Small Business Automation: Replace Paper with Digital Tools in 2026

Automate your small business by replacing paper invoices, estimates, and receipts with digital tools. Save 5-10 hours weekly.

The stack of carbon-copy invoices sits on your truck’s dashboard, curling in the afternoon sun. You finished a job two hours ago, but that handwritten invoice is still waiting to be entered into your system. Meanwhile, your customer is waiting for a formal invoice before they can process payment.

Small business automation solves exactly this problem. By replacing paper processes with simple digital tools, you can send invoices from job sites, get paid faster, and eliminate hours of manual data entry every week.

This scene plays out millions of times daily across small businesses. Paper processes that once felt simple have become bottlenecks. They slow payments, create data entry headaches, and consume hours that should go toward billable work.

Here is the good news: automating your small business does not require enterprise software, IT consultants, or weeks of training. Research from Deloitte shows that businesses implementing automation tools report 15-20% cost reduction, and the most practical approach is replacing one paper process at a time, starting with the workflows that cause the most friction.

This guide walks through the most common paper processes in small businesses and shows you exactly how to digitize each one in 2026 without disrupting the operations that keep your business running.

The Hidden Costs of Paper-Based Workflows

Before diving into small business automation solutions, understanding the true cost of paper-based workflows helps justify the transition. Most business owners underestimate these hidden expenses:

Time costs: Manually writing invoices, re-entering data into accounting software, filing receipts, and searching for past records consumes 5-10 hours weekly for the average small business owner.

Payment delays: Paper invoices take 2-3 days longer to reach customers and get paid compared to digital invoicing alternatives. That is cash flow sitting idle when it could be working for your business.

Error rates: Manual data entry has a 1-4% error rate. On 100 invoices per month, that means 1-4 contain mistakes requiring correction or causing disputes.

Storage costs: Filing cabinets, folders, and the physical space to store years of records add up. More importantly, retrieving specific documents wastes time that could go toward billable work.

Lost documents: Paper gets damaged, misplaced, or accidentally discarded. A single lost invoice can mean losing that payment entirely.

The businesses that thrive in 2026 treat automation not as a luxury but as a competitive advantage. When your competitor sends professional digital invoices from the job site while you are still writing on a clipboard, customers notice the difference.

The Low-Risk Approach to Automate Workflows

The biggest mistake businesses make when implementing small business automation is trying to change everything at once. New software across all departments, mandatory training, and sudden process changes create chaos and resistance.

A better approach that works for small business technology adoption: identify your highest-friction paper process and digitize that one first. Master it. Then move to the next.

This method offers several advantages:

- Minimal disruption: Your team learns one new tool at a time

- Quick wins: You see benefits immediately, building momentum for a paperless business

- Lower risk: If something does not work, you have only changed one process

- Easier training: Staff become comfortable with digital tools gradually

Most small businesses can configure a workflow in 1-2 weeks and measure material impact within 30-60 days. Let us examine the four most common paper processes and exactly how to automate each one.

Digital Invoicing: The Highest-Impact Automation

The Problem: Handwritten or printed invoices create the longest delay between completed work and received payment. They require manual delivery, manual data entry, and give customers no convenient way to pay immediately.

The Friction Points:

- Writing invoices by hand on job sites

- Returning to office to type and mail formal invoices

- Customers misplacing paper invoices

- No automatic payment reminders

- Manual entry into accounting software

The Mobile Invoicing Solution:

