Net Credit Sales Explained: Formula, Examples & Why It Matters

Net credit sales explained with the formula, real examples, and step-by-step calculations to track credit revenue.

You completed the job. You sent the invoice. But where is the money?

If you have ever wondered why your bank account does not match your sales reports, net credit sales explained simply is the missing piece. This accounting concept sounds complex, but it directly answers a straightforward question: how much revenue did you actually earn from customers who owe you money?

Whether you are a plumber billing for emergency repairs, a consultant invoicing for project work, or a photographer delivering wedding photos, knowing your net credit sales helps you understand the real health of your business — not just the numbers on paper.

Table of Contents

- What Are Net Credit Sales?

- The Net Credit Sales Formula

- Credit Sales vs Cash Sales: Key Differences

- Why Net Credit Sales Matter for Your Business

- Net Credit Sales on Financial Statements

- Net Credit Sales vs. Accounts Receivable

- Real-World Examples

- How to Track and Improve Your Net Credit Sales

- Frequently Asked Questions

What Are Net Credit Sales?

Net credit sales represent the total revenue you earn from customers who purchase on credit (pay later), minus any returns, allowances, or discounts. In simpler terms, it is the actual amount customers owe you after adjusting for any reductions.

Let us break that down:

- Credit sales: When customers receive your product or service now but pay later. This is different from cash sales, where payment happens immediately.

- Net: The amount remaining after subtracting returns (refunds), allowances (partial credits for problems), and discounts (early payment incentives or promotional pricing).

For service businesses, credit sales happen constantly. An HVAC technician fixes a commercial air conditioning system and invoices the property management company with Net 30 payment terms. A freelance developer completes a website project and bills the client upon delivery. A landscaping company finishes monthly maintenance and sends an invoice at month-end.

In all these cases, the work is done, but the cash has not arrived yet. Net credit sales measure this gap accurately.

Important clarification: Credit sales refer to deferred payment arrangements — not credit card transactions. If a customer swipes a credit card and you receive the funds within a few business days, that counts as a cash sale for accounting purposes. Credit sales only apply when you extend payment terms and wait for the customer to pay an invoice.

The Net Credit Sales Formula

The net credit sales formula is straightforward:

Net Credit Sales = Gross Credit Sales - Sales Returns - Sales Allowances - Sales Discounts

Here is what each component means:

| Component | Definition | Example |

|---|---|---|

| Gross Credit Sales | Total value of all invoiced sales on credit terms | $50,000 in invoices sent this month |

| Sales Returns | Full refunds for returned products or cancelled services | $2,000 in project cancellations |

| Sales Allowances | Partial credits for problems (damaged goods, incomplete work) | $500 credit for a delayed delivery |

| Sales Discounts | Reductions for early payment or promotions | $1,500 in 2/10 Net 30 discounts taken |

Using the net credit sales formula: $50,000 - $2,000 - $500 - $1,500 = $46,000 Net Credit Sales

This $46,000 represents what customers actually owe you — the realistic revenue figure for planning purposes.

A common calculation mistake: Some of your sales returns and allowances may relate to cash sales, not credit sales. Make sure you only subtract returns and allowances that apply to credit transactions. Otherwise, your net credit sales figure will be artificially low.

Credit Sales vs Cash Sales: Key Differences

Understanding the difference between credit sales vs cash sales is essential for accurate revenue tracking. Here is how they compare:

| Factor | Cash Sales | Credit Sales |

|---|---|---|

| Payment timing | Immediate (at point of service) | Deferred (Net 15, Net 30, Net 60) |

| Cash flow impact | Money available right away | Delayed cash receipts |

| Risk level | No collection risk | Risk of late or non-payment |

| Record keeping | Simpler tracking | Requires accounts receivable management |

| Common in | Residential service calls, retail | Commercial contracts, B2B projects |

Many service businesses operate with a mix of both. A plumber might collect payment on the spot for residential jobs but invoice commercial clients with 30-day terms. Only the commercial invoices count toward credit sales.

