Pronto Invoice vs Wave

Compare Pronto Invoice and Wave side-by-side. Free invoicing vs AI-powered mobile invoicing. See pricing and features.

Updated February 2026 · Honest comparison from the Pronto Invoice team

Quick Comparison

| Feature | Pronto Invoice | Wave |

|---|---|---|

| Starting Price | $0/month (Free plan) | $0/month (Free plan) |

| Free Plan Invoice Limits | 10 invoices/month | Unlimited |

| Unlimited Invoices | $12/month (Growth) | Free |

| Built-In Accounting | No (QuickBooks sync on Growth+) | Yes — full double-entry bookkeeping, free |

| AI Invoice Creation | Yes — Smart AI (natural language) | No |

| Native Mobile Apps | iOS (SwiftUI) + Android (Jetpack Compose) | Yes, but web-first experience |

| Offline Mode | Full offline support | No |

| Recurring Invoices | Yes (Growth, $12/mo) | Pro plan only ($16/mo) |

| Payment Processing Fees | $0 markup — use your own Stripe/PayPal | 2.9% + $0.60 (credit card), 1% ACH ($1 min) |

| QuickBooks Integration | Yes (Growth+) | No — uses own accounting system |

| Multi-User Support | 3 users (Pro, $24/mo) | Yes — multiple permission levels, free |

| Reports | Basic (Growth), Advanced (Pro) | Profit & loss, balance sheet, sales tax, aging |

| Client Portal | Yes (Pro) | No |

Wave information based on publicly available data as of February 2026. Pricing and features may have changed. Visit Wave's website for current information.

We’re Pronto Invoice, so naturally we think our product is the better choice. But this is a comparison where we need to be especially straightforward — because Wave offers something genuinely hard to compete with: free unlimited invoicing and free full accounting.

Wave is a free accounting and invoicing platform that includes unlimited invoices, double-entry bookkeeping, financial reporting, receipt scanning, and multi-user access — all at $0/month. Wave makes money primarily through payment processing fees and their payroll add-on. It’s a legitimate, full-featured business tool at an unbeatable price point.