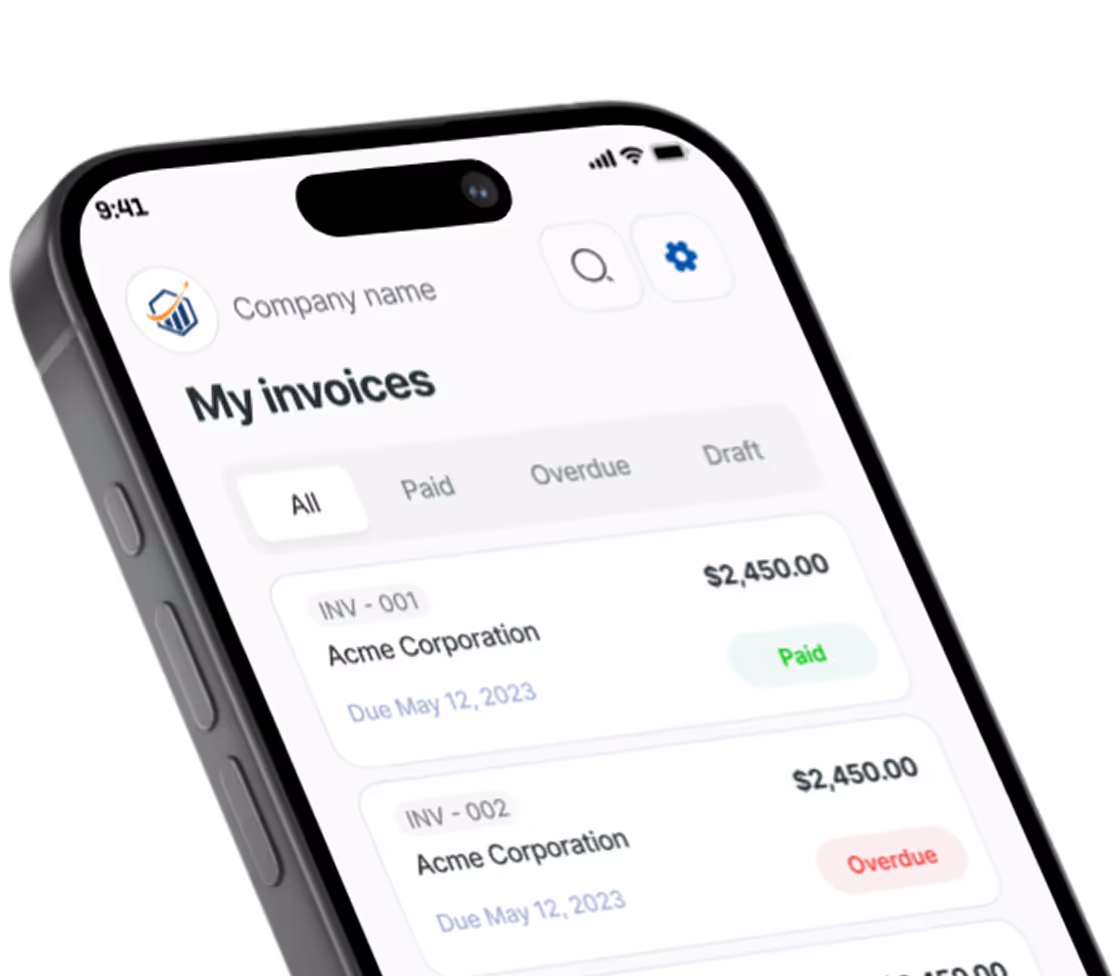

Mobile invoicing apps let you create professional invoices in under a minute, send them instantly via email or text, and accept payment on the spot. According to industry research, companies using automated invoice processing spend only $1.83 per invoice compared to $6.20 for manual processing.

Step-by-Step Transition to Digital Invoicing:

Choose a mobile-first invoicing app. Look for one that works offline (critical for field service), syncs with your accounting software, and lets you create invoices in under 60 seconds. Pronto Invoice, for example, uses a 5-step process designed specifically for one-handed operation on job sites: select client, add items, set payment terms, add details, and send.

Import your existing client list. Most apps let you upload a spreadsheet or sync from your phone contacts. This eliminates re-entering customer information for your paperless business transition.

Create your service/product catalog. Add your common line items once so you can select them rather than typing each time.

Set up your payment processing. Connect Stripe, Square, or your preferred processor. Customers can then pay directly from the invoice with a card.

Run parallel systems for two weeks. Continue your paper process while also sending digital invoices. This builds confidence before fully switching.

Go digital-only. Once comfortable, stop creating paper invoices entirely.

Expected Results:

- Invoices sent same-day instead of 2-3 days later

- 30-40% faster payment collection

- Zero data entry (most apps sync with QuickBooks and similar tools)

- Professional appearance regardless of job site conditions

This small business automation transition typically takes one week and delivers the fastest ROI of any digitization project.

Automated Estimates and Digital Quotes

The Problem: Handwritten estimates look unprofessional, cannot be easily modified, and create no record for follow-up. Customers requesting quotes often go with whoever responds fastest with a professional-looking proposal.

