ACH, so customers choose their preferred method.

Complete record-keeping. Every invoice is tracked, payments are recorded, and reports are generated automatically.

Works offline. Create invoices even without cell signal, then send when connected. Critical for field service professionals working in basements, rural areas, or commercial buildings with poor reception.

Mobile Invoicing Solutions Compared

Several platforms offer mobile-first invoice creation with integrated payments:

Pronto Invoice focuses specifically on field service professionals and freelancers who need to invoice from job sites. The app allows you to create and send professional invoices in under 60 seconds, with integrated payment links for credit cards and ACH. Voice-to-invoice capability lets you speak your line items instead of typing on a small screen. Customers receive a branded invoice and can pay with one tap.

Square Invoices integrates with Square’s broader ecosystem. Free for basic invoicing, with the same 2.9% + $0.30 online payment fee as their other products.

FreshBooks and QuickBooks offer mobile apps with invoicing and payment capabilities, though they are desktop-first tools adapted for mobile rather than mobile-first designs.

When Invoice-Based Mobile Payments Excel

Invoice-based mobile payments work best for:

Larger transactions. For invoices over $500, the professional presentation and payment flexibility matter more than the slight convenience of payment apps.

Recurring clients. Build a professional paper trail from the start of your relationship.

Complex jobs. Itemized invoices document exactly what work was performed and materials used.

Mixed payment timing. Some customers pay immediately; others need a few days. Invoices accommodate both with due dates and automatic payment reminders.

Mobile Payment Processing Fees Compared

Choosing a mobile payment method is partly about features and partly about cost. Here is how the major mobile payment solutions compare on a $1,000 transaction.

| Payment Method | Fee Structure | Cost on $1,000 | Effective Rate |

|---|---|---|---|

| Zelle | Free | $0 | 0% |

| PayPal Zettle (card-present) | 2.29% + $0.09 | $22.99 | 2.30% |

| Pronto Invoice (card) | 2.4% | $24.00 | 2.40% |

| Square (card-present) | 2.6% + $0.10 | $26.10 | 2.61% |

| Stripe Terminal | 2.7% + $0.05 | $27.05 | 2.71% |

| Cash App | 2.75% | $27.50 | 2.75% |

| Square (online invoice) | 2.9% + $0.30 | $29.30 | 2.93% |

| PayPal | 2.99% + $0.49 | $30.39 | 3.04% |

ACH Mobile Payments: The Hidden Cost Savings

For larger invoices, the payment method matters less than whether you can accept ACH bank transfers. On a $5,000 invoice:

- Credit card at 2.9%: $145 in fees

- ACH at $0.50-$5.00: $0.50-$5.00 in fees

Many invoice-based mobile payment solutions include ACH as an option. This allows you to offer customers a way to pay that saves you significant money on larger transactions, making it an essential feature for any small business that handles invoices over $1,000 regularly.

How to Choose the Right Mobile Payment Solution for Your Business

The best mobile payment method depends on how you work, your average transaction size, and who you serve. Here is a breakdown by business type.

Mobile Payment Methods for Field Service Professionals (HVAC, Plumbing, Electrical, Landscaping)

Primary method: Mobile invoicing with integrated payments

You need to document work performed, provide professional receipts, and offer flexible payment timing. Customers expect an invoice, not a Venmo request. The ability to create invoices offline and send immediately when you get signal is essential for jobs in basements, attics, and remote locations.

Secondary method: Mobile card reader for customers who want to pay on the spot without the invoice step.

Mobile Payment Solutions for Creative Freelancers (Photographers, Designers, Writers)

Primary method: Mobile invoicing with integrated payments

Detailed invoices document your creative work, establish payment terms, and create a professional paper trail. For larger projects with deposits and milestones, formal invoicing is essential.

Secondary method: Payment apps for quick, casual transactions with repeat clients.

Best Mobile Payments for Retail and Market Vendors

Primary method: Mobile card reader with contactless capability

Transaction speed and volume matter more than detailed invoicing. Square or similar readers handle high-volume sales efficiently.

Secondary method: Payment apps for customers who specifically prefer them.

Mobile Payment Processing for Service Businesses with Recurring Clients

Primary method: Invoicing software with automated billing

Set up recurring invoices that send automatically each month with payment links included. This reduces manual work and ensures consistent cash flow.

Frequently Asked Questions About Mobile Payments for Small Business

What is the cheapest mobile payment method for small business?

Zelle is free but offers no dispute protection. Among paid options, card-present transactions through mobile card readers (2.29% - 2.7%) are cheaper than online or keyed-in payments (2.9% - 3.5%). For large invoices, ACH bank transfers often cost under $5 regardless of amount, making them the most cost-effective mobile payment solution for high-value transactions.

Do I need special equipment to accept mobile payments?

Payment apps require only a smartphone. Card acceptance requires a mobile card reader ($0-99 depending on capabilities). Invoice-based payments work with just your phone and an invoicing app. Newer tap-on-phone solutions from Apple and Android let you accept contactless payments without any additional hardware.

Which mobile payment method is most secure?

All major mobile payment options use encryption and fraud protection. Card readers with chip/NFC capability are more secure than magstripe-only readers due to tokenization technology that replaces sensitive card data with encrypted codes. Invoice-based payments through established processors like Stripe include robust fraud detection and PCI-DSS compliance.

Can I use multiple mobile payment methods for my small business?

Yes, and many businesses do. A contractor might use mobile invoicing for most jobs, a card reader for customers who want to pay immediately, and occasionally accept Venmo when customers specifically request it. Offering multiple mobile payment options increases your chances of getting paid on the spot.

How fast do mobile payments deposit into my bank account?

Most mobile payment methods deposit within 1-2 business days. Payment apps offer instant transfers for additional fees (typically 1-1.75%). ACH payments take 3-5 business days. Some providers like Square and Stripe offer next-day or same-day deposits for qualifying accounts.

What are the best mobile payment methods for accepting payments on-site?

For on-site payments, the best mobile payment methods for small business are mobile card readers (like Square or Clover Go) for immediate card transactions, and mobile invoicing apps (like Pronto Invoice) for professional invoicing with embedded payment links. Both work from your smartphone and let you accept payments anywhere you have a cellular signal.

Build Your Mobile Payment Strategy Today

Accepting payments on mobile is no longer a competitive advantage for small businesses. It is a baseline expectation. The question is not whether to accept mobile payments but which methods make the most sense for your business.

For most small businesses, the ideal mobile payment approach combines:

- A primary invoicing solution that works from your phone, includes integrated payment processing, and creates professional documentation

- A backup payment method (card reader or payment app) for situations where customers prefer immediate, in-person payment

Pronto Invoice was built specifically for this workflow. Create an invoice in under 60 seconds from any job site, send it before you leave the driveway, and let customers pay instantly via the embedded payment link. For field service professionals and freelancers who need to invoice on the go, it eliminates the gap between completing work and getting paid.

Whatever mobile payment tools you choose, the goal is the same: make it as easy as possible for customers to pay you, right when they are ready to pay.

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.