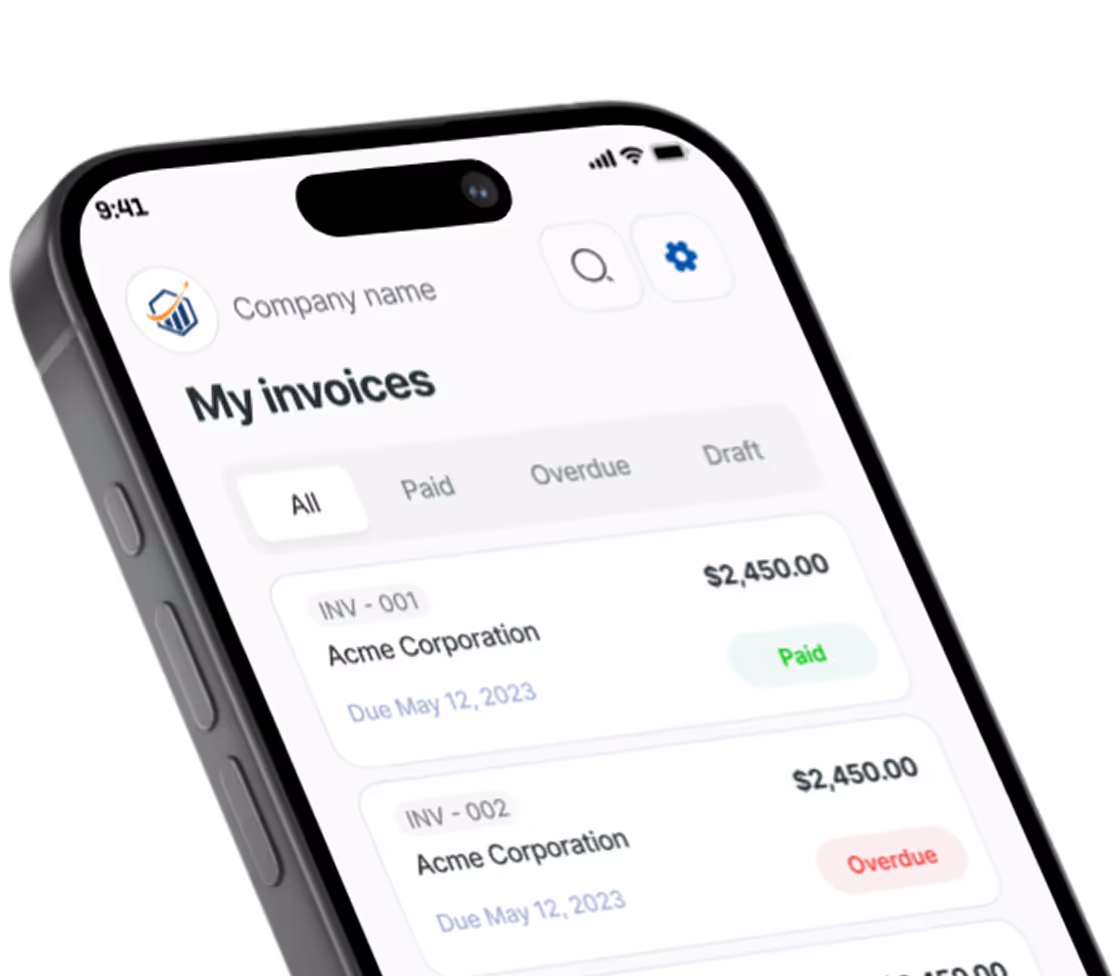

Pronto Invoice takes a different approach: AI-powered invoice creation, a mobile-first offline experience, and a focus on speed for field service professionals. We charge for our software but take zero markup on your payments.

The question isn’t really “which is better” — it’s “which approach fits your business?”

Pricing Comparison

This is where the conversation gets interesting.

Pronto Invoice Pricing

| Plan | Price | Invoices/Month | Key Features |

|---|---|---|---|

| Free | $0/mo | 10 | 5 clients, 3 templates, email delivery, mobile apps |

| Starter | $5/mo ($48/yr) | 30 | AI Chat (10/mo), all templates, estimates, item library, expense tracking |

| Growth | $12/mo ($115/yr) | Unlimited | Unlimited AI Chat, recurring invoices, QuickBooks, SMS delivery, payment reminders |

| Pro | $24/mo ($230/yr) | Unlimited | 3 team members, API access, custom branding, client portal, phone support |

Wave Pricing

| Feature | Price | Details |

|---|---|---|

| Invoicing | Free | Unlimited invoices, unlimited clients |

| Accounting | Free | Double-entry bookkeeping, reports, receipt scanning |

| Multi-User | Free | Multiple permission levels |

| Credit Card Payments | 2.9% + $0.60 | Per transaction |

| ACH Payments | 1% ($1 min) | Per transaction |

| Pro Plan | $16/mo | Recurring invoices, auto-reminders, custom receipts |

What the Numbers Mean

On sticker price, Wave wins. Free unlimited invoices and free accounting is objectively cheaper than $12/month for unlimited invoices without accounting. No amount of feature comparison changes this math.

But the total cost picture is more nuanced. Wave makes money through payment processing fees: 2.9% + $0.60 per credit card transaction. Pronto Invoice charges $0 markup — you use your own Stripe or PayPal rate.

Let’s compare total monthly costs for a business processing $5,000/month in card payments:

| Wave (Free plan) | Pronto Invoice (Growth) | |

|---|---|---|

| Software cost | $0 | $12 |

| Processing fees ($5K @ rates) | ~$175 (2.9% + $0.60/txn) | ~$145 (standard Stripe 2.9% + $0.30) |

| Total monthly cost | ~$175 | ~$157 |

At $5,000/month in card payments, Pronto Invoice actually costs less when you include processing fees — and you get AI creation, offline mode, and SMS delivery. The breakeven point depends on your payment volume, average transaction size, and your Stripe rate.

If you don’t process card payments (cash, check, or transfer only), Wave is cheaper. Period.

Where Pronto Invoice Wins

AI-Powered Invoice Creation

Pronto Invoice’s Smart AI lets you create invoices by typing (or dictating) what you need:

- “Invoice John Smith $500 for plumbing repair”

- “Bill ABC Corp for 3 hours electrical work at $85/hour”

- “New invoice for Sarah Chen, website design, $3,000”

The AI handles client matching, item suggestions, tax calculations, and document assembly. Repeat clients take under 15 seconds.

Wave uses traditional form-based creation. Select a client, add line items, set terms, and send. It works well — but it’s a manual process that takes significantly longer, especially on a phone.

Learn more about Smart AI Assistance

True Offline-First Mobile Experience

Pronto Invoice was built mobile-first. The phone app IS the product.