The Friction Points:

- Writing estimates on-site that look rushed or unprofessional

- No system for tracking which estimates you have sent

- Forgetting to follow up on pending quotes

- Inability to modify estimates easily when scope changes

- No way to convert accepted estimates directly into invoices

The Small Business Technology Solution:

Estimate and proposal software creates professional quotes that can be accepted with a digital signature and automatically converted into invoices, streamlining your workflow automation.

Step-by-Step Transition:

Select software that handles both estimates and invoices. Using the same platform for both means a one-click conversion from accepted quote to invoice, eliminating duplicate data entry. Pronto Invoice and similar tools handle this workflow seamlessly.

Create estimate templates for your common job types. A residential HVAC inspection, a logo design package, a lawn maintenance contract—build these templates once.

Add acceptance options. Digital signatures and approval buttons let customers accept estimates without printing, signing, and scanning.

Set up estimate tracking. Your tool should show which estimates are pending, accepted, or expired.

Enable automatic follow-up. Many platforms send reminder emails for estimates that have not received a response.

Expected Results:

- 50% faster quote delivery (on-site instead of “I’ll email it later”)

- Higher close rates due to professional presentation

- Automatic conversion to invoices when accepted

- Complete visibility into your sales pipeline

Digital Work Orders for Field Service

The Problem: Paper job tickets—those worksheets describing what needs to be done at each job—get lost, damaged, or left in trucks. Information written in the field is difficult to read later. There is no easy way to attach photos, customer signatures, or completion notes.

The Friction Points:

- Illegible handwriting on job site paperwork

- Tickets left at job sites or in wrong vehicles

- No photos to document work completed

- Customer disputes about what was done

- Difficulty coordinating multi-day jobs

The Workflow Automation Solution:

Digital work order apps capture job details, photos, customer signatures, and completion notes—all synced to a central system accessible from anywhere, supporting your paperless business goals.

Step-by-Step Transition:

Choose a work order tool appropriate for your business size. For solo operators, a simple notes or forms app may suffice. Teams benefit from dedicated field service software.

Create digital versions of your current job tickets. Include all the fields you currently use on paper.

Add photo capability. Require before and after photos for each job to document work quality and protect against disputes.

Include digital signature capture. Customer sign-off on completed work eliminates disagreements later.

Connect to your invoicing system. Work orders should flow directly into invoices, carrying all relevant details automatically.

Expected Results:

- Complete job documentation with photos

- Elimination of “he said, she said” disputes

- Improved team coordination on multi-day projects

- Historical record for warranty and service issues

Automated Expense Tracking and Receipt Management

The Problem: That shoebox of crumpled receipts is a tax-time nightmare. Paper receipts fade, get lost, and require hours of sorting and data entry. Missing receipts mean missed deductions.

The Friction Points:

- Receipts fading before tax season

- Lost receipts from gas stations, supply runs, and client meals

- Hours of manual categorization

- No connection between expenses and specific jobs

- Reimbursement delays for employee purchases

The Small Business Automation Solution:

Expense tracking apps let you photograph receipts instantly, extract information automatically using AI, and categorize expenses with a tap. Nucleus Research found returns of $8.55 per dollar spent for SMBs investing in content management solutions.

Step-by-Step Transition:

Select an expense app that integrates with your accounting software. Standalone apps work, but integrated tools eliminate export/import steps.

Photograph receipts immediately. Make this a habit: transaction happens, photo happens. AI-powered apps can extract vendor, amount, date, and category automatically.

Set up expense categories matching your chart of accounts. This ensures your expense data flows correctly into your accounting system.

Link receipts to projects or jobs. For reimbursable expenses, connect them to specific clients or projects during capture.

Transition away from paper storage. Once photographed and backed up to cloud storage, paper receipts serve no purpose. Check with your accountant about retention requirements, but digital copies are generally accepted.

Expected Results:

- No lost receipts

- 80% reduction in manual expense entry

- Accurate expense data for tax preparation

- Job costing accuracy (knowing true profit per project)

Connecting Your Automated Workflows

The real power of small business automation emerges when your digital tools communicate with each other. Here is how the four processes connect to create a truly paperless business:

- Estimate accepted automatically creates work order

- Work order completed automatically creates invoice

- Expenses logged automatically attach to relevant job

- Invoice paid automatically records in accounting software

This connected workflow eliminates every manual handoff between processes. Data flows from sales through delivery to payment without re-entry.

When evaluating small business technology tools, prioritize those offering native integrations. Pronto Invoice, for instance, syncs with QuickBooks in real-time at the Professional tier and above, ensuring your books update automatically as invoices are created and paid.