For businesses that rely heavily on credit sales, getting customers to pay faster becomes a critical skill that directly impacts cash flow.

Why Net Credit Sales Matter for Your Business

Understanding net credit sales is not just an accounting exercise. It affects real decisions about your business and your revenue tracking strategy.

Cash Flow Forecasting

Your profit and loss statement might show $10,000 in revenue, but if $8,000 of that is credit sales, you cannot pay this week’s business overhead expenses with money you have not received yet. Net credit sales help you anticipate when cash will actually arrive.

Evaluating Collection Efficiency With Accounts Receivable Turnover

The accounts receivable turnover ratio uses net credit sales to measure how quickly you collect payments:

Accounts Receivable Turnover = Net Credit Sales / Average Accounts Receivable

A higher number means you collect faster. A lower number suggests customers are paying slowly — a warning sign for cash flow problems.

For example, if your net credit sales for the year total $120,000 and your average accounts receivable balance is $20,000:

$120,000 / $20,000 = 6

This means you collect your entire receivables balance about six times per year, or roughly every two months on average.

You can also calculate your average collection period to see the result in days:

Average Collection Period = 365 / Accounts Receivable Turnover

Using the example above: 365 / 6 = approximately 61 days to collect on average.

Setting Credit Policies

When you know your net credit sales and collection patterns, you can make smarter decisions about:

- Which customers get credit terms

- How long payment terms should be

- Whether to offer early payment discounts

- When to require deposits upfront (especially important when writing estimates that win jobs)

Identifying Revenue Leakage

Tracking returns, allowances, and discounts reveals patterns. If your sales allowances spike one quarter, something went wrong with service delivery. If discount usage increases, customers might be cash-strapped or you are incentivizing behavior too aggressively.

Estimating Bad Debt Expense

Net credit sales are also the starting point for estimating bad debt expense — the amount you expect to lose from customers who never pay. One common method, the percentage of sales method, calculates bad debt as a percentage of net credit sales:

Estimated Bad Debt = Net Credit Sales x Estimated Uncollectible Percentage

If your net credit sales total $200,000 and historical data shows 2% of credit sales go uncollected, you would set aside $4,000 as an allowance for doubtful accounts. This protects your financial records from overstating revenue.

Net Credit Sales on Financial Statements

Understanding where net credit sales appear in your financial statements helps with accurate revenue tracking and bookkeeping:

- Income statement: Net credit sales are part of total net sales revenue. They appear in the revenue section at the top of your profit and loss statement. However, most income statements do not separate credit sales from cash sales — you need your own records for that breakdown.

- Balance sheet: Net credit sales do not appear directly on the balance sheet. Instead, unpaid credit sales show up as accounts receivable under current assets. As customers pay their invoices, accounts receivable decreases and cash increases.

This is why maintaining a proper chart of accounts and tracking invoices by status matters. Without separating cash sales from credit sales in your records, calculating net credit sales requires extra work at the end of each period.

Net Credit Sales vs. Accounts Receivable

These two concepts are related but different:

- Net credit sales is a flow — the total credit revenue earned during a specific period (month, quarter, year)

- Accounts receivable is a stock — the total amount customers currently owe you at a single point in time

Think of it like a bathtub. Net credit sales represent the water flowing in from the faucet. Payments received represent water draining out. Accounts receivable is the current water level in the tub.

A healthy business maintains balance: new credit sales flowing in, payments flowing out, and a manageable receivables level that does not overflow.