- Full offline support. Create invoices, add clients, manage items, and preview PDFs with no internet. Everything syncs when you reconnect.

- One-handed operation. Navigation and primary actions designed for thumb reach.

- Sub-2-second launch. Fully native iOS (SwiftUI) and Android (Jetpack Compose) apps.

- Voice input. Dictate invoices in the field with dirty or gloved hands.

Wave has mobile apps, but the platform is web-first. The mobile experience reflects that — it’s functional but not optimized for field work. And Wave does not support any offline use. No signal means no invoicing.

For a plumber finishing a job in a client’s basement with no cell service, this is the difference between invoicing on-site (Pronto Invoice) and invoicing later when you get back to the truck (Wave).

Zero Payment Processing Markup

Pronto Invoice never touches your payment processing. Connect your own Stripe or PayPal account, pay your own rate, and keep any volume discounts you negotiate.

Wave processes all payments through their own platform. Their rates (2.9% + $0.60 per card, 1% for ACH) are their primary revenue source. You cannot connect your own payment processor or negotiate lower rates.

For businesses processing significant payment volume, this difference compounds:

| Monthly Card Volume | Wave Processing Fees | Pronto Invoice (Std Stripe) | Difference |

|---|---|---|---|

| $2,000/mo | ~$78 | ~$58 | $20/mo |

| $5,000/mo | ~$175 | ~$145 | $30/mo |

| $10,000/mo | ~$350 | ~$290 | $60/mo |

SMS Invoice Delivery

Pronto Invoice sends invoices via text message (Growth plan, $12/month). For field service pros, SMS gets faster client responses than email. Wave delivers invoices via email only.

Recurring Invoices at a Lower Price

Pronto Invoice includes recurring invoices on Growth ($12/month). Wave restricts recurring invoices to their Pro plan ($16/month). Pronto Invoice is $4/month cheaper for this feature — and includes AI creation, QuickBooks sync, and SMS delivery that Wave Pro doesn’t offer.

Client Portal

Pronto Invoice Pro includes a client portal where clients can view all their invoices, payment history, and outstanding balances in one place. Wave does not offer a client portal.

Where Wave Might Be Better

We believe in honest comparisons. Wave has genuine, significant advantages:

Free Full Accounting

This is Wave’s strongest card. Free double-entry bookkeeping, chart of accounts, journal entries, profit and loss reports, balance sheets, sales tax reports, and aging reports. Pronto Invoice does not do accounting at all — it syncs with QuickBooks ($30+/month). If you need accounting and can’t afford QuickBooks, Wave is objectively the better choice.

Free Unlimited Invoices

Wave’s free plan includes unlimited invoices with unlimited clients. Pronto Invoice’s free plan caps at 10 invoices/month and 5 clients. If you don’t need AI creation, offline mode, or SMS delivery, and you want to send as many invoices as possible for $0, Wave delivers.

Free Multi-User Access

Wave includes multiple user accounts with permission levels at no additional cost. Pronto Invoice charges $24/month (Pro plan) for up to 3 team members. For teams that need multiple users without per-user fees, Wave’s approach is more accessible.

Financial Reporting

Wave includes comprehensive financial reports: profit and loss, balance sheet, sales tax, accounts aging, and more. Pronto Invoice offers basic reporting on Growth and advanced reporting on Pro, but nothing approaching full accounting reports. For businesses that need financial reporting without a separate accounting tool, Wave provides substantially more.

No Subscription Required

Wave’s core product is genuinely free — not freemium with watermarks or aggressive upsells. You get a complete invoicing and accounting tool without paying a monthly fee. For businesses watching every dollar, this matters.

What Real Users Say

Pronto Invoice Users

“I can invoice customers before I leave their driveway. The AI just gets it — I say what the job was and it builds the invoice.” — Mike R., Plumbing Contractor

“Finally an invoicing app that works without cell service. Half my jobs are in basements or rural properties.” — Dave T., Electrician

What Wave Users Say

“Can’t beat free. The accounting features alone would cost $30+/month anywhere else.” — Online review

“Great for desk work but the mobile experience is frustrating. I end up doing everything on my laptop.” — App Store review

“The processing fees add up fast. Wish I could use my own Stripe account.” — Community review

Who Should Choose Pronto Invoice?

Contractors and Field Service Professionals

You finish jobs on-site and need to invoice immediately — often without cell service. AI creates invoices in seconds. Offline mode works everywhere. Speed matters more than free.