Common Small Business Automation Objections Answered

“My customers prefer paper invoices.” Some do, particularly older customers or government clients with specific requirements. Digital invoicing tools let you print PDF invoices for these clients while sending digital versions to everyone else. You do not have to choose one or the other.

“I’m not good with technology.” Modern small business automation tools are designed for people who are not technical. If you can use a smartphone, you can use these apps. The learning curve for basic mobile invoicing is under 30 minutes.

“What if I lose my phone?” Cloud-based tools store your data on secure servers, not on your device. Log into a new phone or computer, and everything is there. This is actually more secure than paper, which cannot be recovered if lost.

“Digital tools are expensive.” Compare the cost of software (often $10-50 per month) to the cost of delayed payments, data entry time, and lost documents. Most workflow automation tools cost between $30-300 per month, and many businesses recover this cost within weeks through time savings.

“My industry is different.” The specific forms and workflows vary, but every business shares the core processes of quoting, tracking work, invoicing, and managing expenses. The tools adapt to industry-specific needs.

Your 30-Day Small Business Automation Roadmap

Week 1: Setup and Import

- Choose your mobile invoicing app

- Import client list and create service catalog

- Connect payment processing

- Send first test invoice

Week 2: Parallel Operations

- Send digital invoices alongside paper process

- Track which method gets paid faster

- Refine your templates based on usage

Week 3: Full Digital Transition

- Stop creating paper invoices

- Set up automatic payment reminders

- Train any team members on the new system

Week 4: Measure and Expand

- Calculate time saved and payment speed improvement

- Identify next paper process to automate

- Document your baseline for future comparison

Frequently Asked Questions About Small Business Automation

What is small business automation? Small business automation uses digital tools and software to replace manual, paper-based processes with streamlined digital workflows. Common applications include digital invoicing, automated expense tracking, electronic estimates, and digital work orders.

How much does it cost to automate a small business? Most small business automation tools cost between $10-50 per month for basic features. Comprehensive solutions range from $30-300 monthly. Most businesses see positive ROI within the first month through time savings and faster payments.

What should I automate first in my small business? Start with digital invoicing. It directly accelerates cash flow, requires minimal behavior change, delivers visible results immediately, and creates the foundation for other workflow automation.

How long does it take to implement small business automation? Most small businesses can implement a single automated process (like digital invoicing) in 1-2 weeks and measure material impact within 30-60 days. Complete digital transformation of multiple processes typically takes 3-6 months.

Will automation replace my employees? No. Small business automation handles repetitive tasks like data entry, payment reminders, and document filing. This frees employees to focus on higher-value work like customer relationships, strategy, and skilled services.

Taking the First Step Toward a Paperless Business

Small business automation is not about becoming a technology company. It is about eliminating the friction that slows your work and frustrates your customers.

Start with digital invoicing. Run paper and digital in parallel for a week or two. When you see the first invoice paid within hours of sending rather than the usual week, you will be ready to tackle the next paper process.

The goal is not a paperless office for its own sake. The goal is a faster, more profitable business with fewer administrative headaches. Small business technology tools are simply how you get there in 2026.

Whether you choose Pronto Invoice—built specifically for field service professionals who need fast, one-handed mobile invoicing on job sites—or another tool, the important thing is starting. Every week you continue with paper invoices is another week of delayed payments and unnecessary data entry.

Your customers are waiting for professional invoices they can pay instantly. Your evenings are waiting to be freed from data entry. Your cash flow is waiting to accelerate.

The only question is: which paper process will you automate first?

There is always something more to read

Auto Repair Invoice: What's Required and How to Build Customer Trust

Master auto repair invoice best practices: state requirements, parts/labor itemization, and trust-building tips.

Bill vs Invoice: What's the Difference? Complete Guide

Bill vs invoice explained: Learn the key differences between bills, invoices, receipts, and statements. Know which document to use and when.

![Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]](https://res.cloudinary.com/dynvqwql0/image/upload/c_limit,w_600/f_auto/q_auto/v1/electrician-contractor-featured-image_kgq0ax?_a=BBGMR9ZF0)

Electrical Contractor Invoice Guide: Get Paid Faster for Electrical Work [2026]

Complete electrical contractor invoice guide with permit docs, NEC compliance notes, and material markup tips.