Real-World Examples

Example 1: Electrical Contractor

Mike runs a small electrical contracting business. In October, he reviews his numbers:

- Gross credit sales (all invoiced work): $35,000

- Returned/cancelled jobs: $0

- Allowance given for a problematic installation: $800

- Early payment discounts taken by customers: $350

Net credit sales: $35,000 - $0 - $800 - $350 = $33,850

Mike’s accounts receivable balance on October 31: $28,000 His accounts receivable balance on September 30 was: $22,000 Average: ($28,000 + $22,000) / 2 = $25,000

Accounts receivable turnover: $33,850 / $25,000 = 1.35 for the month

Annualized, that suggests about 16 turnovers per year — customers pay in roughly three weeks on average, which is healthy for his Net 30 terms.

Example 2: Freelance Marketing Consultant

Sarah sends professional invoices for strategy and content work. Her Q4 summary:

- Gross credit sales: $48,000

- Project scope reductions (partial refunds): $3,000

- Discounts for annual retainer clients: $2,400

Net credit sales: $48,000 - $3,000 - $2,400 = $42,600

Sarah notices her scope reductions are unusually high. Digging into the details, she finds three projects where clients reduced scope mid-project. This triggers a change: she now requires signed change orders before adjusting project scope — protecting her net credit sales going forward.

How to Track and Improve Your Net Credit Sales

Track Every Invoice and Its Status

You cannot calculate net credit sales without accurate records. Every invoice needs clear documentation:

- Original amount billed

- Any adjustments made (returns, allowances, discounts)