Businesses Processing Significant Card Volume

You process $5,000+ per month in card payments. Pronto Invoice’s zero-markup processing plus subscription cost can be cheaper than Wave’s per-transaction fees.

Businesses Already Using QuickBooks

You already have QuickBooks for accounting. Wave’s accounting features would be redundant. Pronto Invoice syncs with your QuickBooks and adds AI creation, offline mobile, and SMS delivery.

Making the Switch

Getting started with Pronto Invoice takes less than 2 minutes:

- Download the app (iOS or Android) or sign up on the web

- Enter your business name and email — that’s the only required setup

- Create your first invoice using Smart AI or the guided 5-step workflow

- Send it — via email, text, or share link

No data migration needed. Your Pronto Invoice account starts fresh, and you can build your client list and item catalog as you go. Your Wave account remains active for historical records and accounting data.

Try it risk-free:

- Free plan: 10 invoices/month, no credit card required

- Paid plans: 14-day free trial with full access

Frequently Asked Questions

It depends on how you define 'cheaper.' Wave's free plan offers unlimited invoices and accounting at $0/month — you cannot beat that on sticker price. However, Wave charges 2.9% + $0.60 per credit card transaction for payment processing. Pronto Invoice charges $0 markup on payments (you use your own Stripe/PayPal rate). For businesses processing card payments regularly, Pronto Invoice's Growth plan at $12/month can cost less overall when you factor in the lower per-transaction fees.

There is no direct import tool between the two platforms. However, Pronto Invoice is designed for fast setup. The Smart AI builds your client list and item catalog automatically as you create invoices. Most users have their regular clients and items populated within the first week. Your Wave account remains active, so you retain access to all historical invoices and accounting records.

No. Pronto Invoice is purpose-built for invoicing, not full accounting. We do not offer double-entry bookkeeping, chart of accounts, journal entries, or balance sheet reports. Instead, Pronto Invoice integrates with QuickBooks Online (on the Growth plan, $12/month) to sync your invoice data with dedicated accounting software. If you need free built-in accounting, Wave is the better choice. If you need fast, intelligent invoicing that syncs to your existing accounting tool, Pronto Invoice is the better fit.

Yes. Pronto Invoice's mobile app works fully offline. Create invoices, add clients, manage items, and preview PDFs without any internet connection. Everything syncs automatically when you reconnect. This is particularly valuable for field service professionals working in basements, rural areas, construction sites, or anywhere with unreliable signal. Wave does not support offline use.

Pronto Invoice supports credit and debit cards (via Stripe), PayPal, Venmo, Zelle, Cash App, ACH bank transfers, cash, and check. You can also add custom payment instructions. Clients pay directly from the invoice, and you choose which methods to enable per invoice. Unlike Wave, Pronto Invoice does not process payments directly — you connect your own Stripe or PayPal account and keep whatever rate you have negotiated.

Yes. Smart AI Assistance lets you create invoices by typing or speaking natural language descriptions like 'Invoice John Smith $500 for AC repair.' The AI handles client matching, item suggestions from your catalog, tax calculations, and document assembly. It supports 16 industries with tailored item suggestions and terminology. Available on Starter ($5/month, 10 AI chats/month) and Growth ($12/month, unlimited AI chats). Wave does not offer any AI-powered features.

Yes. Some users keep Wave for free accounting and bookkeeping while using Pronto Invoice for on-the-go invoicing. You can run both platforms simultaneously. However, if you use Pronto Invoice's QuickBooks integration (Growth plan), you may find that QuickBooks replaces Wave's accounting role entirely — giving you a cleaner, more integrated workflow.

Related Comparisons

Pronto Invoice vs Billdu

European favorite meets AI-powered American challenger.

Read Comparison →Pronto Invoice vs FreshBooks

Accounting suite vs focused invoicing. Right-sized for your needs.

Read Comparison →Pronto Invoice vs InvoiceHome

Compare Pronto Invoice and InvoiceHome side-by-side. Pricing, AI features, mobile experience, and templates.

Read Comparison →Pronto Invoice vs Invoice Ninja

Free tier vs free tier. Open-source vs polished mobile experience.

Read Comparison →Pronto Invoice vs Invoice Simple

Both built for simplicity — but only one has AI invoice creation.

Read Comparison →Pronto Invoice vs Invoice2Go

Mobile invoicing showdown: native apps, offline mode, and field service features.

Read Comparison →