- Current payment status

- Days outstanding

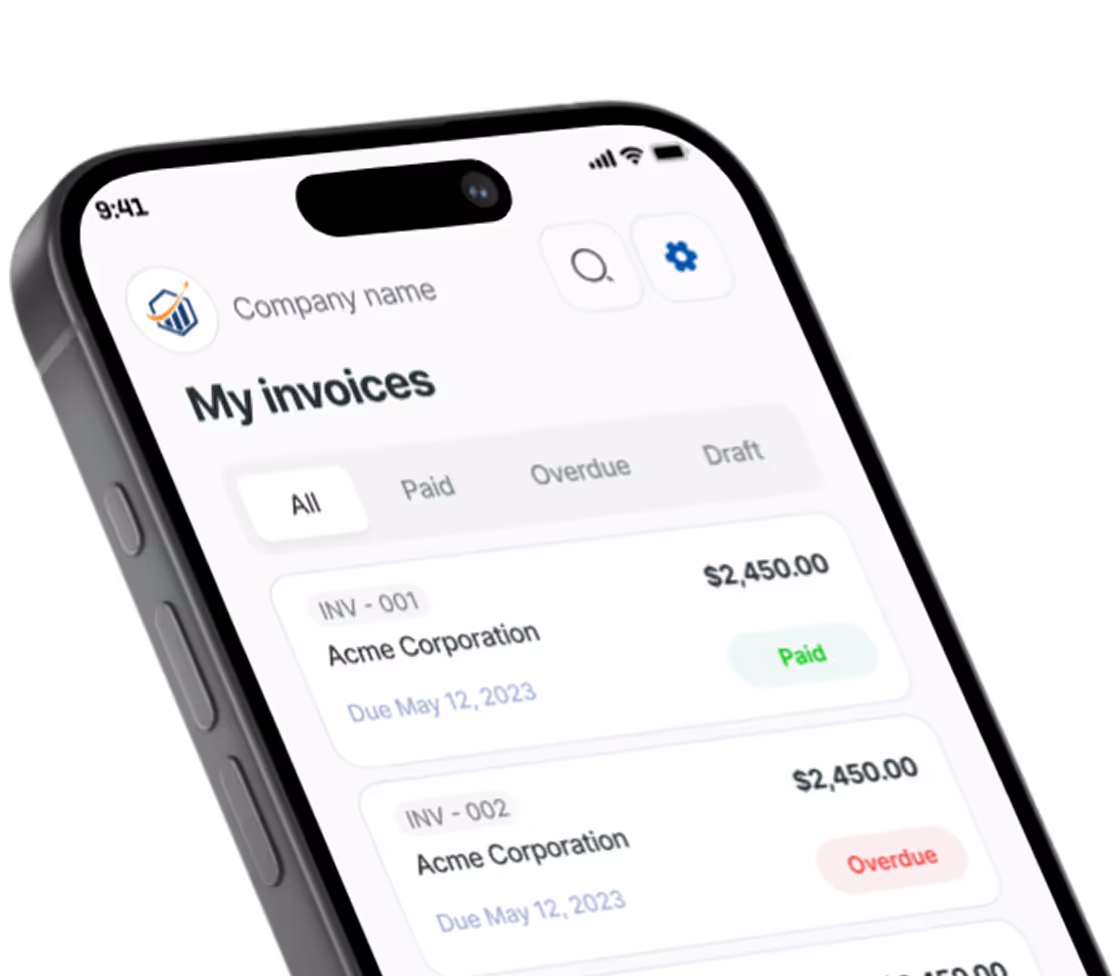

Modern invoicing tools like Pronto Invoice automatically track these details. When you send an invoice, you can see at a glance which are paid, which are pending, and which are overdue — the raw data you need for net credit sales calculations.

Minimize Revenue Leakage

Reduce returns and allowances:

- Set clear expectations before starting work

- Document scope in writing with a detailed estimate

- Communicate proactively about delays or issues

- Deliver on promises

Be strategic with discounts:

- Only offer early payment discounts if cash flow is more valuable than the margin you sacrifice

- Track which customers use discounts and factor that into pricing

Speed Up Collections

- Send invoices immediately upon completing work using professional invoice formatting

- Use clear payment terms (Net 15 is faster than Net 30)

- Accept multiple payment methods

- Send payment reminders before invoices become overdue

- Consider requiring deposits for larger projects

Review Regularly

Check your net credit sales monthly, not just at tax time. Trends reveal problems early — before they become crises. If you notice a rising gap between gross credit sales and net credit sales, investigate which component (returns, allowances, or discounts) is driving the increase.

Frequently Asked Questions

What is the difference between net credit sales and net sales?

Net sales include all sales (both cash and credit) minus returns, allowances, and discounts. Net credit sales only include the credit portion — transactions where customers received goods or services but have not yet paid. If your business operates entirely on credit terms, the two numbers may be very close. If you accept a mix of cash and credit, net sales will be higher than net credit sales.

Where do I find net credit sales on financial statements?

Net credit sales are not typically broken out as a separate line item on standard financial statements. Total net sales appear on the income statement, and unpaid credit sales show up as accounts receivable on the balance sheet. To calculate net credit sales specifically, you need internal records that separate cash transactions from credit transactions.

How do net credit sales affect accounts receivable turnover?

Net credit sales are the numerator in the accounts receivable turnover ratio (Net Credit Sales / Average Accounts Receivable). Higher net credit sales relative to accounts receivable indicate faster collection. If your turnover ratio is declining, it means either credit sales are dropping or customers are taking longer to pay — both signals worth investigating.

Are credit card payments considered credit sales?

No. Credit card payments are treated as cash sales for accounting purposes because the business receives the funds within a few business days. Credit sales specifically refer to situations where you extend payment terms to a customer (such as Net 30) and wait for them to pay your invoice.

How often should I calculate net credit sales?

Monthly calculation is recommended for active businesses. This frequency gives you enough data to spot trends in returns, allowances, and discounts without waiting too long to catch problems. Quarterly reviews are the minimum for businesses with lower transaction volumes.

The Bottom Line

Net credit sales tell you something your bank balance cannot: how much revenue you have genuinely earned from credit customers, adjusted for real-world reductions. This number feeds into cash flow projections, the accounts receivable turnover ratio, bad debt estimates, and smarter credit policies.

For service businesses that invoice after completing work, understanding net credit sales is not optional — it is essential for managing the gap between doing the work and getting paid.

Start with accurate invoice tracking. Know the status of every dollar owed to you. From there, the net credit sales formula and the insights it provides follow naturally.

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.